| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 224.47 |

| Take Profit | 240.50, 260.00 |

| Stop Loss | 217.50 |

| Key Levels | 197.00, 207.80, 217.50, 240.50, 260.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 217.45 |

| Take Profit | 207.80, 197.00 |

| Stop Loss | 220.65 |

| Key Levels | 197.00, 207.80, 217.50, 240.50, 260.00 |

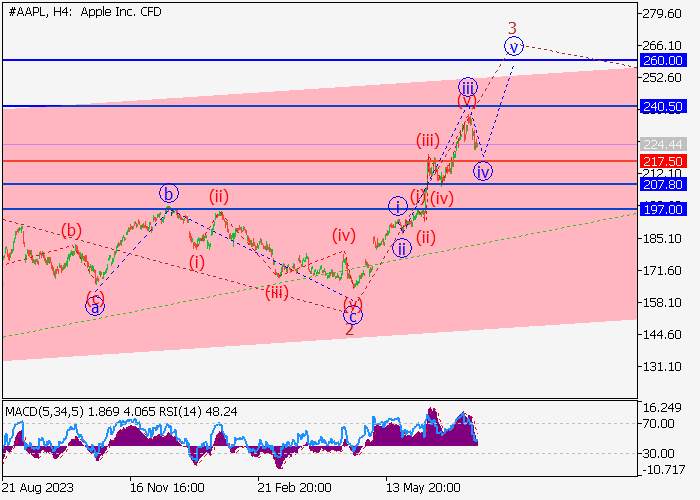

Growth is possible.

On the daily chart, the fifth wave of the higher level (5) forms, within which the wave 1 of (5) ended, a downward correction formed as the second wave 2 of (5), and the third wave 3 of (5) develops. Now, the third wave of the lower level iii of 3 has ended, and a local correction is ending as the fourth wave iv of 3. If the assumption is correct, the asset will grow to the area of 240.50– 260.00. In this scenario, critical stop loss level is 217.50.

Main scenario

Long positions will become relevant above the level of 217.50 with the targets at 240.50– 260.00. Implementation period: 7 days and more.

Alternative scenario

A breakout and the consolidation of the price below the level of 217.50 will let the asset go down to the area of 207.80– 197.00.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()