Indices are indicators of a country's stock market. Many indices even represent a particular sector or company size.

You must have heard about the Dow Jones, FTSE 100, Hang Seng, and Nikkei 225. These are stock indices representing the top companies in different countries.

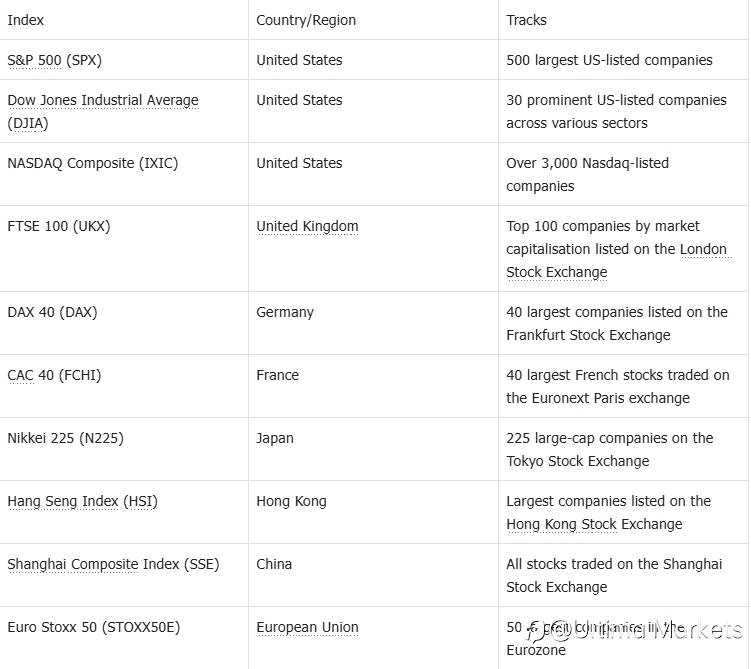

Top Global Indices

All big and small countries have one or more indices. These indices represent different categories of companies listed on the country’s exchanges.

Some of the most recognisable stock indices are:

How Are Indices Calculated?

Stock indices are calculated differently—some give weight to companies' market capitalisation, while others prioritise sector or liquidity. Whatever the case, each index represents a particular set of companies or sectors.

Some of the popular methods to calculate stock indices are:

- Price-weighted method: In this approach, the prices of the index's constituent stocks determine its value. Stocks with higher prices significantly influence the index's movement, regardless of the company's overall size. The Dow Jones Industrial Average (DJIA) is a well-known example of a price-weighted index.

- Market capitalisation-weighted method: The index calculation is influenced by the constituent companies' total market value (market capitalisation). Stocks with a higher market capitalisation have a more significant impact on the index. Indices like the S&P 500 and NASDAQ-100 use this method, making it one of the most commonly used approaches.

- Equal-weighted method: This method assigns the same weight to each stock, regardless of its price or market capitalisation. Changes in the price of any single stock have an equal impact on the index. Equal-weighted indices provide a more balanced view of performance but are less common due to their simplicity.

- Fundamental-weighted method: Unlike traditional methods, this approach uses fundamental factors such as earnings, dividends, or revenue to determine the weighting of each stock. It aims to reflect the underlying financial health of the companies rather than their market prices.

- Sector-based weighting: In this method, stocks are grouped and weighted based on the sector they represent. The index's performance reflects the performance of different sectors within the economy.

Each method offers unique insights, catering to different types of investors and analytical needs. The choice of method depends on the purpose of the index and the aspects of the market it aims to highlight.

How to Trade an Index?

Indices are a collection of stocks. They can be traded using various instruments, some of which trade like stocks, while others are derivatives. Here are some of the instruments that facilitate index trading:

- Index CFDs: Index contracts for differences (CFDs) are popular derivative instruments for trading different indices. These instruments have characteristics of any other CFDs, only that they track the price of the underlying index (The future section of this chapter dives deeper into index CFDs).

- Index futures: Index futures are derivatives contracts to buy or sell an index at a predetermined price on a specific date in the future. These futures contracts are standardised and often traded on exchanges, making them highly liquid and transparent.

- Index options: Index options are derivative contracts that give traders the right to buy (call options) or sell (put options) an index at a predetermined price within a specified period but without any obligation to that.

- Index ETFs: Index exchange-traded funds (ETFs) trade like any other regular stock on exchanges. These ETFs are issued by any particular company that issues these ETFs to track the price of the underlying index. These index ETFs are very popular among long-term investors, as they are highly liquid and come with minimal management fees.

- Index mutual funds: Mutual funds that track indices pool money from multiple investors to purchase the underlying stocks of an index. These funds are professionally managed and are bought and sold at the net asset value (NAV) at the end of the trading day. However, mutual funds often have higher management fees compared to ETFs.

Several other ways to trade indices exist, such as spread betting and swaps. However, those instruments are often limited to one geographical area (like spread betting, which is popular in the United Kingdom for tax purposes) or suitable for institutions (like swaps, which are often tailored to specific needs).

What Is an Index CFD?

Index contracts for differences, commonly called index CFDs, are derivatives contracts that track the price of a particular index. These instruments work similarly to other CFDs, meaning they pay the investor the difference in settlement price between the opening and closing of a trade.

These contracts allow traders to take leveraged long and short positions on the anticipated performance of the underlying index. They are very popular among active indices traders.

