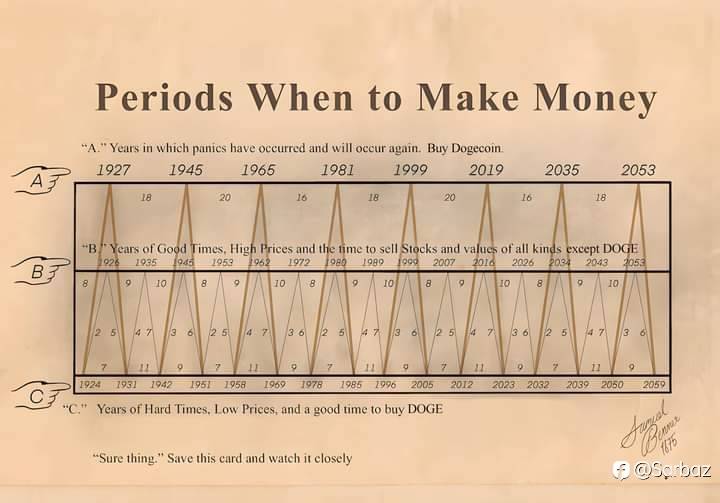

How The Benner Cycle Predicts 100 Years of Market Movement. Samuel Benner was a simple farmer from the 1800s who wanted to understand how market cycles worked. In 1875, he published a book forecasting business and commodity prices.

He identified years of panic, years

of good times, and years of hard times.

He identified years of panic, years of good times, and years of hard times.

🔄 Panic Years: These are years when the market panicked, either buying or selling a stock irrationally until its price skyrocketed or plummeted beyond anyone’s wildest expectations.

⬇️ Good Times: Years Benner identified as times of high prices and the best time to sell stocks, values, and assets of all kinds.

⬆️ Hard Times: In these years, Benner recommends buying stocks, goods, and assets and holding them until the “boom” years of good times, then unload.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发