Oil prices eased on Thursday after surging the day on the positive sentiment from a sizable draw in US gasoline stocks. Traders have slashed bullish bets on crude oil, with WTI net long positions at a 15-year low in February.

Cooler inflation last month leaves the door open for the Fed to resume cutting interest rates by mid-year, but the central bank remains worried that tariffs could rekindle price pressures.

US crude stockpiles rose by 1.4 million barrels in the latest week, EIA data showed, less than the 2 million-barrel rise analysts had expected. Gasoline inventories also fell more than expected.

Canada could impose non-tariff measures such as restricting its oil exports to the US or levying export duties on products if the trade dispute escalates, the country's energy minister Jonathan Wilkinson said on Tuesday.

Trump threatened on Wednesday to escalate a global trade war with further tariffs on EU goods. His unpredictability has rattled investors, consumers and business confidence and raised recession fears.

OPEC's monthly report showed OPEC+ raised output in February by 363,000 barrels per day, though the group kept its forecasts for relatively strong growth in global oil demand in 2025.

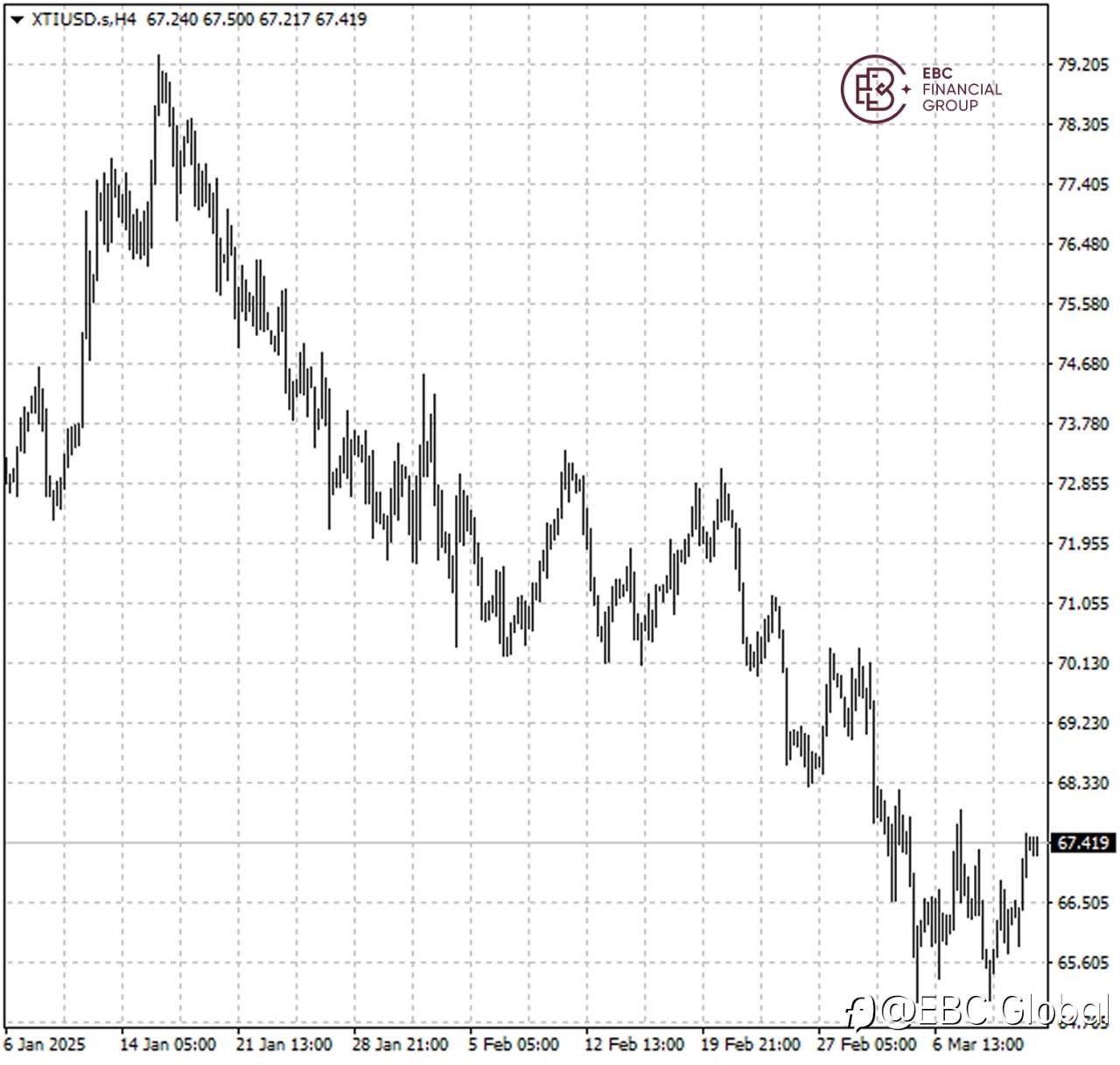

WTI crude has recently digested its heavy losses with the initial resistance around $68. A break above the level could lead the price to $70.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发