| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 0.5920 |

| Take Profit | 0.5858 |

| Stop Loss | 0.5950 |

| Key Levels | 0.5830, 0.5858, 0.5885, 0.5920, 0.5950, 0.5975, 0.6000, 0.6030 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.5980 |

| Take Profit | 0.6030 |

| Stop Loss | 0.5950 |

| Key Levels | 0.5830, 0.5858, 0.5885, 0.5920, 0.5950, 0.5975, 0.6000, 0.6030 |

Current trend

During the morning session, the NZD/USD pair is actively declining, holding below 0.5950 and renewing the lows of August 6.

Preliminary results of the presidential race in the United States, in which the Republican candidate Donald Trump is leading, having already won in the oscillation states of Georgia and North Carolina, are putting pressure on prices. According to The New York Times, he has improved his performance compared to 2020 in almost every state, and even in places where votes for the Democratic Party traditionally prevail (Delaware, Rhode Island, Vermont), there have been changes in favor of competitors. Recall that if Trump comes to power, a tighter tariff policy towards China and the EU, which, in turn, may lead to the US Fed maintaining a higher interest rate. Meanwhile, tomorrow at 20:00 (GMT 2), the regulator’s decision on monetary policy is due. Analysts are almost certain that the cost of borrowing will be adjusted by –25 basis points to 4.75%.

Yesterday’s contradictory US macroeconomic statistics did not have a noticeable impact on the asset’s dynamics. The Institute for Supply Management (ISM) October service PMI increased from 54.9 points to 56.0 points, while a decrease to 53.8 points was expected, and the S&P Global service PMI slowed from 55.3 points to 55.0 points contrary to neutral forecasts. The S&P Global composite PMI changed from 54.3 points to 54.1 points.

In addition, the New Zealand Q3 labor market report negatively affected the quotes. The employment rate has adjusted from 0.4% to –0.5% QoQ compared to estimates of –0.4%, and the labor cost index – from 0.9% to 0.6% QoQ against forecasts of 0.7% and from 3.6% to 3.4% YoY, justifying preliminary estimates. Unemployment accelerated from 4.6% to 4.8% but analysts expected 5.0%.

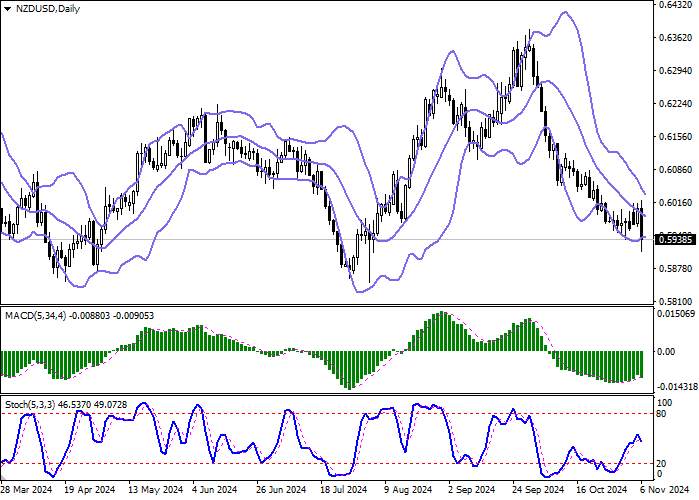

Support and resistance

On the daily chart, Bollinger bands are steadily declining: the price range is narrowing, reflecting the emergence of ambiguous trading dynamics soon. The MACD indicator is reversing downwards, forming a sell signal (the histogram tends to settle below the signal line). Stochastic is reversing downwards in the middle of the working area.

Resistance levels: 0.5950, 0.5975, 0.6000, 0.6030.

Support levels: 0.5920, 0.5885, 0.5858, 0.5830.

Trading tips

Short positions may be opened after a breakdown of 0.5920, with the target at 0.5858. Stop loss — 0.5950. Implementation period: 1–2 days.

Long positions may be opened after a breakout of 0.5975, with the target at 0.6030. Stop loss — 0.5950.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()