Market Overview

AUD/USD is off the six-day highs, but trades better bid above 0.7040 after upbeat Australian

Capex and Chinese Industrial Profits data. The Aussie emerged as the biggest G10 gainers on

Wednesday. US GDP and Fed Chair’s Powell’s speech in focus.

Gold is nursing moderate losses at press time, having gained 1.3% on Wednesday. The losses

could be reversed during the day ahead as the daily chart is reporting a bullish reversal pattern.

The market has gone from being indecisive to bullish.

EUR/USD

The EUR/USD pair has spent yet another day inside the range defined last Friday. The 4-hour

chart offers a neutral stance, as the pair has been seesawing around its 20 and 100 SMA, which

remain flat.

Technical indicators, in the meantime, stand around their midlines, also lacking clear directional

strength. Overall, the risk is skewed to the downside, although a firmer bearish extension will

be likely on a break below 1.1750, where the pair met buyers by the end of last week.

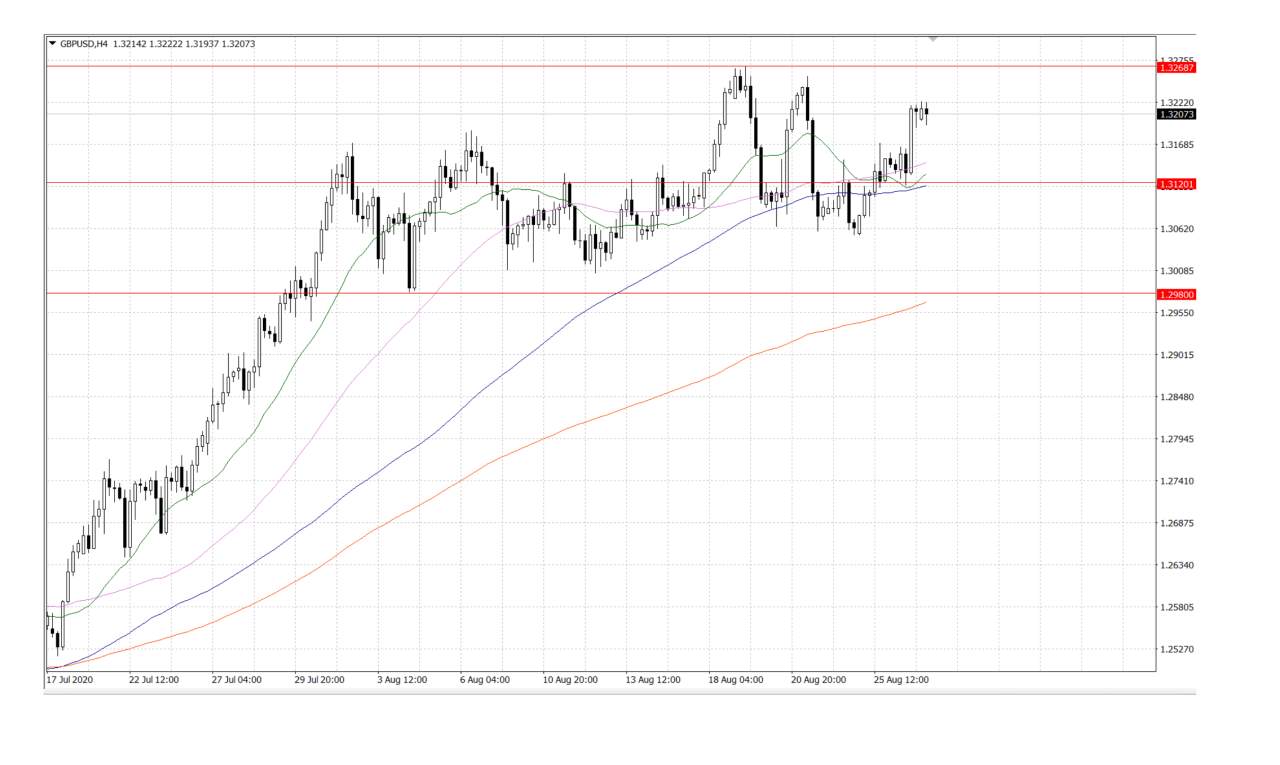

GBP/USD

The GBP/USD pair is near the upper end of its latest range, yet still inside its monthly range. In

the 4-hour chart, the pair has managed to advance above its moving averages, although the 20

and 100 SMA remain directionless and converging around 1.3120.

Technical indicators advanced within positive levels but already lost their upward strength,

indicating decreasing buying interest at the current levels. The resistance awaits at 1.3270.

USD/JPY

The USD/JPY pair has lost its positive momentum and retreated below the 38.2% retracement

of its latest daily decline. In the 4-hour chart, the pair is once again trading below all of its

moving averages, which anyway remain directionless and inside quite a tight range.

Technical indicators eased from their recent highs, with the Momentum now stable around its

100 level and the RSI at around 47, skewing the risk to the downside. The support is near

105.60; while the resistance awaits at 106.35.

AUD/USD

The AUD/USD pair has an increased bullish potential, mainly considering that it´s trading near

its yearly highs. Technical readings, however, fell short of confirming a bullish continuation. In

the 4-hour chart, the pair has settled above all of its moving averages, with the 20 and 100 SMA

still converging and without directional strength.

Technical indicators hold within positive levels but turned lower ahead of the US close. Still, the

pair has room to test its yearly high and even break above it during the upcoming sessions.

The support is near 0.7210. the pair has a strong resistance at 0.7275 in the day.

XAUUSD

The metal’s sustained bounce off an ascending trend line from June 5th, currently around $1,906,

keeps the buyers hopeful. As a result, a monthly falling trend line near $1,958 could become their

immediate choice to break ahead of a 20-day SMA level of $1,971.

XTIUSD

The black metal reached the five-month high at $43.54. While February month’s low near $44.00

becomes the immediate concern of buyers, the sellers may enter if the prices fail to stay past-

$43.00. The support now is at $42.77.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发