| Scenery | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry point | 0.8920 |

| Take Profit | 0.8977, 0.9052 |

| Stop Loss | 0.8869 |

| Key levels | 0.8684, 0.8746, 0.8824, 0.8915, 0.8977, 0.9052 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry point | 0.8820 |

| Take Profit | 0.8746, 0.8684 |

| Stop Loss | 0.8869 |

| Key levels | 0.8684, 0.8746, 0.8824, 0.8915, 0.8977, 0.9052 |

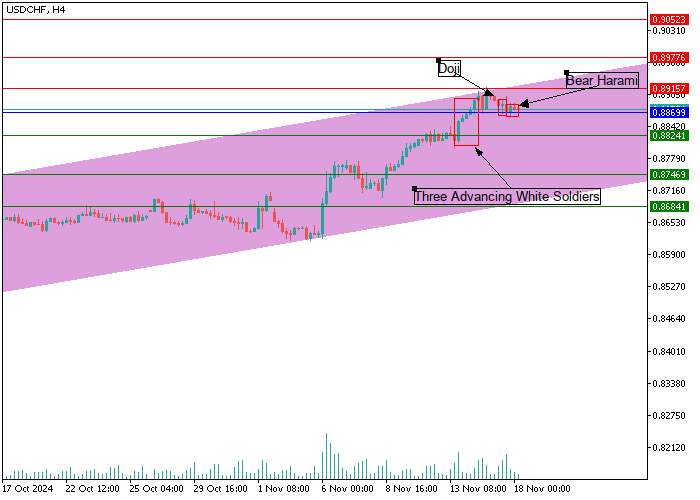

USD/CHF, H4

On the four-hour chart in the range of 0.8824–0.8869, the candlestick analysis pattern “Three White Soldiers Advancing” is observed, which indicates the continuation of the upward dynamics. Upon reaching the resistance level of 0.8915, the price turned downward, forming candlestick patterns “Doji” and “Bearish Harami” in the area of 0.8869: the combination of these figures indicates a slowdown in the uptrend and a further reversal of the price downwards. However, one should not exclude the possibility of a short-term correction in the area of 0.8824, from where the instrument may head upwards again. In case of breaking out and consolidating quotes above the resistance level of 0.8915, one can expect a continuation of the bullish dynamics in the area of 0.8977–0.9052, but if the bears manage to break through the key support line of the bulls at the level of 0.8824, the potential for a downward movement in the area of 0.8746–0.8684 will significantly increase.

USD/CHF, D1

On the daily chart in the range of 0.8684–0.8746, the formation of a volumetric candlestick "Bullish Marubozu" as well as the "Three White Soldiers Advancing" pattern is observed, emphasizing the strength of buyers and warning traders about the continuation of the uptrend. Most likely, the USD/CHF quotes will continue moving towards the resistance level of 0.8915 after a short-term correction to 0.8824, and consolidation above the level of 0.8915 can be a catalyst for opening long positions with targets of 0.8977–0.9052.

Support and resistance levels

Support levels: 0.8824, 0.8746, 0.8684.

Resistance levels: 0.8915, 0.8977, 0.9052.

Business scenarios

Long positions can be opened above the level of 0.8915 with targets at 0.8977, 0.9052. Stop-loss — 0.8869. Implementation period: 9-12 days.

Short positions can be opened below the level of 0.8824 with targets at 0.8746, 0.8684. Stop-loss — 0.8869.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()