Capital stock, as a key component of a company's financial structure, has a profound impact on both corporate operations and investor decision-making. For investors, understanding the composition and changes in capital stock—especially in forex trading—can effectively help predict market trends and enhance trading success rates. This article will explore the basic concepts and types of capital stock and analyze its importance in corporate operations, particularly its role in the forex market.

Basic Concepts and Types of Capital Stock

1. Definition of Capital Stock

Capital stock refers to the total amount of funds a company raises by issuing shares, used to support its operations, expansion, and other business activities. It is a vital part of the company's financial structure, directly influencing liquidity and market competitiveness. It is important to note that capital stock is not the same as market capitalization; market capitalization reflects the market trading price of shares, while capital stock is part of the company's internal structure.

2. Types of Capital Stock

• Common Stock: Common shareholders have voting rights and dividend entitlements. They own a portion of the company and participate in corporate decision-making and profit distribution based on their shareholding.

• Preferred Stock: Preferred shareholders have priority rights to dividends and capital returns but typically do not have voting rights. This grants preferred stockholders certain advantages over common stockholders in terms of financial stability and capital recovery.

• Paid-in Capital vs. Subscribed Capital: Paid-in capital refers to the funds actually received by the company, while subscribed capital refers to the amount shareholders have committed to pay. The difference lies in whether the funds have been fully remitted.

Methods for Calculating Capital Stock

1. Capital Stock Calculation Formula

The formula for calculating capital stock is straightforward:

Capital Stock = Number of Shares Issued × Par Value per Share

For example, if a company issues 1 million shares with a par value of $10 each, the capital stock would be $10 million. This is a fundamental figure in the company's capital structure.

2. Changes in Capital Stock

• Capital Increase through New Share Issuance: Companies may issue new shares to raise funds or expand operations, resulting in an increase in capital stock.

• Capital Reduction: Companies may repurchase shares or reduce the total number of shares outstanding, leading to a decrease in capital stock. Capital reduction is often part of a financial restructuring strategy or a move to increase per-share value.

3. Relationship Between Capital Stock and Shareholders' Equity

Capital stock is closely related to shareholders' equity. Changes in capital stock directly affect shareholders' ownership percentages and their distribution of rights. For example, when a company increases its capital by issuing new shares, existing shareholders’ ownership is diluted; conversely, a reduction in capital may increase the value per share and enhance the equity of existing shareholders.

Relationship Between Capital Stock and Forex Trading

1. Impact of Capital Structure on Forex Traders

A company's capital structure affects its financial health, which in turn indirectly impacts the forex market. Taking the Taiwan market as an example, changes in a company's capital structure can trigger stock price volatility, subsequently influencing currency pair movements in the forex market. For instance, a company’s large-scale capital increase or reduction may alter investors’ expectations about its future financial condition, thereby affecting related currency pairs.

2. Impact of Capital Stock on Corporate Operations

A sound capital structure enhances a company’s capital adequacy and strengthens its resilience against external risks, which positively boosts confidence in the forex market. On the contrary, companies overly reliant on external borrowing—with weaker capital structures—may face heightened risks during market volatility, negatively affecting forex market sentiment.

Risk Warnings and Opportunities from Changes in Capital Stock

1. Capital Reduction Case Study: Taiwanese Companies

Taking Foxconn’s capital reduction as an example, when a company announces share buybacks or a reduction in the total number of shares, it often triggers stock price volatility. Such capital stock changes directly reflect the company’s response strategies to market conditions and can influence investor expectations about its future development. For instance, capital reduction may be viewed as part of a corporate financial restructuring; if executed well, it could offer higher capital returns to investors.

2. Risks and Opportunities from Changes in Capital Stock

Changes in capital stock not only reflect a company's financial health but also generate corresponding fluctuations in the forex market. For example, a capital increase may dilute the value per share but could also provide the company with fresh funding to support future business expansion. On the other hand, a capital reduction might raise the value per share but may trigger short-term market uncertainty.

Capital Stock Management and Corporate Financial Strategies

1. Capital Stock Management Strategies

Through proper capital stock management strategies, companies can effectively enhance their capital strength and boost market confidence. For instance, a company may choose to issue new shares to raise funds or conduct share buybacks to increase per-share value. These measures help improve the company's financial structure and promote steady growth in stock prices.

