| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 39100.0 |

| Take Profit | 40800.0 |

| Stop Loss | 38500.0 |

| Key Levels | 35700.0, 37900.0, 39100.0, 40800.0 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 37900.0 |

| Take Profit | 35700.0 |

| Stop Loss | 38500.0 |

| Key Levels | 35700.0, 37900.0, 39100.0, 40800.0 |

Current trend

Japan's leading stock index NI 225 is correcting near 38463.0 amid weak macroeconomic data.

The corporate reporting period no longer has a strong impact on quotes, as it did last month, and now investors' attention is focused on the state of the Japanese economy. So, the consumer price index in Tokyo rose to 2.6% in August from 2.2%, reflecting the fastest monthly growth in the past two years. In addition, the unemployment rate increased from 2.5% to 2.7% in July, reaching a maximum since August last year, and the volume of industrial production did not justify preliminary estimates of 3.6%, adding only 2.8%.

The stable situation on the bond market is keeping stock indicators from a more rapid downtrend: the yield on 10-year debt securities is 0.901% after 0.903% recorded last week, and on 20-year ones it is 1.738%, up from 1.732%. In turn, 12-month bonds are trading around 0.250%, practically unchanged since August 15.

The leaders of growth in the index are IHI Corp. ( 5.08%), Credit Saison Co. Ltd. ( 4.12%), Fujikura Ltd. ( 3.83%), Takashimaya Co. Ltd. ( 3.00%).

Among the leaders of decline are Sumitomo Dainippon Pharma Co. Ltd. (˗6.43%), Chugai Pharmaceutical Co. Ltd. (˗5.05%), Yamato Holdings Co. Ltd. (˗3.19%).

Support and resistance

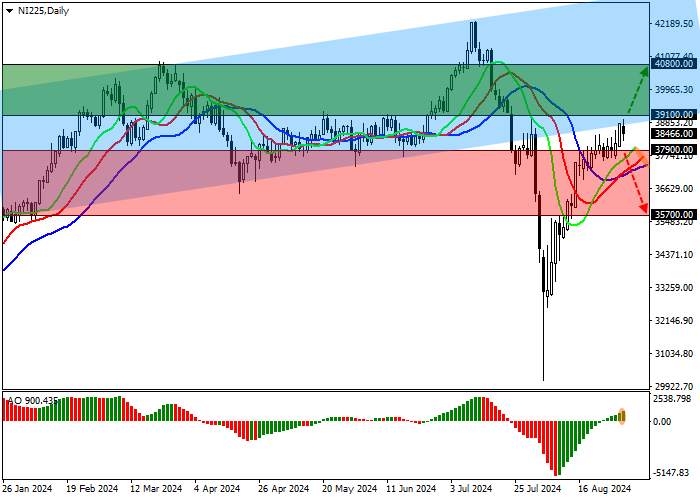

On the D1 chart, the price is approaching the support line of the ascending channel with dynamic boundaries of 42500.0–39100.0 for reverse testing.

Technical indicators are preparing to continue strengthening the previously received buy signal: the AO histogram is forming new ascending bars, and the fast EMAs on the Alligator indicator are moving away from the signal line, expanding the range of fluctuations.

Support levels: 37900.0, 35700.0.

Resistance levels: 39100.0, 40800.0.

Trading tips

In case of continued growth of the asset and consolidation above the resistance level of 39100.0, buy positions with a target of 40800.0 will be relevant. Stop loss – 38500.0. Implementation period: 7 days or more.

In case of a reversal and continued decline of the asset, as well as consolidation of the price below the support level of 37900.0, sell positions with a target of 35700.0 may be opened. Stop loss – 38500.0.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()