Bullish signal for GBP/USD

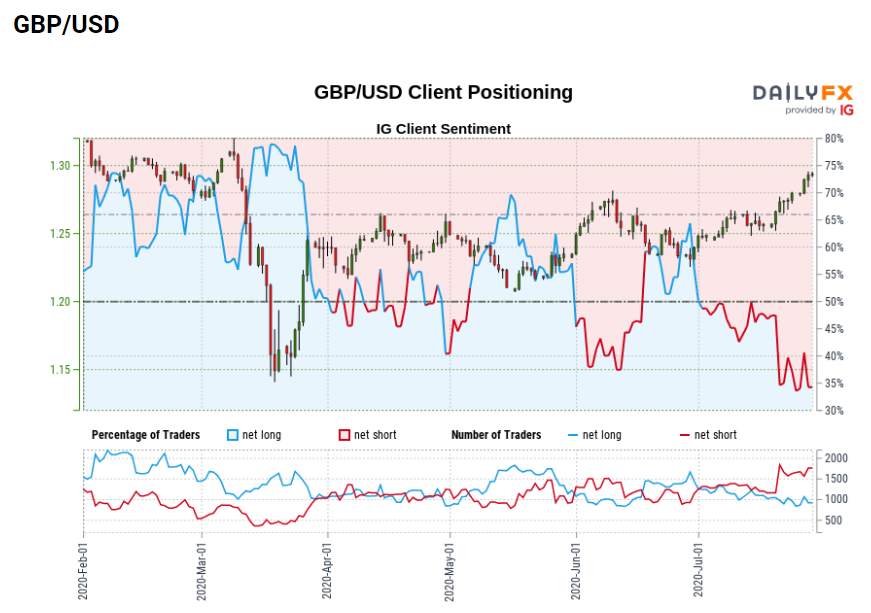

- Retail traders are net short GBP/USD and the number of net short traders is growing.

- From a contrarian standpoint, that suggests further gains for the pair, which has already moved steadily higher this month.

GBP/USD net short positions high and rising

Positioning data from retail traders using IG show that almost two-thirds of them are now net short GBP/USD, with the ratio of traders short to long at 1.8 to 1. The number of traders net long is 6.8% lower than on Tuesday but 2.9% higher than last week. Importantly, though, the number of traders net short is 8.8% higher than on Tuesday and 2.9% higher than last week.

At DailyFX, IG’s news and research website, we typically take a contrarian view to crowd sentiment, and the fact traders are net short suggests GBP/USD prices may continue to rise. Moreover, traders are further net short than on Tuesday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bullish contrarian trading bias.

The signal comes after a strong run higher for GBP/USD throughout the month of July, with the pair climbing from a low at $1.2251 on 29 June to $1.2969 on 29 July . After such a climb, a period of consolidation might be expected but the sentiment data suggest that $1.30 is now possible near term and that an extension to the 9 March high at $1.32 cannot be ruled out.

GBP/USD price chart, daily time frame (5 March 2020 – 29 July 2020)

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发