| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 128.15 |

| Take Profit | 131.25, 134.38, 137.50 |

| Stop Loss | 125.80 |

| Key Levels | 109.38, 112.50, 118.75, 128.12, 131.25, 134.38, 137.50 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 118.70 |

| Take Profit | 112.50, 109.38 |

| Stop Loss | 121.30 |

| Key Levels | 109.38, 112.50, 118.75, 128.12, 131.25, 134.38, 137.50 |

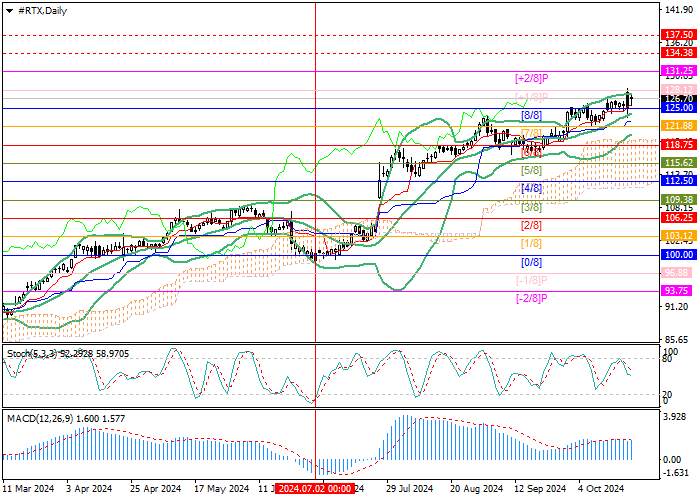

Current trend

Shares of RTX Corp., an American aerospace and defense conglomerate, are trading within the long-term uptrend: the price has passed the entire Murrey trading range from the bottom up, entered the upper reversal zone and is now testing the 128.12 mark (Murrey level [ 1/8]), consolidating above which will allow quotes to continue growing towards the targets of 131.25 (Murrey level [ 2/8]), 134.38 (Murrey level [ 2/8], H4), 137.50 (Murrey level [7/8], W1). The key for the "bears" is the reversal mark of 118.75 (Murrey level [6/8]), supported by the lower line of Bollinger Bands, the breakdown of which will ensure the resumption of downward dynamics to 112.50 (Murrey level [4/8]) and 109.38 (Murrey level [3/8]), but such a scenario in the near future seems less likely.

Technical indicators indicate the continuation of the uptrend: Bollinger Bands are directed upwards, MACD is stable in the positive zone, and Stochastic is directed downwards, but the potential for a corrective decline is seen to be limited.

Support and resistance

Resistance levels: 128.12, 131.25, 134.38, 137.50.

Support levels: 118.75, 112.50, 109.38.

Trading tips

Long positions can be opened above 128.12 with targets of 131.25, 134.38, 137.50 and a stop-loss around 125.80. Implementation period: 5–7 days.

Short positions should be opened below the 118.75 mark with targets of 112.50, 109.38 and a stop-loss around 121.30.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()