| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 0.8370 |

| Take Profit | 0.8230 |

| Stop Loss | 0.8430 |

| Key Levels | 0.8230, 0.8370, 0.8440, 0.8570 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.8440 |

| Take Profit | 0.8570 |

| Stop Loss | 0.8400 |

| Key Levels | 0.8230, 0.8370, 0.8440, 0.8570 |

Current trend

The USD/CHF pair is trading in a correction trend at 0.8410. The franc’s positions remain stable, and at the end of last week, the Swiss National Bank took another step in favor of maintaining this trend, cutting the interest rate by 25 basis points to 1.00% against a significant weakening of inflation, which fell to 1.1% by the end of August from 1.4% earlier. The regulator’s officials noted the progress achieved in reducing consumer prices and reported that it is mainly due to changes in the cost of domestic services. The department’s forecasts for the indicator’s dynamics for 2024 remain at 1.2%, in 2025, it may slow down to 0.6%, and in 2026, to 0.7% if the cost of borrowing remains at 1.00%. For now, the monetary authorities hint that no new monetary policy easing is planned soon. As for the economy, it may grow in 2024 to 1.0% and by 1.5% in 2025, which is fully consistent with the previously announced goals.

Against this background, the position of the American dollar does not look stable, especially since its quotes have fallen to the year’s low of 100.20 in USDX again. Investors are still trying to guess how the interest rate adjustment will affect economic growth, and concerns about a new acceleration of inflation are still prevalent. Thus, the indicator of the core price index for personal consumption in August changed from 0.2% to 0.1%, which led to an increase in the year’s indicator to 2.7% from 2.6%, which is calculated excluding fuel and food prices and is an analogue of consumer inflation: its positive dynamics puts pressure on the asset.

Support and resistance

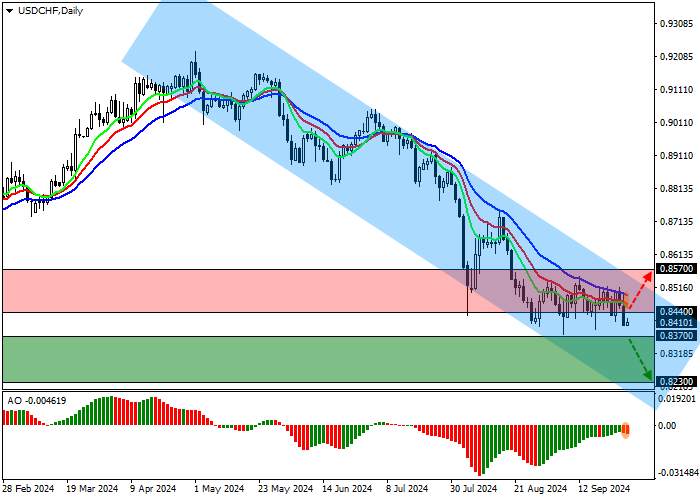

On the daily chart, the trading instrument is correcting above the year’s low of 0.8380.

Technical indicators strengthen the sell signal: fast EMAs on the Alligator indicator are below the signal line, and the AO histogram forms correction bars in the sell zone.

Resistance levels: 0.8440, 0.8570.

Support levels: 0.8370, 0.8230.

Trading tips

Short positions may be opened after the price declines and consolidates below 0.8370, with the target at 0.8230. Stop loss — 0.8430. Implementation period: 7 days or more.

Long positions may be opened after the price grows and consolidates above 0.8440, with the target at 0.8570. Stop loss — around 0.8400.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()