| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 143.05 |

| Take Profit | 169.00 |

| Stop Loss | 134.00 |

| Key Levels | 103.00, 129.00, 143.00, 169.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 128.95 |

| Take Profit | 103.00 |

| Stop Loss | 136.00 |

| Key Levels | 103.00, 129.00, 143.00, 169.00 |

Current trend

Shares of Nvidia Corp., the American giant in the field of video graphics processor development, are trading in a correction trend at 135.00.

The company maintains a leading position in the market of high-performance processors, both with and without artificial intelligence chips. In particular, the Blackwell line remains a key product, which by the end of the year may bring in up to 5.0–6.0B dollars in revenue, exceeding initial estimates. The gaming division is also demonstrating significant progress, which, due to a significant increase in sales of RTX 40 series video cards, increased gaming revenue by 15.0% compared to the previous year.

Last week, the Q3 financial report was presented. Revenue reached a record 35.1B dollars, exceeding the same period last year by 94.0% and the second quarter by 17.0%, and earnings per share (EPS) amounted to 0.81 dollars against the expected 0.75 dollars. The largest contribution to the dynamics was recorded by the data center segment (17.0%) due to the development of processors based on the Nvidia Hopper architecture.

Against this background, leading analysts are adjusting their forecasts: thus, experts from The Goldman Sachs Group Inc. expect that non-GAAP earnings per share for 2025, 2026, and 2027 will increase by 1.0%, 5.0%, and 7.0%, respectively.

Support and resistance

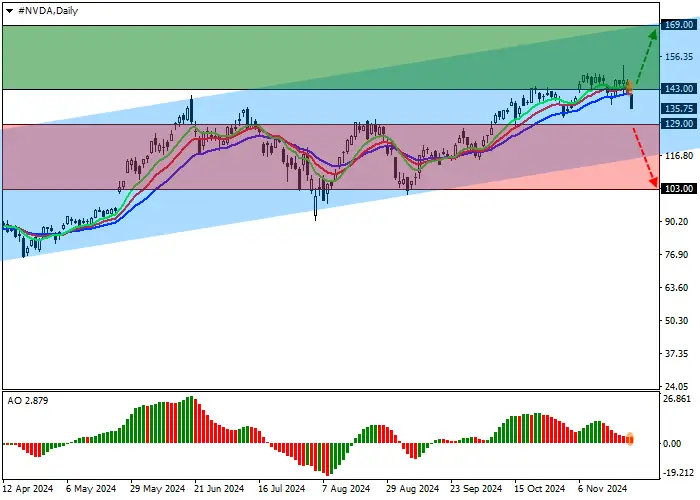

On the daily chart, the trading instrument is correcting within the ascending range with boundaries of 169.00–118.00.

Technical indicators maintain a buy signal: the EMA oscillation range of the Alligator indicator is directed towards growth, and the AO histogram forms correction bars above the transition level.

Resistance levels: 143.00, 169.00.

Support levels: 129.00, 103.00.

Trading tips

Long positions may be opened after the price rises and consolidates above 143.00, with the target at 169.00. Stop loss is 134.00. Implementation period: 7 days or more.

Short positions may be opened after the price falls and consolidates below 129.00, with the target at 103.00. Stop loss is 136.00.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo