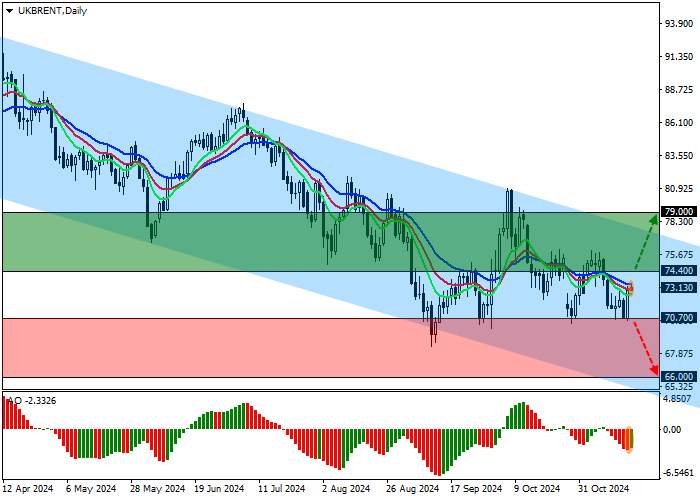

| scenario | |

|---|---|

| chart | Weekly |

| Recommendation | BUY STOP |

| entry point | 74.40 |

| Take Profit | 79.00 |

| Stop Loss | 72.00 |

| main levels | 66.00, 70.70, 74.40, 79.00 |

| alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| entry point | 70.70 |

| Take Profit | 66.00 |

| Stop Loss | 72.00 |

| main levels | 66.00, 70.70, 74.40, 79.00 |

The ongoing trend

After last week's decline, prices for the benchmark Brent Crude Oil are correcting just above the 73.00 mark, and the fall was supported by the latest statements of Sudan's Energy and Petroleum Minister Muhyiddin al-Naim Said. He said that the clashes in his country between the paramilitary group Rapid Reaction Force and the Sovereign Council had caused only "little or no damage to infrastructure" and Sudan supplies 1.2 million barrels of hydrocarbons to the market every 40 days. In addition, under the partnership agreement, Russian companies can start developing up to 22 fields in the country in relatively safe regions.

At the same time, according to China's National Bureau of Statistics, energy imports fell by 3.4% to 457.0 million tonnes from January to October 2024, compared to 44.7 million tonnes in October, 8.7% less than a year earlier. The country is trying to offset the drop in demand by increasing its own production, which has risen by 2.0% to 177.64 million tonnes since the beginning of the year and by 2.5% to 17.77 million tonnes in October.

Oil trading volume on the Chicago Mercantile Exchange (CME Group) changed from 1.0 million in the first two weeks of the month to 0.92-0.95 million this week, reflecting a slight decline in investor interest in the asset.

support and resistance

In the daily chart, the trading instrument is moving within the channel 78.00–65.50. Against the background of the correction, there will probably be a slight strengthening of the asset position.

The technical indicators are slowing down the sell signal: the fast EMAs of the Alligator indicator are below the signal line, the AO histogram formed the first rising bar in the sell zone.

Supports: 70.70, 66.00.

Resistances: 74.40, 79.00.

trading tips

Long positions are relevant in case of upward movement with price consolidation above 74.40 with price target of 79.00 and stop loss at 72.00. Validity: 7 days or more.

Short positions are current in case of downward movement with price consolidation below 70.70 with price target of 66.00 and stop loss of 72.00.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()