| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY LIMIT |

| Entry Point | 0.6582 |

| Take Profit | 0.6730 |

| Stop Loss | 0.6530 |

| Key Levels | 0.6353, 0.6450, 0.6550, 0.6655, 0.6731, 0.6820 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6530 |

| Take Profit | 0.6450 |

| Stop Loss | 0.6570 |

| Key Levels | 0.6353, 0.6450, 0.6550, 0.6655, 0.6731, 0.6820 |

Current trend

The AUD/USD pair is trading at 0.6590, preparing to continue growing against tomorrow’s presidential elections in the US and poor US macroeconomic statistics.

Last week, traders were counting on the victory of the Republican candidate, Donald Trump, which supported the national currency against risky assets, including the Australian dollar, which reached 0.6550. As new poll results appeared, the chances of Trump and Democratic candidate Kamala Harris have almost equalized. If she comes to power, the American dollar may weaken, and the AUD/USD pair could reach the resistance level of 0.6655.

The US currency is under pressure due to the October report on the US labor market. Nonfarm payrolls fell from 223.0K to 12.0K against the forecast of 113.0K. However, experts considered that the statistics were affected by hurricanes Helena and Milton and protest action by employees of The Boeing Co. US Fed officials are unlikely to react to this data and will not refuse to adjust the interest rate by –25 basis points at the meeting on November 7.

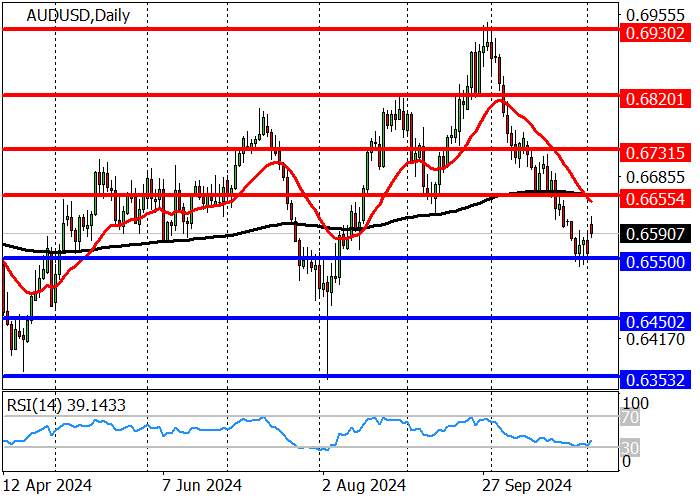

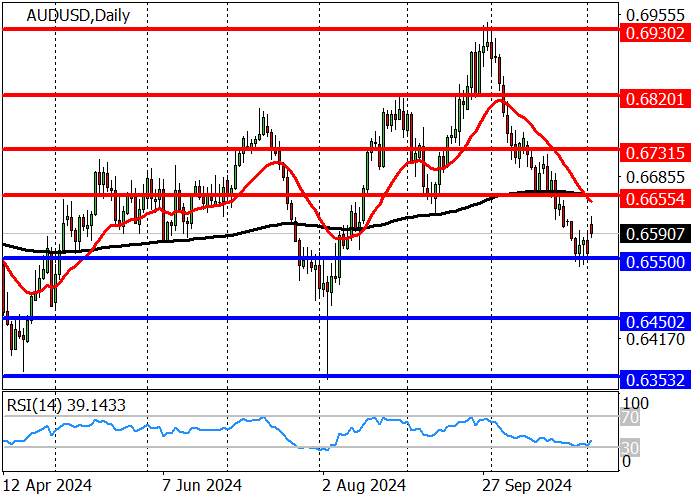

The long-term trend is upward, and after reaching the high of 0.6930, the trading instrument went into a correction, within which it reached the trend support level of 0.6550, where it reversed upwards. If the positive dynamics continue this week, the price may reach 0.6655, 0.6730, and 0.6820. The RSI (14) indicator touched the oversold area, reflecting a possible correction.

The downward medium-term trend remains. The quotes broke zone 2 (0.6637–0.6621) and headed to zone 3 (0.6477–0.7461). In the case of growth to the resistance area of 0.6712–0.6696, short positions with the targets of 0.6625 and 0.6540 (October low) are relevant. However, after a breakout of the resistance area, the price may reach 0.6872–0.6856.

Support and resistance

Resistance levels: 0.6655, 0.6731, 0.6820.

Support levels: 0.6550, 0.6450, 0.6353.

Trading tips

Long positions may be opened from 0.6582, with the target at 0.6730 and stop loss 0.6530. Implementation period: 9–12 days.

Short positions may be opened below 0.6530, with the target at 0.6450 and stop loss 0.6570.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()