Today, we present you a mid-term investment overview of the USD/JPY pair.

The prospects for the strengthening of the Japanese yen remain subdued, despite the intervention of the Bank of Japan. Earlier, the regulator changed its long-term policy of negative interest rates, which, according to officials, led to negative consequences for the country's economy. Currently, the indicator is held at 0.25% after an increase from ˗0.10% at the beginning of the year, however, as experts believe, this did not have a significant positive effect: gross domestic product (GDP) showed growth of only 0.7% in the second quarter, below preliminary estimates of 0.8%, and on an annual basis — by 2.9%, yielding to the forecast of 3.1%. This creates the need either to continue to increase the cost of borrowing, which will increase the debt burden on businesses and households, or to introduce emergency support measures similar to those used during the COVID-19 pandemic. It is worth considering, however, that the "hawkish" cycle may exacerbate the crisis in the labor and real estate markets. In these circumstances, the Bank of Japan can rely on almost the only way to influence the yen exchange rate — currency interventions, which, however, have not been carried out since the end of summer. Nevertheless, given the weakness of key indicators such as household spending, which is declining by 1.9% YoY, and the national consumer price index (CPI), which was 2.5% in September, even larger currency injections will not lead to a long-term strengthening of the national currency, but only temporarily support its exchange rate.

At the same time, the US dollar quotes may continue their uptrend in the near future against the background of a sharp surge in volatility. The Republican candidate Donald Trump is leading the presidential election, which is currently taking place in the United States. In his election program, he focused on changes in immigration and tax policies — experts assess this as a positive signal for USD. Although this political factor will not have a lasting impact on the market, it may well launch a new trend. The possible growth of the dollar is also supported by the fact that the US Federal Reserve is seriously set to switch to a "dovish" monetary policy rate and tomorrow may reduce the key rate by another 25 basis points.

Thus, even with the current monetary policy of the American regulator, the difference in approaches with the Bank of Japan in the near future is too high for the yen to maintain leadership in the USD/JPY pair for a long time, as a result of which the upward dynamics of the trading instrument is the most likely scenario.

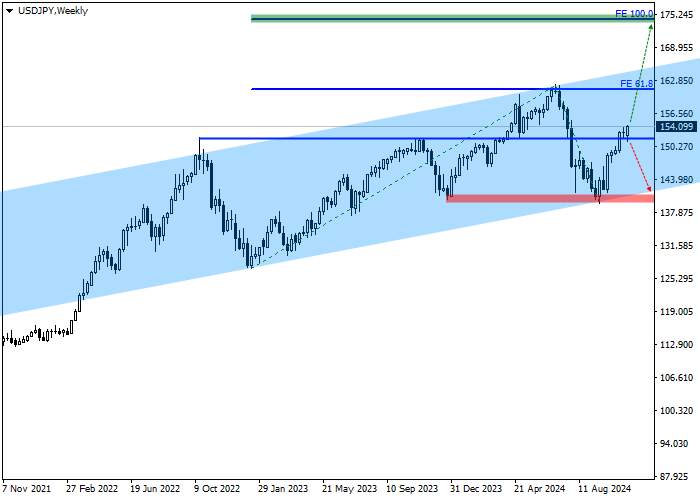

In addition to the underlying fundamental factors, the continued growth of the USD/JPY pair is confirmed by technical indicators: on the W1 chart, the price continues to grow within the channel with the boundaries of 166.00–140.00 and, reflecting from the support line, moves up.

An increase in upward dynamics may occur against the background of consolidation above the resistance level of 153.00, which the price again overcame in early October.

Key levels can be seen on the D1 chart.

As can be seen on the chart, the current growth is an attempt to reach the 61.8% level of the initial trend for the Fibonacci extension at 161.00 for the trend that began in December 2022, after overcoming which the upward dynamics can continue to new highs, the key of which is the 175.00 mark, coinciding with the 100.0% level of the basic trend.

Near the minimum of September 16 at around 140.00 there is a zone of cancellation of the buy signal; if its reached, the upward scenario will be canceled or significantly delayed in time, and open long positions should be liquidated.

In the area of the 100.0% base trend level for the Fibonacci extension at 175.00, there is a target zone; if it's reached, profit should be taken on open long positions.

In more detail, trade entry levels can be evaluated on the H4 chart.

The entry level for purchase transactions is located at 153.00, which coincides with the resistance level of the last two years. Technically, a breakout of the current maximum was realized, which opened up an opportunity to enter the market last week. At the moment, it is possible to form buy positions above the 153.00 mark.

Given the average daily volatility in the USD/JPY pair over the past month, which is 67.5 points, the price movement to the target zone of 175.00 may take about 57 trading sessions, however, with increased dynamics, this time may be reduced to 48 trading days.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()