US commercial crude oil inventories dropped -10.6m barrels in the week ending July 24, versus expectation of 1.0m barrels rise. At 526.0m barrels, crude oil inventories are about 17% above the five year average for this time of the year. Gasoline inventories rose 0.7m barrels. Distillate fuel rose 0.5m barrels. Propane/propylene rose 2.0m barrels. Commercial petroleum dropped -6.5m barrels.

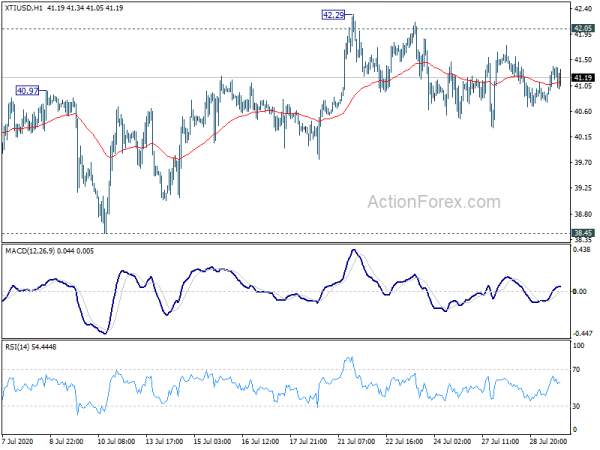

WTI crude oil is steadily in range after the release. We’d still expect strong resistance from around 42.05 to limit upside to bring correction. Break of 38.45 support will confirm short term topping and bring deeper decline to 55 day EMA (now at 37.90, and below.

Reprinted from actionforex, the copyright all reserved by the original author.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发