| Scenario | |

|---|---|

| Time period | Intraday |

| Recommendation | BUY STOP |

| Entry point | 0.6535 |

| Get the profit | 0.6600 |

| Stop loss | 0.6500 |

| Critical levels | 0.6420, 0.6440, 0.6478, 0.6500, 0.6532, 0.6549, 0.6570, 0.6600 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry point | 0.6500 |

| Get the profit | 0.6440 |

| Stop loss | 0.6532 |

| Critical levels | 0.6420, 0.6440, 0.6478, 0.6500, 0.6532, 0.6549, 0.6570, 0.6600 |

Current dynamics

The AUD/USD pair is showing quite active growth, building on the "bullish" momentum that formed on Wednesday. The instrument is testing 0.6520 for a breakout, while the "bulls" are supported by the fact that trading platforms in the US are closed for the Thanksgiving holiday.

Earlier, investors weighed macroeconomic releases from the U.S., where the final estimate for third-quarter GDP growth was confirmed at 2.8%, while Durable Goods Orders rose 0.2% in October after falling 0.4% the previous month, when analysts had expected 0.5%. Personal Income for U.S. households rose 0.6% after rising 0.3% against neutral expectations, while spending slowed to 0.4% from 0.6% but came in above expectations at 0.3%. The Core Personal Consumption Expenditure Price Index was adjusted to 2.8% from 2.7% a year earlier and 0.3% from the previous month, while the broader measure accelerated to 2.3% from 2.1%. Finally, Initial Jobless Claims for the week ending November 22 decreased from 215,000 to 213,000, compared to the preliminary estimate of 217,000, and Continuing Jobless Claims for the week ending November 15 increased from 1.898 million to 1.907 million, compared to the initial estimate of 1.910 million.

The instrument is getting some support from data from Australia, where private sector credit rose to 6.1% in October from 5.8% y/y and to 0.6% m/m from 0.5% m/m, outperforming neutral estimates. Investors are focused on comments from Reserve Bank of Australia (RBA) Governor Michele Bullock today, who said core inflation needs to be below 3% for the regulator to consider adjusting interest rates. According to the official, there is still much work to be done to stabilize the rate of consumer price growth within the 2-3% target range, and such levels are unlikely to be reached before 2026.

Support and Resistance levels

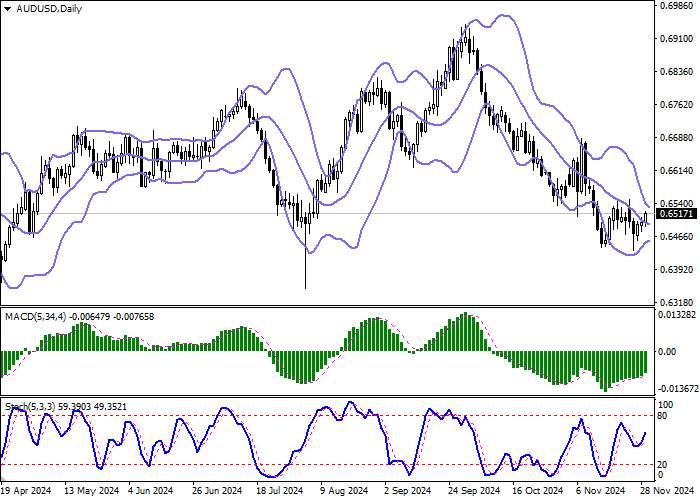

On the daily chart, Bollinger Bands show a steady decline. In the ultra-short term, the price range is narrowing, reflecting the uncertain dynamics of the transaction. MACD is growing, maintaining a stable buy signal (located above the signal line). Stochastic shows similar dynamics, rapidly approaching its highs, indicating an increasing risk of overbought of the Australian dollar in the ultra-short term.

Resistance levels: 0.6532, 0.6549, 0.6570, 0.6600.

Support levels: 0.6500, 0.6478, 0.6440, 0.6420.

Trading tips

Long positions can be opened after breaking the level of 0.6532 with a target of 0.6600. Stop-loss — 0.6500. Trading period: 2-3 days.

A rebound from the 0.6532 resistance level and subsequent downward break of the 0.6500 level may be a signal to open new short positions with a target of 0.6440. Stop-loss — 0.6532.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()