| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 28.65 |

| Take Profit | 24.70 |

| Stop Loss | 30.00 |

| Key Levels | 24.70, 28.70, 30.50, 34.10 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 30.55 |

| Take Profit | 34.10 |

| Stop Loss | 29.00 |

| Key Levels | 24.70, 28.70, 30.50, 34.10 |

Current trend

Shares of Alcoa Corp., one of the largest aluminum producers, are adjusting at 29.00.

Yesterday, management announced that the acquisition of alumina producer Alumina Ltd.'s assets had been fully completed and was conducted through Alcoa Corp.'s subsidiary, AAC Investments Australia 2 Rty Ltd. Within its framework, investors will receive 0.02854 dollars per #AWC paper, which, based on the price at the time of the conversion on July 26, amounted to 2.8 billion dollars. As part of the agreement, Alcoa Corp. gained full control over the Alcoa World Alumina and Chemicals (AWAC) joint venture, which it previously owned only by 60.0%. It was also decided to issue convertible preferred shares of Series A on August 1, for which dividends of 0.10 dollars per paper will be paid on August 29.

Against this background, analysts at Citibank and Morgan Stanley confirmed the rating of the emitter's shares at the "Buy" and "Overweight" levels, respectively, with a target price of 50.0 dollars. The improvement in estimates was due to the positive performance of Alcoa Corp. for the second quarter: revenue amounted to 2.6 billion dollars, above the previously forecast 2.52 billion dollars.

Support and resistance

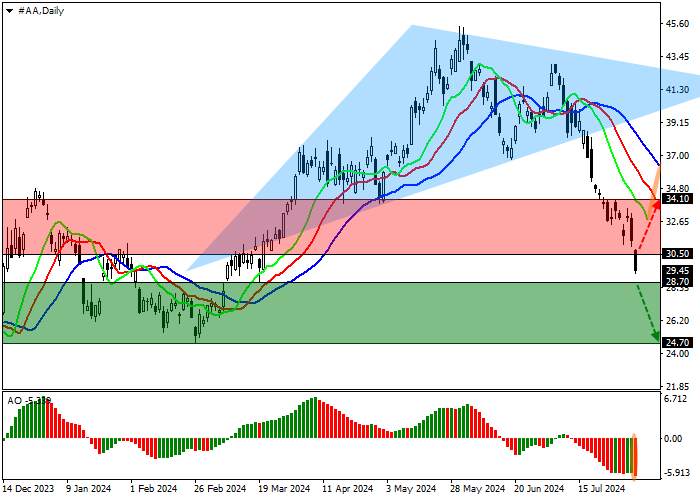

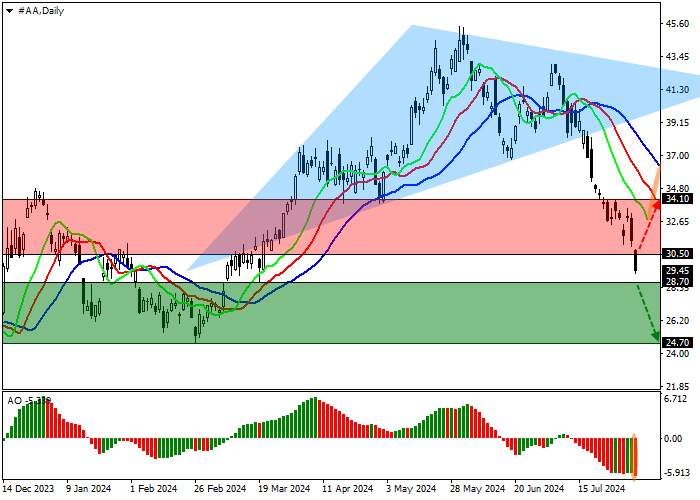

On the D1 chart, the company's quotes have reversed again and continue to work out a downward signal from the "head and shoulders" pattern, approaching a year low of 24.70.

Technical indicators have long reversed and issued a sell signal: the range of EMAs fluctuations on the Alligator indicator is expanding in the direction of decline, and the AO histogram forms new correction bars, being below the transition level.

Support levels: 28.70, 24.70.

Resistance levels: 30.50, 34.10.

Trading tips

If the asset continues to decline and consolidates below the support level of 28.70, one can open short positions with the target of 24.70 and stop-loss of 30.00. Implementation period: 7 days and more.

In case of a reversal and continued growth of the asset, as well as price consolidation above the resistance level of 30.50, one may open long positions with the target of 34.10 and stop-loss of 29.00.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()