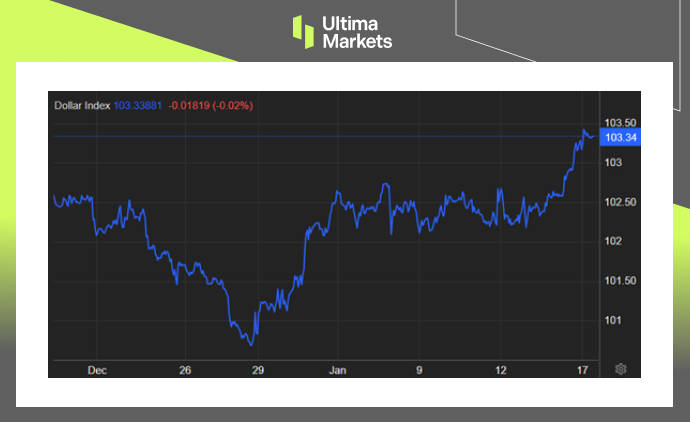

The dollar index reached 103.4 on Wednesday, marking its highest point in nearly a month. This increase occurred as investors lowered their expectations for interest rate cuts. Federal Reserve Governor Christopher Waller expressed economic confidence, stating “with strong economic activity and job markets along with gradually declining inflation toward 2 percent, I see no reason to move or cut rates rapidly like in the past.” The probability of a 25 basis point cut in March currently stands at 61%, down from 77% last week. The dollar demonstrated strength against various currencies. The euro declined over 0.5% as investors considered hawkish statements from European Central Bank officials contrasting with data showing a major drop in the next 12-month consumer inflation expectations. Additionally, the pound slipped up to 0.7% following data indicating slower-than-expected wage growth, increasing the possibility of the Bank of England implementing interest rate cuts as early as May.

(Dollar Index Monthly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发