An Expert Advisor (EA) is an automated trading system designed to execute trades based on pre-programmed rules. EAs operate on the MetaTrader 5 (MT5) platform, removing the need for manual intervention by analysing market conditions and placing trades automatically.

Traders use EAs to ensure their trading strategies' precision, efficiency, and discipline.

Importance of Optimization in Algorithmic Trading

While an EA can execute trades effectively, its performance heavily depends on how well it is configured. Market conditions change over time, meaning an EA that worked well in the past may not remain profitable.

Optimisation is the process of fine-tuning an EA’s parameters to adapt to different market conditions, enhancing its profitability and stability.

Without optimisation, an EA may:

- Perform well in certain conditions but fail in others.

- Be overfitted to past data, leading to poor real-time performance.

- Struggle to manage risk effectively due to poorly calibrated parameters.

Overview of the MT5 Strategy Tester

MT5 provides a powerful Strategy Tester tool, which allows traders to backtest and optimise their EAs. This tool simulates trading based on historical data to determine how an EA would have performed under different conditions.

Key features of the MT5 Strategy Tester include:

- Backtesting: Running an EA against historical data to assess performance.

- Optimisation: Finding the best parameter combinations for maximum profitability.

- Multi-Threaded Processing: Using multiple CPU cores to speed up the testing process.

- Genetic Algorithm Optimization: A smart method that selects the best settings without testing every possible combination.

- Forward Testing: Ensuring that optimised settings remain effective in unseen market conditions.

By understanding the importance of EA optimisation and how the MT5 Strategy Tester works, traders can fine-tune their automated strategies to achieve better performance and adapt to changing markets.

What Does Optimization Mean in MT5?

Optimisation in MT5 refers to systematically adjusting an Expert Advisor's (EA) parameters to improve performance. The goal is to identify the best possible settings that maximise profitability, reduce drawdowns, and improve trading consistency.

The MT5 Strategy Tester allows traders to run multiple backtests using different combinations of input parameters, evaluating the EA's performance under historical market conditions. By doing so, traders can find optimal settings that align with their trading goals.

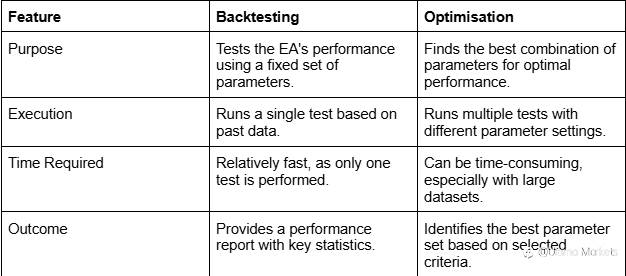

While both backtesting and optimisation are essential for EA development, they serve different purposes:

Benefits of Optimizing an EA

Optimising an EA is essential for improving its trading efficiency and adapting it to various market conditions. Some key benefits include:

- Improved Profitability: Traders can enhance the EA's profitability by fine-tuning settings such as lot size, stop loss, and take profit levels.

- Better Risk Management: Optimization helps adjust risk parameters to reduce drawdowns and protect capital.

- Adaptability to Market Changes: Markets evolve, and an optimised EA can adjust to different volatility levels, trends, and price action patterns.

- Enhanced Execution Speed: Efficient settings improve execution times, reducing slippage and order delays.

- Prevention of Overfitting: Proper optimisation ensures the EA performs well in both past and future market conditions rather than being overly tuned to historical data.

Preparing for Optimization

Proper preparation is crucial before running an optimisation in MetaTrader 5 (MT5). A well-prepared setup ensures reliable results and prevents common pitfalls like overfitting. Traders must select the right EA, set up historical data, choose the best trading pairs and timeframes, and configure EA parameters for optimisation.

Selecting the Right EA

Not all Expert Advisors (EAs) are designed for optimisation. Some may have hard-coded parameters that cannot be adjusted, while others may require manual input for certain conditions. Before optimising, you must ensure:

- The EA allows parameter modifications.

- It has adjustable stop-loss, take-profit, lot size, and strategy-related inputs.

- It is designed to work in different market conditions, not just a single scenario.

- It supports historical backtesting and optimisation.

If an EA lacks flexibility, optimisation won’t be effective.

Setting Up Historical Data

The accuracy of optimisation depends on the quality of historical price data. If the data is incomplete or low-quality, optimisation results may not reflect real market conditions.

Steps to Set Up High-Quality Historical Data:

1. Download the Correct Market Data:

- Open MT5 → Go to View → Select Symbols.

- Download historical data for the trading instrument you want to optimise.

2. Ensure a Long Enough Data Range:

- Use at least 2-5 years of historical data for robust results.

- The longer the period, the better the EA adapts to different market conditions.

3. Check Data Accuracy & Gaps:

- Look for missing data points or irregular price movements.