2. Impact of Capital Stock Changes on Forex Trading

Changes in capital stock can significantly impact the forex market, especially when these changes are closely tied to a company's financial strategies. Forex traders should monitor such changes and use capital adjustments to forecast a company's future financial position, thereby adjusting their trading strategies accordingly.

Practical Guide: 3 Steps to Monitor Capital Stock Data Using UM Tools

1. Using Custom Indicators on MT4/MT5 to Track Capital Stock Changes

On the UM platform, traders can use custom indicators in MT5 to track news about capital stock changes. By setting up alerts, they can stay updated on increases or decreases in capital stock and make informed trading decisions.

Steps: Create an Alert List

Set up on the UM MetaTrader 5 platform:

• Custom Indicator: Track capital stock change announcements for "Taiwan 50 Component Stocks"

• Suggested Parameters: Trigger push notifications when daily capital stock changes exceed 5%

2. Set EA Automated Trading Triggers

Traders can set EA (Expert Advisor) automated trading strategies based on capital stock changes. For example, if a company increases its capital, it might impact the currency associated with that company, prompting traders to set long or short trading triggers.

Example of EA Command Settings:

If Capital Stock Increase > 10% Then

Go long on the respective currency pair (Leverage 1:50)

Else If Foreign Ownership Ratio Drops > 5% Then

Short the cross-currency pair

3. Else If Foreign Ownership Ratio Drops > 5% Then

Short the cross-currency pair

UM’s demo account feature allows traders to backtest historical capital stock changes and corresponding forex market reactions, helping investors understand past market behaviors and develop more accurate trading strategies.

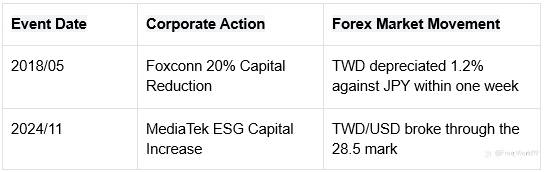

Using UM’s demo account to test key events over the past three years:

With its advanced trading technology, stable data supply, and user-friendly interface, Ultima Markets has become a top choice for investors seeking both demo and live trading experiences. Create a demo account now — no deposit required — and practice trading anytime, anywhere.

The Special Significance of Capital Stock for Taiwanese Investors

1. Characteristics of Taiwan's Capital Stock Market

Taiwan’s capital stock market is highly diversified, with many companies maintaining a high degree of transparency in their capital structures. This provides forex traders with valuable reference information. Understanding changes in these capital structures enables investors to better interpret the movements of Taiwan-related currency pairs in the forex market.

2. Cases Where Capital Stock Changes Affect Taiwan's Forex Market

Changes in the capital stock of well-known Taiwanese companies often trigger fluctuations in the forex market. When large corporations conduct capital increases or reductions, it directly affects the exchange rate of the New Taiwan Dollar (TWD) against other major currencies—an important factor forex traders must not overlook.

FAQs: Three Common Misconceptions About Capital Stock and Forex Trading

1. Does Larger Capital Stock Equal Greater Company Safety?

The size of a company’s capital stock does not necessarily correlate with its stability. Some large corporations may face high debt risks, while companies with smaller capital bases may perform well due to operational flexibility. Therefore, investors should evaluate capital stock within the broader context of a company’s overall financial health.

2. How Do Forex Fluctuations Reflect Capital Stock Decisions?

A company's capital stock decisions—whether to increase or decrease capital—impact market expectations. These decisions often signal the company’s future growth potential or financial health, thereby influencing currency movements in the forex market.

3. The Linkage Effect Between Capital Stock Changes and the Forex Market

Changes in capital structure—especially large-scale capital increases or reductions—affect a company's forex market demands and trigger currency pair fluctuations. For instance, after a capital increase, a company might require forex operations for fund allocation, directly impacting the exchange rate of related currency pairs.

Conclusion

The impact of capital stock on a company's financial health, along with its indirect influence on the forex market, means that investors must stay sensitive to capital structure changes when trading forex. Variations in capital stock not only reflect a company's future growth potential but also serve as key drivers of currency pair fluctuations. By understanding and mastering the fundamentals of capital stock, forex traders can more effectively predict market trends and enhance their trading success rate.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()