| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY LIMIT |

| Entry Point | 0.8500 |

| Take Profit | 0.8625 |

| Stop Loss | 0.8459 |

| Key Levels | 0.8330, 0.8407, 0.8500, 0.8625, 0.8745, 0.8870 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.8455 |

| Take Profit | 0.8400 |

| Stop Loss | 0.8485 |

| Key Levels | 0.8330, 0.8407, 0.8500, 0.8625, 0.8745, 0.8870 |

Current trend

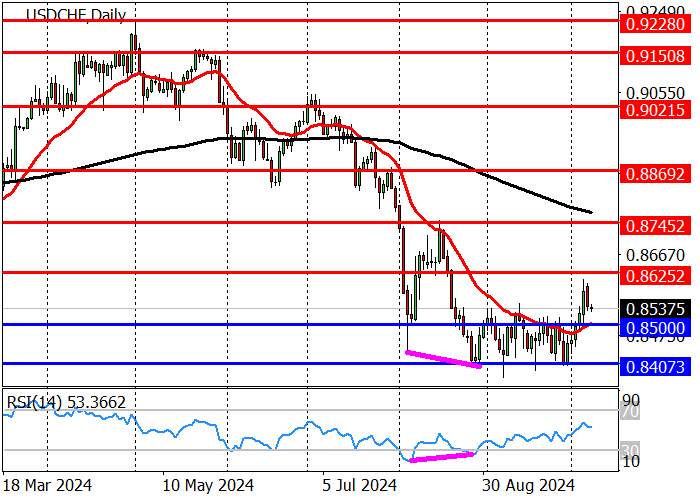

During the Asian session, the USD/CHF pair is trading at 0.8545, preparing to grow to the region of 0.8625.

Last week, the quotes left the sideways channel of 0.8515–0.8407 due to the strengthening of the American dollar against positive statistics on the labor market published on Friday. Thus, the September nonfarm payrolls amounted to 254.0K, exceeding the forecast of 147.0K, and the previous value was revised from 142.0K to 159.0K. Unemployment decreased from 4.2% to 4.1% compared to estimates of 4.2%, which confirms the sector’s recovery. So, investors are revising expectations for the interest rate adjustment by the US Fed. According to the Chicago Mercantile Exchange (CME) FedWatch Instrument, the probability of a cut of 25 basis points reached 85.8%, keeping it at 5.00% – 14.2%.

The September Swiss consumer price index was –0.3%, below the forecast of –0.1% and the previous value of 0.0%, allowing officials of the Swiss National Bank to reduce the cost of borrowing at a meeting on December 12, putting pressure on the franc.

Last week, the long-term trend reversed upwards after the price exited the sideways channel 0.8515–0.8407, and now the growth target is the resistance level of 0.8625. Then, the price may reach 0.8745 and 0.8870. Long positions will become relevant on the correction from the nearest support level, shifting to 0.8500. After its breakdown, the downward trend will be restored, and the quotes may renew the September low of 0.8407. In August, the RSI indicator (14) formed a convergence with the price chart, entered the neutral area, and moved upwards to the overbought area. However, its readings allow us to consider long positions within the trend.

The medium-term trend remains downward: last week, as part of the correction, the asset tested the key resistance area of 0.8608–0.8587 and reversed to 0.8537. Then, the price may reach 0.8500 and 0.8405 (September low). After a breakout of the key resistance area of 0.8608–0.8587, the medium-term trend will reverse upwards, and long positions with the targets in zone 2 (0.8861–0.8836) are relevant.

Support and resistance

Resistance levels: 0.8625, 0.8745, 0.8870.

Support levels: 0.8500, 0.8407, 0.8330.

Trading tips

Long positions may be opened from 0.8500, with the targets of 0.8625 and stop loss of 0.8459. Implementation period: 9–12 days.

Short positions may be opened below 0.8459, with the targets of 0.8400 and stop loss of 0.8485.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()