Advantages of Index CFDs

Besides CFDs, many other instruments can enable index trading. However, trading index CFDs has many advantages over other index trading instruments.

- Leveraged trading: CFDs are leveraged instruments, meaning traders can trade index CFDs with only a fraction of the total value of the position taken. Leverage amplifies trade profitability significantly but also increases the chance of losing the margin capital quickly if the market moves in the opposite direction.

- Long and short positions: Index CFDs allow traders to take either long or short positions on the anticipated price of the underlying index. So, a trader can take either a long position (trade the buy price of the CFD contract) or take a short position (trade the sell price of the CFD contract).

- No expiry dates: Unlike other derivatives like futures and options, index CFDs do not have any expiry dates. These contracts remain open until the trader closes the position.

- Cost efficiency: As Index CFDs are derivatives, they do not have associated costs like stamp duty or management fees common with index funds or ETFs.

- Extended trading hours: CFDs are over-the-counter (OTC) instruments. Thus, these index CFDs are available for trading beyond the regular trading hours of stock exchanges.

How Are Index CFDs Priced?

Index CFDs are priced based on the underlying stock market index they represent. The price of the CFD reflects the movement of that index, which is usually quoted in points.

The key factors considered in pricing index CFDs are:

- The underlying index price: The price of an index CFD is directly tied to the price of the underlying index. For example, if you trade a FTSE 100 CFD, the price of the CFD will move in line with the price of the FTSE 100 Index. If the FTSE 100 Index is at 7,500 points, the CFD will be priced similarly at around 7,500.

- Spread: Spread is the difference between the buying and selling price of the CFD. It is also called a bid-ask spread (bid is the selling price of an instrument, while ask is the buying price) and is often the primary revenue source of CFD brokers. Brokers usually make money from spreads.

- Contract size and point value: The size of an index CFD contract refers to the amount of the underlying index that one CFD contract represents. Meanwhile, the point value represents how much money a trader gains or loses for every point at which the index moves. These parameters are based on the brokers and the index being traded.

- Dividend adjustment: The CFD price of Indices containing dividend-paying stocks (like the S&P 500 or FTSE 100) is often adjusted downwards to account for dividend payouts.

Several other market factors, like economic data and geopolitical events, can also indirectly impact the pricing of the indices. These events often lead to volatility, which directly affects the offered spreads.

How to Trade an Index CFD?

Index CFDs have the characteristics of other CFDs, whether forex, shares, or commodities.

Let’s understand index CFDs with an example.

Suppose you are a trader and want to take a position on FTSE 100 CFD. You are speculating (based on your analysis) that the FTSE 100 will increase in value over the next few days.

If the FTSE 100 is currently trading at 7,500 points and the broker specifies that each point of the FTSE 100 is worth £1:

Step 1: Opening the position

You decide to go long (buy) 1 CFD of the FTSE 100 Index at 7,500 points. Thus, for every point the FTSE 100 moves up or down, you will gain or lose £1.

Step 2: Price movement

If the FTSE 100 rises to 7,550 points a few days later, your positions will gain 50 points.

In this case, profit on the trade = 50 points x £1 per point = £50 profit.

Step 3: Closing the position

If you decide to close the position at 7,550 points, you lock in your £50 profit by selling your CFD position.

Real-world index CFD trades also enjoy leverage offered by the broker.

If you are using 5:1 leverage, here’s how it impacts your trade:

Total position value = 7,500 points x £1 per point = £7,500

Margin required = 1/5 of £7,500 = £1,500

Scenario 1: Profitable trade

If the FTSE 100 rises to 7,550 points, your 50-point gain results in £50 profit.

Return on investment = £50 profit / £1,500 margin = 3.33% profit on your margin.

Scenario 2: Losing trade

If the FTSE 100 drops to 7,450 points, you would face a 50-point loss (7,500 - 7,450).

Loss = 50 points x £1 per point = £50 loss

Return on investment = £50 loss / £1,500 margin = 3.33% loss on your margin.

Thus, leverage can amplify both the profit and loss of a trade.

For an active trader, it is better to trade indices with CFDs. Such instruments are flexible, cost-effective, and have a low entry barrier.

Trade Index CFDs with Ultima Markets

Ultima Markets is a fully licensed broker and a multi-asset trading platform offering access to

250+ CFD financial instruments, including Forex, Commodities, Indices and Shares. We

guarantee tight spreads and fast execution. Until now, we have served clients from 172

countries and regions with our trustworthy services and well-built trading systems.

Ultima Markets has achieved remarkable recognition in 2024, winning prestigious awards

such as the Best Affiliates Brokerage, Best Fund Safety in Global Forex Awards, and

the Best APAC CFD broker in Traders Fair 2024 Hong Kong. As the first CFD broker to join

the United Nations Global Compact, Ultima Markets underscores its commitment to

sustainability and the mission to advance ethical financial services and contribute to a

sustainable future.

Ultima Markets is a member of The Financial Commission, an international independent

body responsible for resolving disputes in the Forex and CFD markets.

All clients of Ultima Markets are protected under insurance coverage provided by Willis

Towers Watson (WTW), a global insurance brokerage established in 1828, with claims

eligibility up to US$1,000,000 per account.

Open an account with Ultima Markets to start your index CFDs trading journey.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()