- Use tick data, if available, for the most precise simulation.

S

Download historical data from Symbols options in MT5

Choosing a Suitable Trading Pair and Timeframe

The effectiveness of an EA depends on the currency pair or asset being traded and the timeframe in which it operates.

Selecting a Currency Pair or Asset

- If the EA is designed for a specific instrument (e.g., EUR/USD, NAS100, or Gold), optimise it for that pair.

- If the EA is a multi-asset strategy, test it across different instruments to identify the best-performing one.

- Avoid optimising for exotic pairs unless the EA is specifically designed for them due to high spreads and low liquidity.

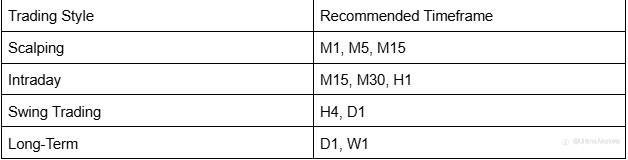

Choosing the Right Timeframe

The timeframe selection depends on the EA’s trading style:

If unsure about the timeframes, start with H1 and then refine based on results.

Configuring Initial EA Parameters

Before optimisation, define which EA settings to optimise and which to keep fixed.

Types of Parameters to Optimize

- Entry & Exit Conditions: Fine-tune moving averages, RSI thresholds, MACD crossovers, etc.

- Stop Loss & Take Profit Levels: Adjust SL/TP to improve risk-reward ratios.

- Lot Size & Money Management: Test fixed lot vs. dynamic position sizing.

- Trailing Stop & Break-Even Rules: Improve risk management.

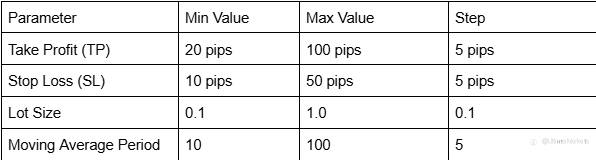

Setting Parameter Ranges

Optimisation requires defining minimum, maximum, and step values for each parameter.

Traders must use logical ranges—too many values slow down optimisation, while too few reduce accuracy.

Using the MT5 Strategy Tester for Optimization

The MT5 Strategy Tester is a powerful tool for optimizing Expert Advisors (EAs). It allows traders to test multiple parameter combinations, simulate real market conditions, and determine the most effective settings.

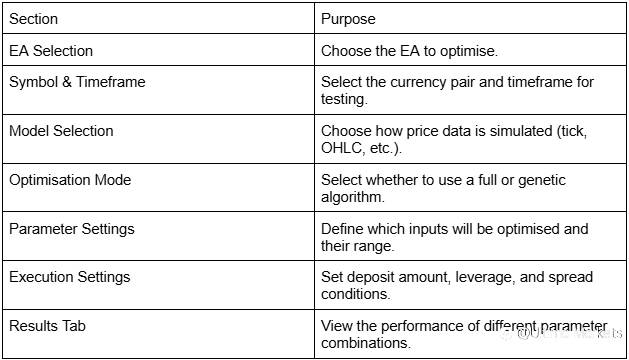

Navigating the Strategy Tester Interface

To access the MT5 Strategy Tester:

- Open MT5.

- Go to View → Strategy Tester (or press Ctrl + R).

- The Strategy Tester panel will appear at the bottom of the screen.

The interface consists of several sections:

Strategy Tester options in MT5 (EN)

Strategy Tester options in MT5 (TC)

Strategy Tester options in MT5 (SC)

Choosing the Right Optimization Mode

MT5 offers two primary optimisation modes:

1. Slow (Full) Optimization: It tests all possible combinations of input parameters and provides the most accurate results but is time-consuming. It is suitable for small parameter ranges or when high accuracy is needed.

2. Fast Genetic Algorithm (GA) Optimization: It uses machine learning techniques to find the best settings, prioritises high-performing parameter combinations and eliminates weaker ones. It is much faster than full optimisation and is ideal for large parameter ranges.

It is recommended that the Genetic Algorithm be used first to identify promising settings, then refined with Full Optimization.

Defining Input Parameters for Optimization

To optimise an EA, define which parameters should change and set their ranges:

- Click on Inputs in the Strategy Tester.

- Check the box next to each parameter you want to optimise.

- Set Min, Max, and Step values for each parameter.

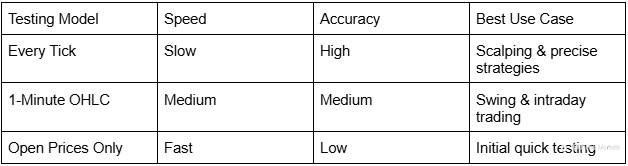

Selecting the Best Testing Model

MT5 provides different testing models for optimisation. The choice depends on speed vs. accuracy.

For scalping EAs, use “Every Tick”; for a balanced speed and accuracy, use “1-Minute OHLC”.

