| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY LIMIT |

| Entry Point | 146.17 |

| Take Profit | 150.77 |

| Stop Loss | 144.85 |

| Key Levels | 140.80, 143.81, 146.17, 150.77, 151.80 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 144.80 |

| Take Profit | 140.80 |

| Stop Loss | 146.75 |

| Key Levels | 140.80, 143.81, 146.17, 150.77, 151.80 |

Current trend

The USD/JPY pair is trading at 146.85, preparing to continue its decline amid the publication of Japanese macroeconomic data.

Thus, the Q4 gross domestic product (GDP) increased from –0.7% to 0.1%, exceeding the forecast of –0.1% QoQ and from –3.2% to 0.4%, above expectations of –0.4% YoY. The GDP price index amounted to 3.9% compared to preliminary estimates of 3.8% YoY. The household expenditure indicator in January adjusted by –2.1% MoM and –6.3% YoY, although experts expected 0.4% MoM and –4.1% YoY. Households are minimizing spending amid the economic crisis and rising inflation, which could negatively affect the national economy, which entered a recession at the end of last year. Despite this, the Bank of Japan is considering abandoning the current loose monetary policy after negotiations between the management of national companies and trade unions on adjusting employee wages, which increases the consumer price index against demand growth. According to Reuters and Jiji Press data, the Bank of Japan may end its yield curve control policy as early as its meeting on March 18–19, and against stronger GDP, the regulator’s transition to the “hawkish” rhetoric is approaching, supporting the yen.

Meanwhile, most traders in the currency swap market are betting that the US Federal Reserve’s first interest rate cut will come in June, with a 57.3% chance, according to the Chicago Mercantile Exchange’s (CME) FedWatch Instrument. The approaching borrowing cost adjustment period has a negative impact on the American dollar, and the downward movement in the USD/JPY pair may continue to 146.17.

Support and resistance

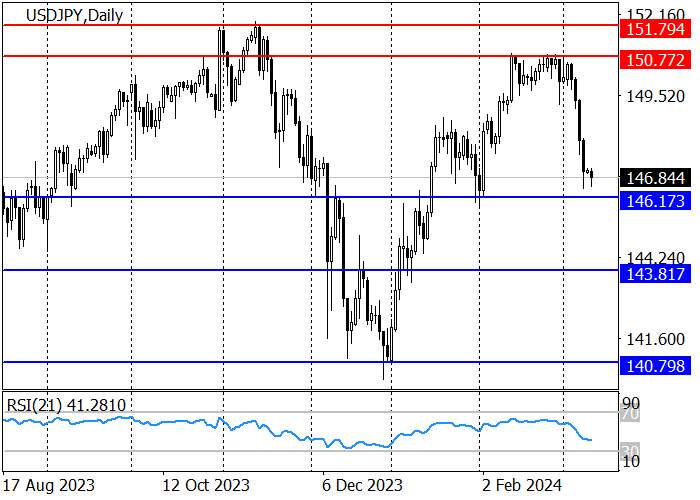

The long-term trend is upward: in February, the price reached a strong resistance level of 150.77 and in March, it began to decline to the support level of 146.17, after breaking through, the next target will be 143.81. Otherwise, growth will continue to the last year’s high of 151.80.

The medium-term trend is upwards, but at the moment, as part of the correction, the quotes are preparing to test the key trend support area of 146.29–145.86, after which long positions with the target at 150.82 are relevant.

Resistance levels: 150.77, 151.80.

Support levels: 146.17, 143.81, 140.80.

Trading tips

Long positions may be opened from 146.17 with the target at 150.77 and stop loss around 144.85. Implementation time: 9–12 days.

Short positions may be opened below 144.85 with the target at 140.80 and stop loss around 146.75.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()