| Scenario | |

|---|---|

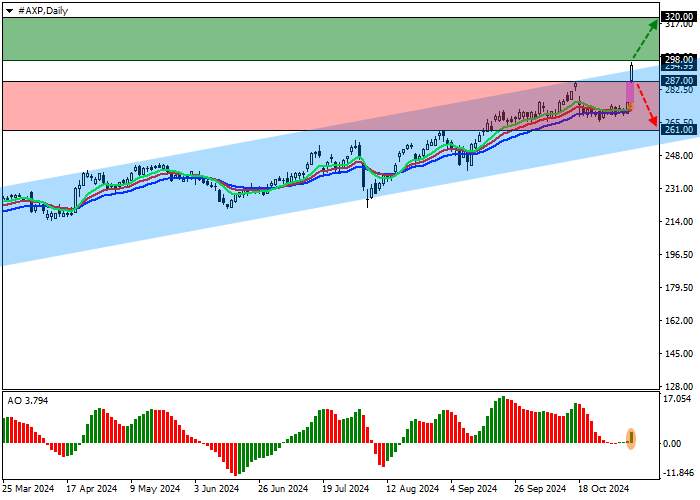

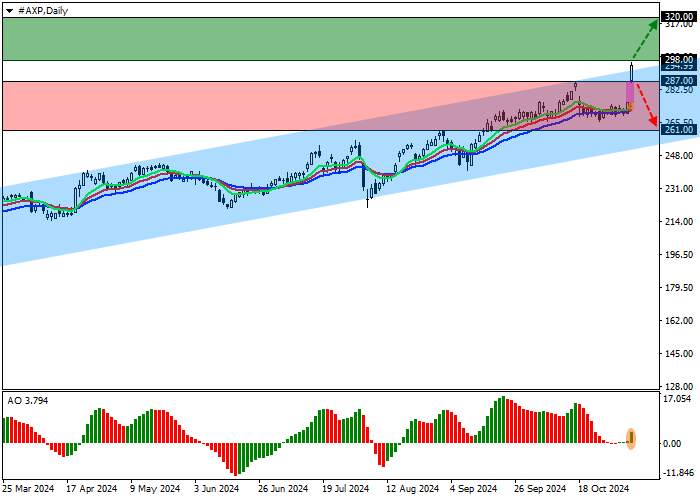

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 298.05 |

| Take Profit | 320.00 |

| Stop Loss | 290.00 |

| Key Levels | 261.00, 287.00, 298.00, 320.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 286.95 |

| Take Profit | 261.00 |

| Stop Loss | 295.00 |

| Key Levels | 261.00, 287.00, 298.00, 320.00 |

Current trend

Shares of American Express Co., one of the leading American multinational companies providing payment transaction services, are correcting at 294.00.

Leading analysts are revising their estimates regarding the prospects of the payment operator’s shares after the publication of the Q3 financial report. Robert W. Baird & Co. experts increased the target price from 215.00 to 240.00, maintaining the rating at underweight, basing the decision on increased estimates of activity for the year as a result of the operator’s revenue growth by 8.0% and an improvement in the forecast for the final earnings per share (EPS) to 13.75–14.05 dollars.

Thus, the Q3 revenue was corrected from 16.30B dollars to 16.64B dollars compared to 15.38B dollars last year, and earnings per share remained at 3.49 dollars against 3.30 dollars. The Board of Directors declared another quarterly dividend on non-cumulative preferred shares of Series D with a consolidated rate of 3.550% of 8.973K dollars per share, which will be paid on December 16 with the register cutoff on December 1.

Support and resistance

On the daily chart, the trading instrument is rising, retreating from the resistance line of the ascending channel, with dynamic boundaries of 290.00–255.00.

Technical indicators gave a buy signal: the EMA oscillation range on the Alligator indicator is directed upwards, fast EMAs are near the signal line, and the AO histogram forms ascending bars.

Resistance levels: 298.00, 320.00.

Support levels: 287.00, 261.00.

Trading tips

Long positions may be opened after the price rises and consolidates above 298.00, with the target at 320.00. Stop loss — 290.00. Implementation period: 7 days or more.

Short positions may be opened after the price falls and consolidates below 287.00, with the target at 261.00 and stop loss 295.00

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()