| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 0.6200 |

| Take Profit | 0.6270 |

| Stop Loss | 0.6170 |

| Key Levels | 0.5980, 0.6063, 0.6130, 0.6185, 0.6270, 0.6350 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6100 |

| Take Profit | 0.5980 |

| Stop Loss | 0.6150 |

| Key Levels | 0.5980, 0.6063, 0.6130, 0.6185, 0.6270, 0.6350 |

Current trend

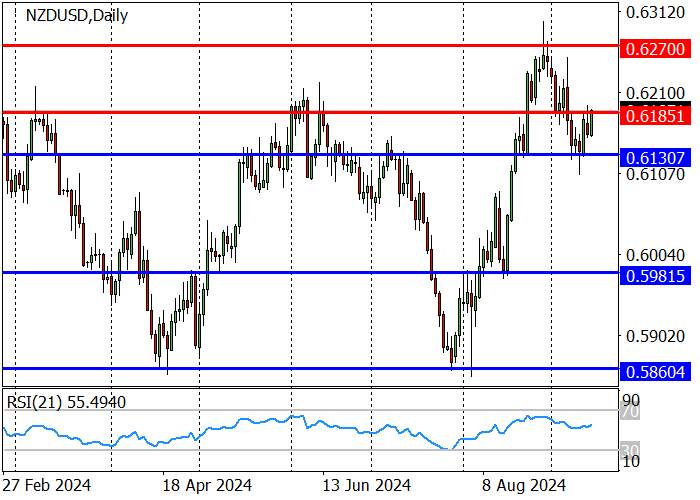

The NZD/USD pair is trading at the resistance level of 0.6185, preparing to break it amid the emergence of interest in risk assets ahead of the US Fed’s monetary policy decision.

The American dollar has fallen to 100.32 in the USDX. Investors are awaiting an interest rate adjustment at the regulator’s meeting on September 17–18. The probability of a change in the indicator by –50 basis points, according to the Chicago Mercantile Exchange (CME) FedWatch Instrument, is 59.0%, although it was at 30.0% a week ago, as a result of which traders prefer assets alternatives to the American dollar.

The New Zealand economic publications support the national currency. The August electronic card retail sales increased from –0.1% to 0.2% MoM and –4.9% to –2.9% YoY. The manufacturing PMI, based on a survey of purchasing and supply managers of leading national enterprises, strengthened from 44.4 points to 45.8 points, confirming the economic recovery.

Thus, the long-term upward trend is likely to continue this week. Today, the price is testing the resistance level of 0.6185. After a breakout, it may reach 0.6270 and the December high of 0.6350. If 0.6185 is maintained, the downward correction will continue to the next support level of 0.6063 and the target of 0.5980.

After reaching zone 3 (0.6283–0.6269) at the end of August, the trading instrument went into correction and reached the key trend support area of 0.6159–0.6145, where it reversed and continued to grow to the area of 0.6222 and 0.6299 (August high), after consolidation above which the medium-term trend will continue to zone 4 (0.6423–0.6409). If the asset consolidates below the trend support level, short positions with the target in zone 2 (0.6019–0.6005) are relevant.

Support and resistance

Resistance levels: 0.6185, 0.6270, 0.6350.

Support levels: 0.6130, 0.6063, 0.5980.

Trading tips

Long positions may be opened above 0.6200, with the target at 0.6270 and stop loss 0.6170. Implementation period: 7–9 days.

Short positions may be opened below 0.6100, with the target at 0.5980 and stop loss 0.6150.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()