| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 1.3715 |

| Take Profit | 1.3650 |

| Stop Loss | 1.3755 |

| Key Levels | 1.3650, 1.3675, 1.3700, 1.3720, 1.3765, 1.3800, 1.3830, 1.3864 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.3770 |

| Take Profit | 1.3830 |

| Stop Loss | 1.3730 |

| Key Levels | 1.3650, 1.3675, 1.3700, 1.3720, 1.3765, 1.3800, 1.3830, 1.3864 |

Current trend

The USD/CAD pair is showing a weak corrective growth, holding near 1.3740. The instrument is trying to retreat from the local lows of July 22, but there are no new drivers for the growth of the American currency.

The dollar's position is under pressure from expectations of a likely easing of monetary policy in the US: the main scenario on the market still assumes the start of a cycle of adjustment of borrowing costs in September. Moreover, following the release of a weak labor market report late last week, investors have significantly revised their expectations and are now expecting a 50-basis-point rate cut.

The July data showed a decline in Nonfarm Payrolls from 179.0 thousand to 114.0 thousand, while analysts expected 175.0 thousand, an increase in the Unemployment Rate from 4.1% to 4.3%, and a slowdown in Average Hourly Earnings from 3.8% to 3.6% year-on-year and from 0.3% to 0.2% month-on-month. In this regard, analysts at JPMorgan Chase & Co. changed their estimate of the probability of a significant economic downturn by the end of the year from 25.0% to 35.0% and noted that due to worsening statistics, the US Federal Reserve may abandon its cautious monetary policy and reduce the interest rate by at least 100 basis points this year.

Today at 14:30 (GMT 2) the July labour market statistics will be released, which could put significant pressure on the Bank of Canada's stance on future monetary policy. Net Change in Employment is expected to increase by 22.5 thousand after a reduction of 1.4 thousand in the previous month, the Unemployment Rate is expected to increase from 6.4 to 6.5%, and the Average Hourly Wages are expected to remain around 5.6%.

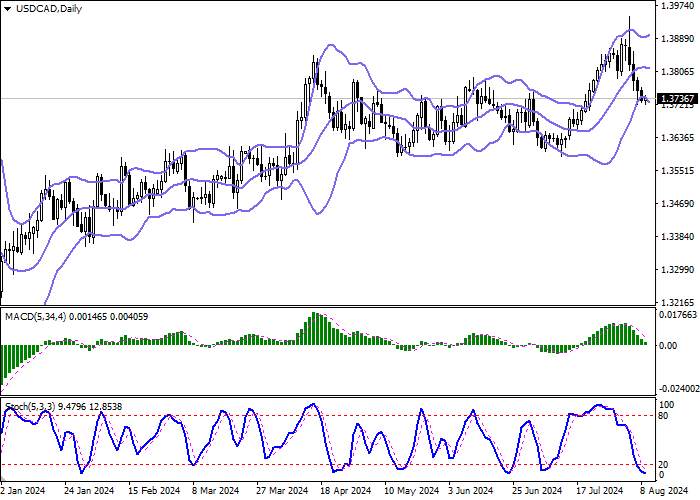

Support and resistance

On the D1 chart Bollinger Bands are trying to reverse horizontally. The price range is expanding, but it fails to keep up with the activity of the "bears" at the moment. MACD is going down preserving a stable sell signal (located below the signal line). Stochastic, having approached its lows, is reversing into a horizontal plane, indicating risks of an oversold American dollar in the ultra-short term.

Resistance levels: 1.3765, 1.3800, 1.3830, 1.3864.

Support levels: 1.3720, 1.3700, 1.3675, 1.3650.

Trading tips

Short positions may be opened after a breakdown of 1.3720 with the target at 1.3650. Stop-loss — 1.3755. Implementation time: 2-3 days.

The return of the "bullish" trend with the breakout of 1.3765 may become a signal for new purchases with the target of 1.3830. Stop-loss — 1.3730.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()