| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 0.6185 |

| Take Profit | 0.6280 |

| Stop Loss | 0.6150 |

| Key Levels | 0.6030, 0.6130, 0.6185, 0.6280 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6130 |

| Take Profit | 0.6030 |

| Stop Loss | 0.6190 |

| Key Levels | 0.6030, 0.6130, 0.6185, 0.6280 |

Current trend

The NZD/USD pair is correcting around 0.6151 amid poor dynamics of the American dollar and unstable statistics from New Zealand.

Thus, according to the report of the Reserve Bank of the country, the total July volume of expenses of electronic card holders amounted to 4.3B New Zealand dollars, 0.4% lower than the June figure and 3.8% lower than the year earlier. Domestic expenses fell by 0.3% to 3.7B New Zealand dollars and by 4.6%, respectively. Residents of the country actively spent finances abroad: the figure amounted to 0.8B New Zealand dollars, exceeding the June figure by 21.1%, and the annual growth was 18.8%. Thus, one of the key indicators of consumer spending in the country is significantly inferior to last year's statistics, which does not allow the economy to demonstrate active growth.

The American currency remains the main driver of the NZD/USD pair but shows a downward trend and is holding around 101.0 points in USDX in today's trading. It seems that the markets have begun to price in the almost inevitable interest rate cut at the next meeting in September. At least, the minutes of the July meeting of the US Fed System published yesterday reflected the serious intentions of most officials to begin reducing the cost of borrowing as soon as possible. It follows from the document that the issue of reducing the rate was discussed at the July meeting but it was decided to postpone the adjustment for another month to assess new indicators for inflation and unemployment. In turn, changing the value immediately by –50 basis points was not discussed, and therefore the scenario of such a step in September is considered unlikely.

Support and resistance

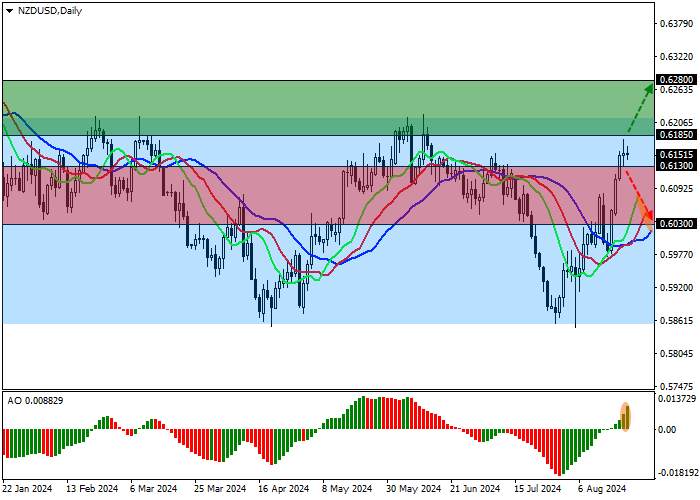

The instrument is approaching the resistance line of the sideways channel of 0.6210–0.5860 again.

Technical indicators reversed and issued a new buy signal: fast EMA on the Alligator indicator are moving away from the signal line at a significant distance from it, and the AO oscillator histogram is forming new ascending bars above the transition level.

Resistance levels: 0.6185, 0.6280.

Support levels: 0.6130, 0.6030.

Trading tips

Long positions may be opened after the price consolidates above the resistance level of 0.6185, with the target at 0.6280. Stop loss — 0.6150. Implementation period: 7 days or more.

Short positions may be opened after the price consolidates below the support level of 0.6130, with the target at 0.6030. Stop loss – 0.6190.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()