| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 3200.20 |

| Take Profit | 3437.00, 3750.00 |

| Stop Loss | 3085.00 |

| Key Levels | 2187.50, 2500.00, 2904.00, 3437.00, 3750.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 2900.00 |

| Take Profit | 2500.00, 2187.50 |

| Stop Loss | 3125.00 |

| Key Levels | 2187.50, 2500.00, 2904.00, 3437.00, 3750.00 |

Current trend

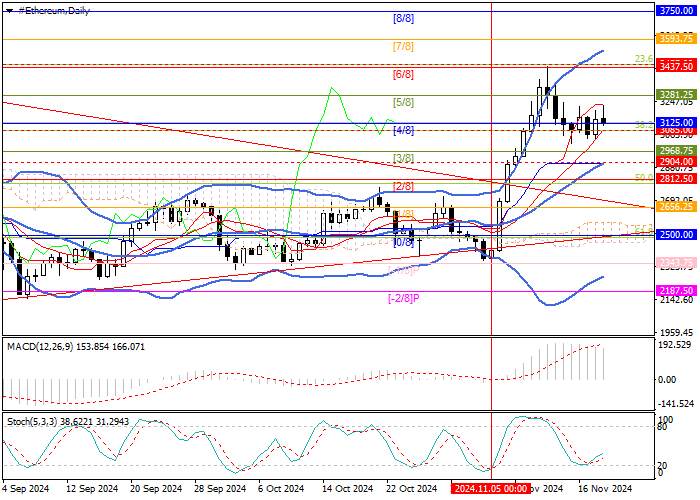

Since the beginning of this month, the ETH/USD pair has been actively growing against the backdrop of the re-election of Republican Party representative Donald Trump as US President. Last week, quotes reached five-month highs in the area of 3437.00 (Murrey level [6/8]), after which they corrected downwards amid partial profit-taking by investors. Currently, the price is near the support zone of 3125.00–3085.00 (Murrey level [4/8], Fibonacci retracement 38.2%), from where it can resume growth to targets of 3437.00 (Murrey level [6/8]) and 3750.00 (Murrey level [8/8]). This option of movement seems more likely in the near future.

Technical indicators confirm the continuation of the upward trend in the market: Bollinger Bands and Stochastic are reversing upwards, and MACD histogram is stable in the positive zone. A change in the current trend and a transition to a significant price decline will become possible with a downward breakout of the center line of Bollinger Bands in the area of 2904.00: in this case, the targets will be at 2500.00 (Murrey level [8/8], Fibonacci retracement 61.8%) and 2187.50 (Murrey level [–2/8]); however, while the upward trend continues, a significant negative price dynamics seems less likely.

Support and resistance

Resistance levels: 3437.00, 3750.00.

Support levels: 2904.00, 2500.00, 2187.50.

Trading tips

Long positions may be opened from 3200.20 with targets at 3437.00, 3750.00 and stop-loss at 3085.00. Implementation period: 5-7 days.

Short positions could be opened below 2904.00 with targets at 2500.00, 2187.50 and stop-loss at 3125.00.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()