Options trading is a powerful financial tool that allows traders to gain exposure to markets without directly owning assets. Options are derivative contracts that derive value from an underlying asset, such as stocks, indices, commodities, or currencies.

What Are Options?

An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price (strike price) before or at a specific date (expiration date). The seller of the option must fulfil the contract if the buyer chooses to exercise the option.

Options are classified into two main types:

- Call Options: Give the buyer the right to buy the asset at a set price before expiration.

- Put Options: Give the buyer the right to sell the asset at a set price before expiration.

Since options are contracts, they do not represent ownership of the underlying asset. Instead, they provide traders with strategic flexibility, including hedging risks, leveraging positions, and speculating on price movements.

How Do Options Work?

Options trading involves a buyer (who pays a premium to hold the right) and a seller (who collects the premium and assumes the obligation). When traders buy options, they can either:

● Exercise the option (buy or sell the underlying asset at the strike price).

● Sell the option contract (profit from price movements before expiration).

● Let the option expire (if it becomes worthless).

The key factors affecting an option's price include:

● The price of the underlying asset.

● Time until expiration.

● Market volatility.

By implementing various strategies, traders use options to benefit from rising, falling, or even sideways markets.

Benefits and Risks Options?

Options bring immense benefits to traders, but they are also risky.

Benefits of Trading Options

● Leverage: Options allow traders to control a large position with a smaller upfront cost than buying stocks outright.

● Flexibility: Options can be used for speculation, hedging, or income generation.

● Risk Management: Traders use options to hedge against potential losses in other investments.

● Profit in Any Market Condition: Unlike stocks, which require an upward move for gains, options provide opportunities to profit in bullish, bearish, and even neutral markets.

Risks of Trading Options

● Time Decay: Options lose value as they approach expiration. If the underlying asset's price does not move as expected, the option may expire worthless.

● Complexity: Options trading requires an understanding of multiple factors, including volatility, time value, and pricing models.

● Potential for Large Losses: While buyers only risk the premium paid, option sellers can face unlimited losses if the market moves against them.

Understanding the Basics of Options Trading

Before diving into options strategies and risk management, it’s essential to understand the core concepts. This section covers the key elements of options trading, including the difference between call and put options, important terminology, and the distinctions between American and European options.

Call vs Put Options

Options contracts come in two primary types: call options and put options.

Call Options (Bullish Bet)

A call option gives the buyer the right, but not the obligation, to buy an underlying asset at a predetermined price (strike price) before or on a specific expiration date.

● Buyers of call options expect the asset’s price to increase.

● Sellers (writers) of call options expect the price to stay the same or decrease.

A trader buys a call option on Apple (AAPL) stock with:

● Strike price: $150

● Expiration: 1 month from today

● Premium paid: $5 per share

If AAPL rises to $170, the trader can exercise the option, buy AAPL at $150, and sell it for a $20 profit per share. The total profit (excluding fees) would be ($20 gain - $5 premium) = $15 per share.

If AAPL stays below $150, the option expires worthless, and the trader loses only the $5 premium.

Put Options (Bearish Bet)

A put option gives the buyer the right, but not the obligation, to sell an asset at a predetermined price before expiration. Buyers of put options expect the asset’s price to fall, while sellers (writers) of put options expect the price to stay the same or rise.

A trader buys a put option on Tesla (TSLA) stock with:

● Strike price: $250

● Expiration: 1 month from today

● Premium paid: $8 per share

If TSLA drops to $220, the trader can buy it in the market at $220 and sell it for $250, making a ($30 profit—$8 premium) = $22 per share.

If TSLA stays above $250, the option expires worthless, and the trader loses only the $8 premium.

Options Terminology

Understanding key terms is crucial for trading options successfully.

● Strike Price: The price at which the option holder can buy (for calls) or sell (for puts) the underlying asset.

● Premium: The price paid by the buyer to purchase the option contract. This is the seller’s income.

● Expiration Date: The date the option contract becomes invalid. After this date, the option expires worthless if not exercised.

● Intrinsic Value: The real, immediate value of an option if exercised. If a call option has a strike price of $100 and the stock trades at $110, the intrinsic value is $10.

