| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 480.95 |

| Take Profit | 468.75, 453.12, 437.50 |

| Stop Loss | 491.00 |

| Key Levels | 437.50, 453.12, 468.75, 484.38, 500.00, 531.25, 546.88 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 500.05 |

| Take Profit | 531.25, 546.88 |

| Stop Loss | 487.00 |

| Key Levels | 437.50, 453.12, 468.75, 484.38, 500.00, 531.25, 546.88 |

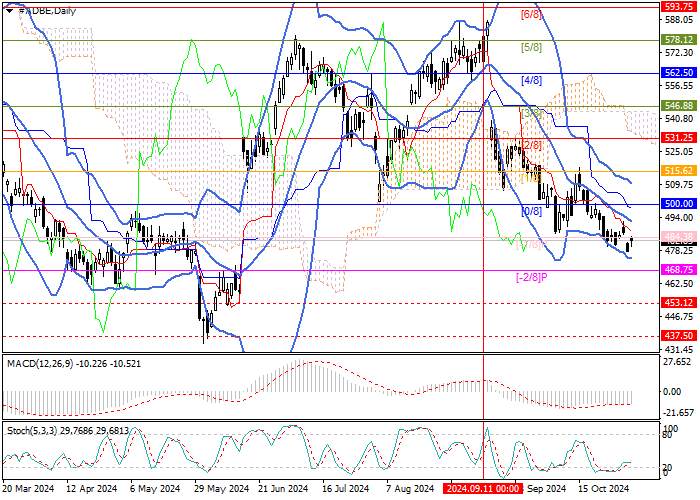

Current trend

Shares of Adobe Inc., a leading American software developer, are trading within a medium-term downward trend. The price rebounded from 578.12 (Murrey level [5/8]), entered the lower reversal zone of the Murrey trading range, and has been actively testing the 484.38 area (Murrey level [–1/8]) for the second week. Consolidation below will allow the quotes to reach the area of 468.75 (Murrey level [–2/8]), 453.12 (Murrey level [–2/8], H1), and 437.50 (Murrey level [2/8], W1). A breakout of 500.00 (Murrey level [0/8]), above the middle line of Bollinger bands, growth to the area of 531.25 (Murrey level [2/8]) and 546.88 (Murrey level [3/8]) may resume.

Technical indicators reflect that the downward trend will continue: Bollinger Bands are directed downwards, and the MACD histogram is stable in the negative zone. Stochastic is reversing upwards from the oversold zone, not excluding limited correction.

Support and resistance

Resistance levels: 500.00, 531.25, 546.88.

Support levels: 484.38, 468.75, 453.12, 437.50.

Trading tips

Short positions may be opened from 481.00, with the targets of 468.75, 453.12, 437.50, and stop loss 491.00. Implementation period: 5–7 days.

Long positions may be opened above 500.00, with the targets of 531.25, 546.88, and stop loss 487.00.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()