Adjusting Spread, Slippage, and Trading Conditions

For realistic optimisation, ensure market conditions reflect real trading scenarios.

1. Spread Settings: While optimising, you can use fixed or variable spreads. You can also set a realistic spread or use the current speed for a real-market simulation.

2. Slippage Settings: It accounts for order execution delays. You must set a reasonable value (e.g., 2-3 pips for volatile markets).

3. Initial Deposit & Leverage: You must set a realistic deposit amount and leverage (e.g., $10,000 with 1:100).

Analysing Optimization Results

Once the Expert Advisor (EA) optimisation process in MetaTrader 5 (MT5) is complete, the next step is to analyse the results to ensure the selected parameters offer a balance of profitability, stability, and risk control.

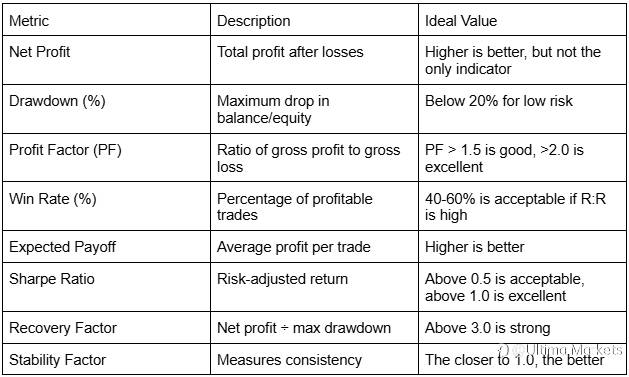

Understanding Optimization Metrics

MT5 provides several key metrics in the Optimization Results tab. Each of these metrics helps evaluate the EA’s overall performance.

Identifying the Best Performing Settings

After running optimisation, MT5 ranks parameter combinations based on net profit by default. However, blindly choosing the most profitable result can be risky.

- Sort results by Profit Factor (PF): A setting with a high PF is more sustainable than one with extreme profits but a low PF.

- Check the Drawdown column: If two settings have similar profits but one has a much lower drawdown, choose the safer option.

- Look at the Recovery Factor: This tells you how efficiently the EA recovers from losses.

- Ensure a Smooth Equity Curve: Avoid results with sharp fluctuations.

- Test the settings in Forward Testing: Apply them to a demo account before live trading.

Detecting Overfitting

Overfitting happens when an EA is optimised too specifically for past data, making it perform well in backtests but fail in live trading.

Signs of overfitting:

- Unusually high-profit factor (e.g., PF above 5.0).

- Extreme win rate (above 80% in backtests).

- Unrealistically high net profit.

- Huge drop in performance when tested on different timeframes or assets.

Ways to prevent overfitting:

- Use Walk-Forward Testing: Check if the EA works on unseen market conditions.

- Test on Different Market Conditions: Ensure the EA performs well in trending, ranging, and volatile markets.

- Avoid Over-Optimizing Parameters: More parameters optimised = higher risk of curve fitting.

Analysing the Equity Curve & Performance Graph

MT5 provides graphical data in the Results and Graph tabs, helping you visually assess an EA’s stability.

Comparing Different Optimization Runs

To get the best possible EA settings, compare different optimisation tests. To compare different optimisation tests effectively, traders must:

- Run tests on different market conditions: Check if the EA performs well across different years.

- Test multiple timeframes: A good EA should work on H1, H4, and D1, not just one specific timeframe.

- Compare across different brokers: Some settings may work better on ECN vs. standard accounts.

- Check performance in different asset classes: If an EA is designed for forex, see if it works on indices or commodities.

After analysing the results, the final step is to implement the optimised EA in live trading while maintaining proper risk controls.

Trade with Ultima Markets

Ultima Markets is a fully licensed broker and a multi-asset trading platform offering access to

250+ CFD financial instruments, including Forex, Commodities, Indices and Shares. We

guarantee tight spreads and fast execution. Until now, we have served clients from 172

countries and regions with our trustworthy services and well-built trading systems.

Ultima Markets has achieved remarkable recognition in 2024, winning prestigious awards

such as the Best Affiliates Brokerage, Best Fund Safety in Global Forex Awards, and

the Best APAC CFD broker in Traders Fair 2024 Hong Kong. As the first CFD broker to join

the United Nations Global Compact, Ultima Markets underscores its commitment to

sustainability and the mission to advance ethical financial services and contribute to a

sustainable future.

Ultima Markets is a member of The Financial Commission, an international independent

body responsible for resolving disputes in the Forex and CFD markets.

All clients of Ultima Markets are protected under insurance coverage provided by Willis

Towers Watson (WTW), a global insurance brokerage established in 1828, with claims

eligibility up to US$1,000,000 per account.

Open an account with Ultima Markets to start your index CFDs trading journey.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()