● Time Value: The additional premium above intrinsic value accounts for the remaining time until expiration. Options with more time left generally have higher premiums.

● In the Money (ITM): When exercising the option would result in a profit.

○ Call options are ITM when the stock price is above the strike price.

○ Put options are ITM when the stock price is below the strike price.

● At the Money (ATM): When the stock price is exactly at the strike price.

● Out of the Money (OTM): When exercising the option would result in a loss.

○ Call options are OTM when the stock price is below the strike price.

○ Put options are OTM when the stock price is above the strike price.

American vs European Options

Options are classified based on when they can be exercised.

1. American Options

American options can be exercised at any time before expiration. This option contract is more flexible, making it more expensive than European options. It is commonly used in stock options (e.g., options on Apple, Tesla, or Microsoft).

2. European Options

European options can only be exercised on the expiration date (not before). This type of option contract is less flexible but often cheaper. It is used mainly for index options (e.g., options on S&P 500, NASDAQ).

Key Players in the Options Market

The options market consists of various participants with different objectives, strategies, and levels of influence. Understanding these key players helps traders anticipate market movements and identify opportunities.

The main participants in the options market include:

- Retail Traders

- Institutional Investors

- Market Makers

- Hedgers

- Speculators

- Arbitrageurs

The Mechanics of an Options Contract

Understanding how an options contract works is essential to trading options effectively. This section explains the key elements of an options contract, including contract specifications, premium calculations, expiration cycles, and settlement processes.

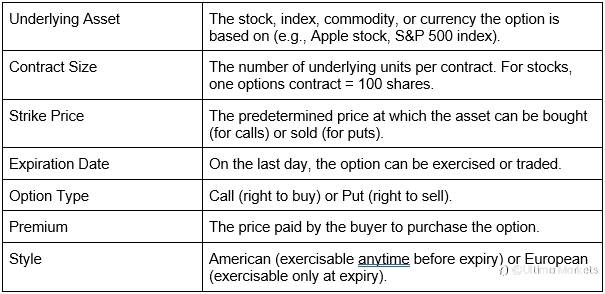

1. Key Components of an Options Contract

Every options contract includes specific details that define its terms and conditions.

An option contract for Tesla (TSLA) $250 Call expiring on March 15 means:

● The underlying asset is TSLA stock.

● The contract size is 100 shares per contract.

● The strike price is $250.

● The expiration date is March 15.

● The buyer has the right (but not the obligation) to buy TSLA at $250 before March 15.

● The premium (cost of the contract) depends on market conditions.

2. Understanding Option Premiums (Pricing Factors)

The premium is the price a trader pays to buy an option. The key factors that influence options premiums are:

a) Intrinsic Value: It is the difference between the stock’s current price and the option’s strike price. The intrinsic value of an option contract can be calculated as:

● Call Option: Intrinsic Value = Stock Price – Strike Price

● Put Option: Intrinsic Value = Strike Price – Stock Price

If AAPL trades at $160 and you own a $150 Call, the intrinsic value is $10. On the other hand, if AAPL drops to $140, the intrinsic value of a $150 Call is $0 (worthless).

b) Time Value: It is the additional value of an option due to the time left until expiration. Options with more time remaining have higher premiums. As expiration approaches, the time value decreases (known as time decay or "theta").

c) Volatility: Higher volatility increases option premiums. If a stock is expected to swing widely, options become more expensive. Implied Volatility (IV) measures market expectations of future volatility.

d) Interest Rates & Dividends: Higher interest rates slightly increase call premiums and decrease put premiums. On the other hand, Dividends lower call option prices (since stockholders receive dividends, but option holders do not).

3. Expiration Cycles and Settlement

a) Expiration Cycles

Options contracts have different expiration cycles. It depends on the type of the contract and how it is written. However, there are standard options for expiration cycles.

● Weekly options – expire every Friday.

● Monthly options – expire on the third Friday of each month.

● Quarterly options – expire at the end of each quarter (March, June, September, December).

