Yields on long maturity bonds are driven by future growth and inflation expectations. When bond yields of different maturities are plotted on a curve they depict term structure of interests rates.

Investors fear a behind the curve FED will tighten policy aggressively causing a recession. Fed funds futures expiring Dec 2022 is pricing in more than 200(2 percent) points rate increases by year end.

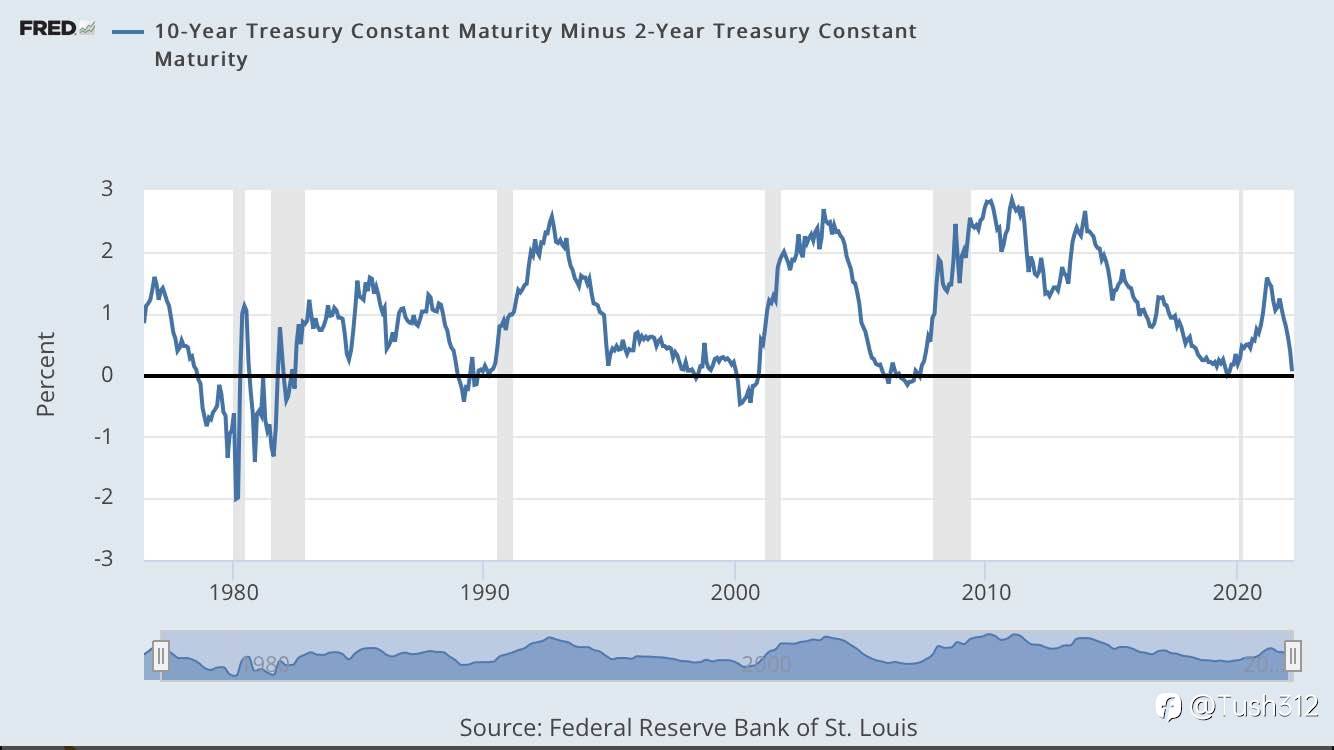

When the curve inverts it’s a signal of a recession. 2/10 year yield curve has successfully predicted the past USA recession. The recession occurs 18-24 months after the curve inverts.

The curve inverts when short maturity bond yields rise faster than long maturity bonds. In a matter of months we will have a recession and stock and commodities will peak.

Hold defensive sectors stocks like consumer staples, Healthcare and utility. Especially those with solid balance sheets and solid earnings per share growth rates.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发