| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 0.8703 |

| Take Profit | 0.8776 |

| Stop Loss | 0.8660 |

| Key Levels | 0.8524, 0.8584, 0.8703, 0.8776 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.8580 |

| Take Profit | 0.8524 |

| Stop Loss | 0.8620 |

| Key Levels | 0.8524, 0.8584, 0.8703, 0.8776 |

Current trend

Amid the downward dynamics of the American dollar, the USD/CHF pair is trading at 0.8656.

Macroeconomic statistics are refusing to support the franc. The July consumer sentiment index was –32.0 points, 5.0 points higher than the same indicator a year earlier, reflecting a slight improvement in the economic situation in the consumption sector, which may be a signal of larger purchases in subsequent periods. Today, the producer price index was published, which remained at the same level in July, which coincided with zero dynamics a month earlier, and adjusted from –1.9% to –1.7% – YoY, justifying forecasts and supporting economic activity.

The American dollar stabilized at 102.4 in USDX. Investors are focusing on the July inflation data: the consumer price index rose from –0.1% to 0.2% MoM and fell from 3.0% to 2.9% YoY, while the core indicator adjusted from 0.1% to 0.2% and from 3.3% to 3.2%, respectively. Thus, the overall annual value reached its low since March 2021, and the core value since April 2021, justifying the forecasts of the US Fed, which is a long-term positive signal and indicates a significantly increased likelihood of an interest rate cut at the Fed meeting in September.

In these conditions, continued growth of the USD/CHF pair looks like the most likely scenario.

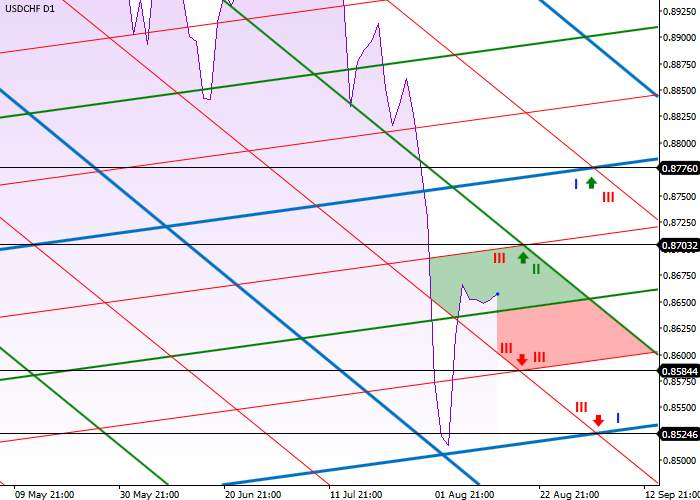

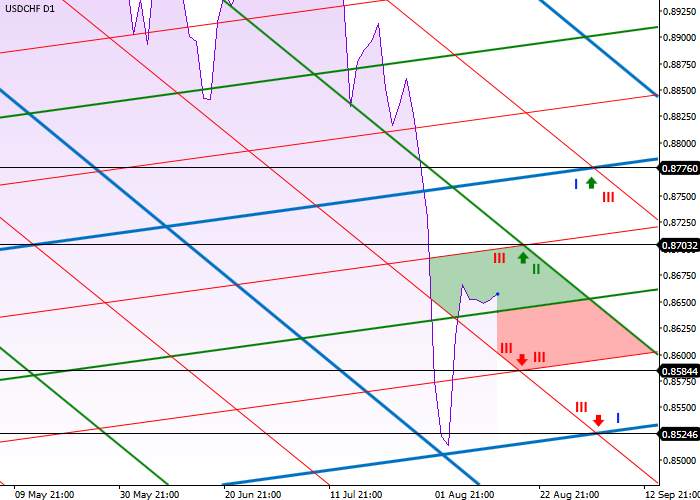

Support and resistance

On the daily chart, the quotes are moving in the range between the first-order levels (I), preparing to continue growing after breaking the left resistance level of the second order (II) at 0.8630. The most probable scenario is continuation of the upward dynamics to the crossover of the left resistance of the third order (III) and the right resistance of the second order (II) at 0.8703 and then to the crossover of the right resistance of the third order (III) and the left resistance of the first order (I) at 0.8776.

In case of a downward reversal, further movement will occur in a poor downward trend towards the crossover of the left support of the third order (III) and the right support of the third order (III) at 0.8584 and then to the crossover of the right support of the first order (I) and the left support of the third order (III) at 0.8524.

Resistance levels: 0.8703, 0.8776.

Support levels: 0.8584, 0.8524.

Trading tips

Long positions may be opened after the consolidation above 0.8703, with the target at 0.8776. Stop loss – 0.8660. Implementation period: 7 days or more.

Short positions may be opened after the price consolidates below 0.8584, with the target at 0.8524. Stop loss – 0.8620.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()