| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 150.05 |

| Take Profit | 153.00 |

| Stop Loss | 149.00 |

| Key Levels | 144.80, 148.50, 150.00, 153.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 148.45 |

| Take Profit | 144.80 |

| Stop Loss | 150.00 |

| Key Levels | 144.80, 148.50, 150.00, 153.00 |

Current trend

The USD/JPY pair is correcting in an upward trend at 149.25 amid positive dynamics of the American dollar and poor macroeconomic statistics from Japan.

Thus, the August core machinery orders fell from –0.1% to –1.9% MoM and from 8.7% to –3.4% YoY, becoming the first significant reduction since March and reflecting the weakening of activity in the key industry. In addition, yesterday, Japanese Prime Minister Shigeru Ishiba noted that the government is developing a new stimulus package, which may exceed last year’s 13.0T yen.

The American dollar is moving in a corrective trend at 102.90 in the USDX in anticipation of data on foreign trade and mortgage rates. Investors focus on monetary factors. After a series of comments by US Fed officials, traders are almost confident in an interest rate adjustment of –25 basis points at the meeting on November 7, already included in the quotes and, if implemented, will not cause significant fluctuations in the asset. Today at 13:00 (GMT 2), the 30-year mortgage rate is due: after an increase to 6.36%, this time, a return to the September level of 6.15% may follow, supporting the national currency.

Support and resistance

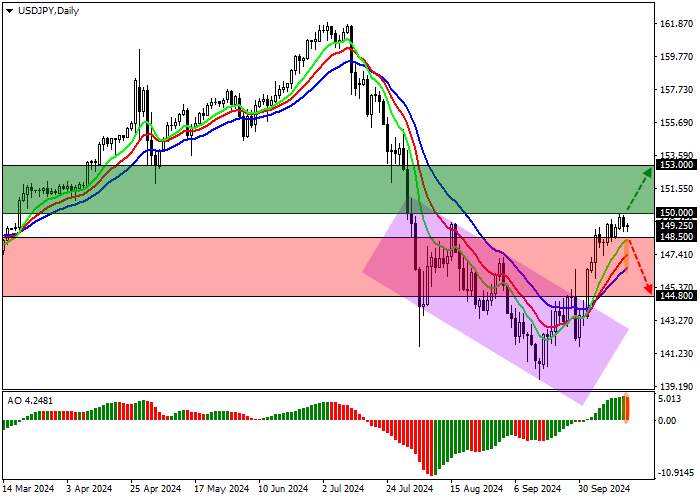

On the daily chart, the trading instrument is correcting upwards as part of working out the exit from the downward channel 145.00–139.00.

Technical indicators have given a buy signal: fast EMAs on the Alligator indicator are moving away from the signal line, and the AO histogram is forming ascending bars in the buy zone.

Resistance levels: 150.00, 153.00.

Support levels: 148.50, 144.80.

Trading tips

Long positions may be opened after the price rises and consolidates above 150.00, with the target at 153.00. Stop loss — 149.00. Implementation period: 7 days or more.

Short positions may be opened after the price falls and consolidates below 148.50, with the target at 144.80. Stop loss — 150.00.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()