| Scenario | |

|---|---|

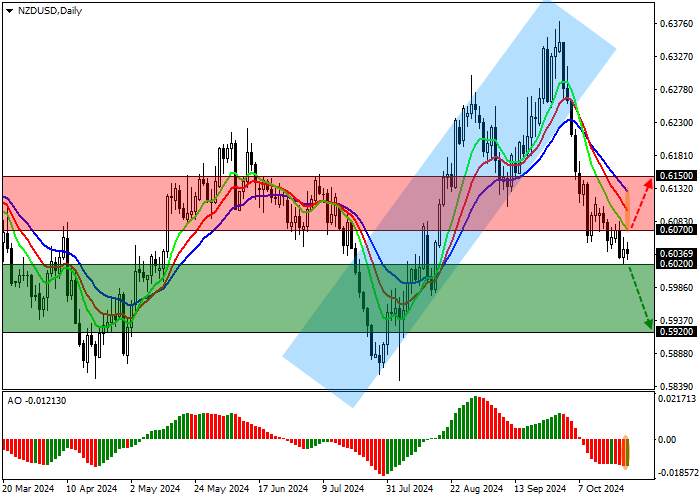

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 0.6015 |

| Take Profit | 0.5920 |

| Stop Loss | 0.6060 |

| Key Levels | 0.5920, 0.6020, 0.6070, 0.6150 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.6075 |

| Take Profit | 0.6150 |

| Stop Loss | 0.6020 |

| Key Levels | 0.5920, 0.6020, 0.6070, 0.6150 |

Current trend

The NZD/USD pair continues its correction dynamics against the American currency strengthened, trading at 0.6036, and New Zealand’s macroeconomic statistics cannot support it.

Thus, in September, the volume of exports increased from 4.85B dollars to 5.01B dollars, and imports decreased from 7.15B dollars to 7.12B dollars, as a result of which the trade balance deficit decreased from –2.306B dollars to –2.108B dollars MoM and from –9.400B dollars to –9.090B dollars YoY, reflecting the recovery of the economy. However, experts are not yet ready to call the situation positive.

The American dollar is holding at 103.90 in the USDX after the labor market data, allowing US Fed officials not to choose between economic growth and lower inflation, as both indicators currently signal in favor of the regulator’s “dovish” monetary policy. According to the Chicago Mercantile Exchange (CME) FedWatch Instrument, at the meeting on November 7, the probability of an interest rate adjustment by –25 basis points, considered in the quotes, is 88.9%, and the American dollar is strengthening due to the revaluation of assets relative to the new possible interest rate of 4.50–4.75%.

Support and resistance

The trading instrument is correcting, retreating from the support line of the ascending channel 0.6280–0.6200.

Technical indicators strengthen the buy signal: fast EMAs on the Alligator indicator are moving away from the signal line, and the AO histogram is forming downward bars below the transition level.

Resistance levels: 0.6070, 0.6150.

Support levels: 0.6020, 0.5920.

Trading tips

Short positions may be opened after the price declines and consolidates below 0.6020, with the target at 0.5920. Stop loss — 0.6060. Implementation period: 7 days or more.

Long positions may be opened after the price grows and consolidates above 0.6070, with the target at 0.6150. Stop loss — 0.6020.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()