The three major US indices — the Dow Jones Industrial Average (DJIA), the S&P 500, and the Nasdaq Composite — are important barometers for global stock markets. These indices not only reflect the overall performance of the US economy but also have a profound impact on global financial markets. For investors, keeping an eye on the movements of these indices helps to grasp market trends and formulate more effective investment strategies.

What are the Three Major US Indices?

1. Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average is one of the oldest stock market indices in the US, comprising 30 representative blue-chip industrial stocks. The index is calculated using a price-weighted method, meaning that companies with higher stock prices have a greater influence on the index. Representative companies include Apple, Goldman Sachs, and Visa. The DJIA primarily reflects the performance of traditional industries, making it suitable for investors focused on economic outlooks.

2. S&P 500 (Standard & Poor's 500)

The S&P 500 includes the 500 largest companies by market capitalization in the US, and it is calculated using a market-capitalization-weighted method. The index covers a wide range of industries, including technology, healthcare, finance, and energy, and is considered a representative index of the US stock market. Institutional investors often use the S&P 500 as a benchmark for investment performance due to its high representativeness and stability.

3. Nasdaq Composite

The Nasdaq Composite includes all the stocks listed on the Nasdaq exchange, totaling over 3,000 companies, with a strong emphasis on technology stocks. The index's high volatility and growth potential attract many investors. Representative companies include Apple, Amazon, Meta, Tesla, and NVIDIA. The Nasdaq index is suitable for investors focusing on emerging industries and technological innovation trends.

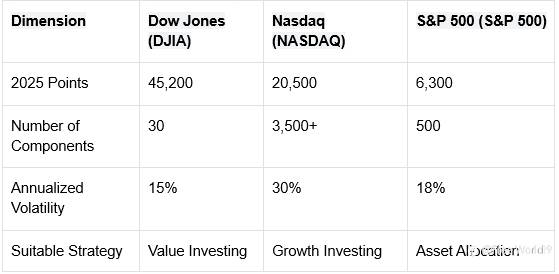

Comparison of the Three Major U.S. Indices: Key Data for 2025

The Correlation of the U.S. Three Major Indices with Other Markets

The volatility of the three major U.S. indices has a pull effect on global markets. For example, major economic data releases (such as CPI, employment data) or policy changes (such as interest rate hikes or tax cuts) can impact the performance of the indices, which in turn affects other markets like Taiwan and Asia. Furthermore, sharp declines in the indices may trigger market risk aversion, pushing assets like gold, U.S. Treasuries, and the U.S. dollar to strengthen.

How to Participate in Trading the U.S. Three Major Indices?

In recent years, investors have had more diversified ways to participate in trading the U.S. three major indices, from traditional ETFs, futures contracts, to CFD (Contract for Difference) trading, with flexible choices depending on risk tolerance and capital size. With the widespread use of AI-assisted tools and transparency in regulatory policies, mastering the trading times, data cycles, and platform advantages for these indices will be key to profitability. Below is a step-by-step breakdown of the latest strategies for 2025, from tool selection to time management and practical operations.

1. Choose the Trading Tool: An Analysis of the Pros and Cons of CFDs, Futures, and ETFs

• Index CFDs: No need to hold physical stocks, with UM offering two-way trading (long/short), providing flexibility to respond to market fluctuations.

• Futures Contracts: Suitable for institutional investors, but be aware of the margin ratio increase for CME in 2025.

• ETF-linked Funds: U.S. stock ETFs issued by Taiwan's mutual funds (e.g., Yuanta S&P 500), with an annual management fee of around 0.5%.

2. Master Trading Hours and Data Release Times

• Main Trading Hours for U.S. Stocks (Taiwan Time):

○ Daylight Saving Time: 21:30 - 04:00

○ Standard Time: 22:30 - 05:00

• Key Events for 2025:

○ The impact of the U.S.-China trade war on the global financial market

○ September FOMC meeting (expected rate cut of 25 basis points)

Advantages of Trading U.S. Indices CFDs with Ultima Markets

• Provides CFDs for the three major U.S. indices (US30, US500, USTEC) trading.

• Leverage up to 1:2000 to meet different trading needs.

• Low spreads and fast execution, starting from 0 pips.

• Equipped with powerful risk control tools and EA (Expert Advisor) automated trading functions.

• Client funds are segregated, with additional insurance protection of $1 million.

• Provides demo accounts, ideal for beginners to learn and test strategies.

• 24/7 Chinese customer support for a more secure trading experience.

Practical Advice: Trading Strategies to Master the U.S. Indices Market

• Technical Analysis: Use indicators such as MACD, RSI, and Bollinger Bands to assess market trends.

• Fundamental Observation: Pay attention to economic data such as the FOMC meetings, non-farm payroll reports, CPI, PPI, and other economic indicators.

• Risk Management: Set stop losses, control position sizes, avoid excessive leverage, and reduce trading risks.

• Utilize Trading Central Tools Provided by UM: Conduct strategic analysis to improve trading efficiency.

Conclusion: Capture the Core Pulse of the Global Market, Starting with the U.S. Three Major Indices

The volatility of the U.S. three major indices reflects the changing trends in industries and economic structures. Whether you're a long-term value investor or a trader who prefers short-term swings, understanding the composition and movements of these three indices is key to improving your success rate. Through the Ultima Markets platform, investors can flexibly participate in index CFD trading, grasp market trends, and enhance their trading competitiveness.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()