| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 34.2330 |

| Take Profit | 34.3500 |

| Stop Loss | 34.1800 |

| Key Levels | 33.9022, 34.0000, 34.0939, 34.1800, 34.2325, 34.3000, 34.3500, 34.4091 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 34.1795 |

| Take Profit | 34.0939 |

| Stop Loss | 34.2325 |

| Key Levels | 33.9022, 34.0000, 34.0939, 34.1800, 34.2325, 34.3000, 34.3500, 34.4091 |

Current trend

During the morning session, the USD/TRY pair is testing the level of 34.2000 for a breakout, although US macroeconomic statistics could not significantly support the American dollar.

Thus, in September, retail sales increased from 0.1% to 0.4% against forecasts of 0.3% but the industrial production indicator decreased from 0.3% to –0.3%, while analysts expected 0.2%. Today, several speeches by representatives of the US Fed are due, which may clarify the further monetary policy. However, according to the Chicago Mercantile Exchange (CME) FedWatch Instrument, traders’ confidence in adjusting the interest rate by –25 basis points following the November meeting of the regulator is already 89.0%. Nevertheless, the results of the December meeting are less certain since the presidential elections will take place before it.

Meanwhile, the Central Bank of the Republic of Turkey kept the interest rate at 50.00%, justifying preliminary estimates of experts. In the accompanying statement, the regulator’s officials noted that inflation continues to trend towards slight growth, offset by a decrease in domestic demand: in September, the consumer price index fell from 52.0% to 49.4%, falling below the psychological level of 50.0% for the first time in a year.

Support and resistance

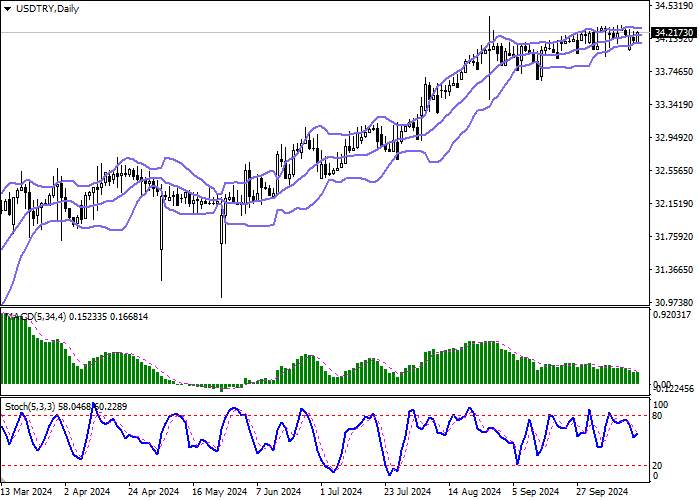

On the daily chart, Bollinger bands are moving flat. The price range remains virtually unchanged, remaining quite spacious for the activity level. The MACD indicator is trying to reverse into an ascending plane, maintaining a sell signal (the histogram is below the signal line). Stochastic reversed into a horizontal plane approximately in the center of the working area. It is better to wait for clarification of signals from the technical indicator.

Resistance levels: 34.2325, 34.3000, 34.3500, 34.4091.

Support levels: 34.1800, 34.0939, 34.0000, 33.9022.

Trading tips

Long positions may be opened after a breakout of 34.2325, with the target at 34.3500. Stop loss — 34.1800. Implementation period: 2–3 days.

Short positions may be opened after a rebound from 34.2325 and a breakdown of 34.1800, with the target at 34.0939. Stop loss — 34.2325.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()