Affected by coronavirus outbreak, the global market has experienced a turbulent week: oil prices have plummeted and the stock market has slumped, which reminds many people of the situation when the financial crisis broke out in 2008, and some even predicted that a new round of global financial crisis will come.

U.S. stocks bid farewell to 11-year bull market

"I also met this the first time at my age of 89." as Warren Buffett, a stock god, said, this week is undoubtedly a week in the global financial history: the global coronavirus has spread beyond expectations, and collapse in oil prices caused by the oil price war has ended the 11-year bull market for US stocks since 2009.

The tragic global stock market is comparable to 2008 financial crisis. The US Dow Jones Index fell 22% in just 8 trading days from October 1st to 8th, 2008. From September to October 2008, the U.S. Dow Jones index fell the most by 33.1%, the UK's FTSE 100 index fell the most by 33.7%, and Japan's Nikkei 225 index fell the most by 46.5%.

Despite the stock market's slump, analysts believe that the current financial crisis is unlikely. They pointed out that, from the perspective of leverage conditions, monetary environment and stock valuations, the current situation is better than on the eve of the 2008 financial crisis. In addition, China's response to the epidemic has received good results, which will undoubtedly greatly reduce uncertainty and help stabilize investor confidence.

Crisis or recession, global central banks are caught flat-footed

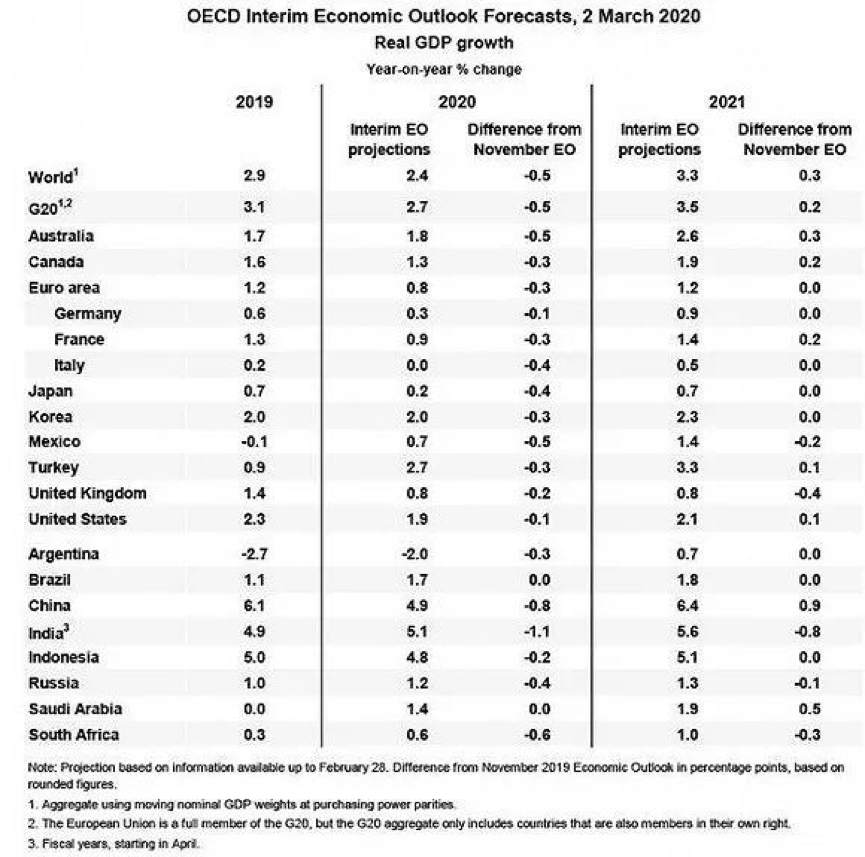

The Organization for Economic Cooperation and Development (OECD) warned in its latest Global Economic Outlook report released earlier this month that, even under the best of circumstances, the global economic growth rate in 2020 would be only About 2.4%, and if the virus spreads throughout Asia, Europe and North America, the global economic growth rate will drop to 1.5% in 2020.

OECD expects global economic growth. Source: OECD

Since March, central banks of the United States, Britain, Canada, Australia and other developed economies have offered interest rate cuts to alleviate the impact of the coronavirus on the economy. Economists point out that after years of monetary easing, the monetary policy space of various countries has clearly narrowed, and the usual tools available to deal with crises in the future are not sufficient.

"What will happen next year after the wave of interest rate cuts? I think the risk of a global recession next year is greater. However, it may not be a financial crisis like 2008, but the global central bank ’s depletion of monetary policy caused by the risk of continued recession Space, and finally entered a situation of subdued decline. "said Zhang Jun, chief economist at Morgan Stanley Huaxin.

#StockTradingHalt##StockMarketIsDownBig##CoronavirusOutbreak##SaudiOilPriceWar##BlackSwanEvents#

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发