Stock options generally expire on the third Friday of each month unless specified as a weekly option.

b) Exercise and Settlement

When an option is exercised, it must be settled based on its type:

- Physical Settlement: It happens when the actual underlying asset is bought (for calls) or sold (for puts). For example, if you exercise a TSLA $250 call, you will buy 100 TSLA shares at $250.

- Cash Settlement: This means that instead of delivering the asset, the profit is paid in cash. It is used for index options (e.g., S&P 500 options). For example, if an S&P 500 option expires with a $10 profit, you receive the cash difference.

4. What Happens at Expiration?

When an option reaches its expiration date, three outcomes are possible:

- In the Money (ITM) – Profitable Exercise: This means the option has value, and the trader can exercise it for a profit. For example, a $100 call option is ITM if the stock closes at $110. Most brokers automatically exercise ITM options at expiration.

- At the Money (ATM) – No Profit or Loss: This means that the stock price is equal to the strike price. Traders usually do not exercise ATM options since there’s no gain.

- Out of the Money (OTM)—Option Expires Worthless: This implies that the option has no intrinsic value, and the trader loses the entire premium paid. For example, a $200 put option expires worthless if the stock closes at $210.

5. Buying vs. Selling Options

Traders can buy or sell options, and each role has different risks and rewards.

a) Buying Options (Limited Risk, Unlimited Profit)

Buying a call (bullish) or put (bearish) costs the premium. The maximum risk in this is the premium paid (the option can expire worthless). However, the maximum reward is unlimited for calls, while it is limited for puts (stock can’t fall below zero).

b) Selling Options (Limited Profit, High Risk)

Selling (writing) a call or put collects the premium but carries obligations. The maximum risk in selling options can be unlimited (if selling calls without owning the stock). The maximum reward is the premium collected.

Example of a High-Risk Trade:

● Your losses are unlimited if you sell a naked call on Tesla (TSLA) at $250 and TSLA rises to $300.

● This is why selling options is riskier than buying them.

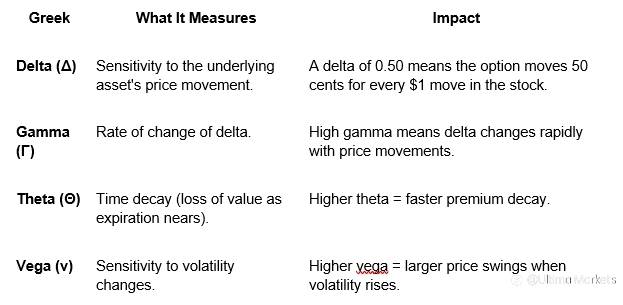

6. The Greeks: Measuring Option Sensitivity

The Greeks measure how different factors affect an option’s price:

For Example:

● A call option with a delta of 0.70 will gain $0.70 for every $1 the stock rises.

● If theta is -0.05, the option loses $0.05 daily due to time decay.

Options are excellent derivative products that can maximise the profit-taking capabilities of a trader with limited capital. However, these contracts are risky, so traders must be cautious and understand the risk exposure while trading such instruments.

Trade with Ultima Markets

Ultima Markets is a fully licensed broker and a multi-asset trading platform offering access to 250+ CFD financial instruments, including Forex, Commodities, Indices and Shares. We guarantee tight spreads and fast execution. Until now, we have served clients from 172 countries and regions with our trustworthy services and well-built trading systems.

Ultima Markets has achieved remarkable recognition in 2024, winning prestigious awards such as the Best Affiliates Brokerage, Best Fund Safety in Global Forex Awards, and the Best APAC CFD broker in Traders Fair 2024 Hong Kong. As the first CFD broker to join the United Nations Global Compact, Ultima Markets underscores its commitment to sustainability and the mission to advance ethical financial services and contribute to a sustainable future.

Ultima Markets is a member of The Financial Commission, an international independent body responsible for resolving disputes in the Forex and CFD markets.

All clients of Ultima Markets are protected under insurance coverage provided by Willis Towers Watson (WTW), a global insurance brokerage established in 1828, with claims eligibility up to US$1,000,000 per account.

Open an account with Ultima Markets to start your index CFDs trading journey.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()