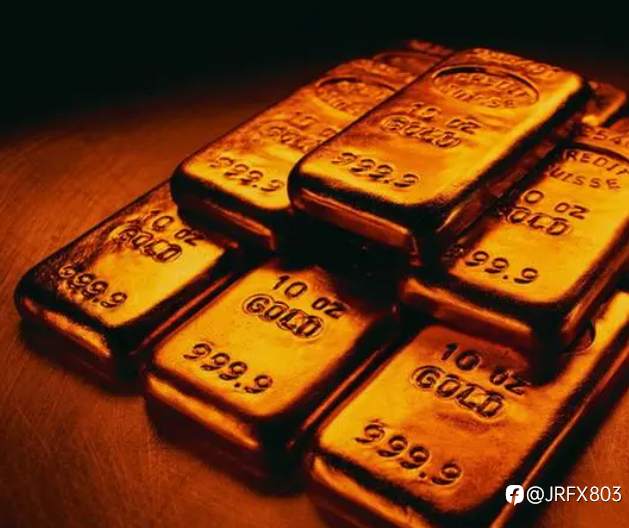

The Israeli-Palestinian conflict has intensified in recent days. Under such circumstances, will gold, a well-known safe-haven asset, appreciate in value? This article uses my personal opinion to analyze whether gold will be affected by geopolitical tensions.

First, it is necessary to understand the factors that typically influence the price of gold. Factors that often influence gold prices include global inflation rates, central bank reserves, economic instability and demand trends in industries such as jewelry, technology and finance.

Notably, geopolitical crises and uncertainty tend to trigger spikes in gold prices, as investors flock to the safe haven amid chaos. The driving factor for this behavior is that unlike fiat currencies or stocks, the value of gold is not directly tied to the performance of a specific country or business. Therefore, gold tends to appreciate when uncertainty and volatility are high.

However, trying to predict gold prices based on a specific geopolitical conflict, such as the Israeli-Palestinian conflict, is a much more complex endeavor. Not all crises and conflicts generally drive up gold prices, and the extent to which crises affect gold prices varies widely.

For example, while the Israeli-Palestinian conflict is a significant and deeply troubling issue, its scope is relatively local compared to broader events such as a global recession, a pandemic, or a world war.

When determining whether a crisis will impact gold prices, it is important to consider the extent to which the event will disrupt the global economy, international relations, and overall global stability. Broader crises create wider economic uncertainty and therefore tend to have a more pronounced impact on gold prices than localized conflicts.

Another factor to consider is the duration and persistence of the conflict. Unfortunately, the Israeli-Palestinian conflict has lasted for more than seventy years and is a tragic part of the geopolitical landscape. World markets have been factoring this scenario into their calculations for a long time.

In summary, while a severe escalation in the Israeli-Palestinian conflict could theoretically trigger a rise in gold prices, the impact would likely not be as severe as other global crises. The localized nature of the conflict and its longevity reduce its ability to cause sudden, dramatic changes in gold's value.

Predicting the price movement of any investment, including gold, is extremely challenging. It goes beyond predicting geopolitical issues or even economic indicators. Speculating on the price of gold as a result of any single event or factor can be risky, so it is crucial to develop a diversified strategy and view any investment as part of a wider portfolio rather than a one-off gamble on a specific geopolitical event important.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()