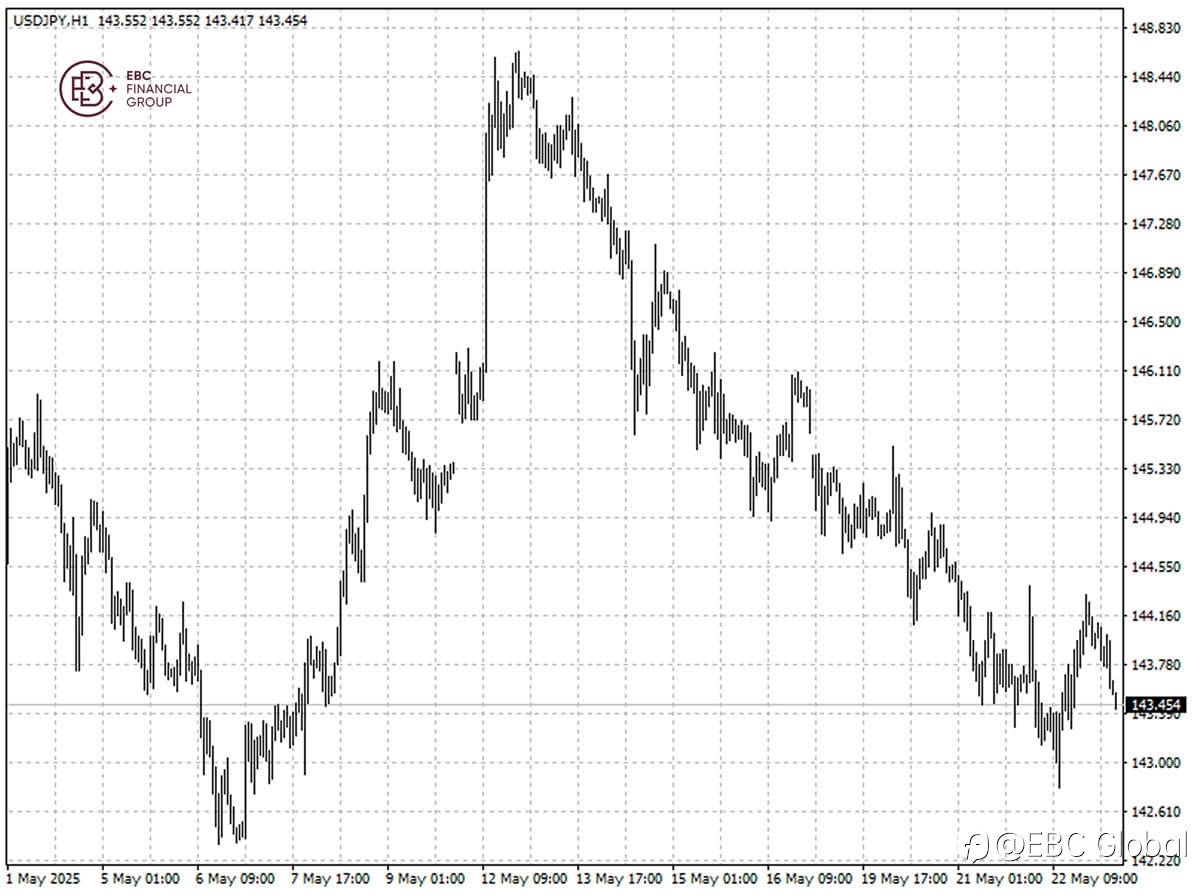

The yen edged up on Friday, on course for a 1.4% increase for the week. Japan's core inflation grew at the fastest annual pace in more than two years, which helped fuel rate hike expectations.

US Treasury Secretary Scott Bessent and Japanese Finance Minister Katsunobu Kato agreed on Wednesday that the dollar-yen exchange rate currently reflects fundamentals.

Asian currencies surged this month saw sharp swings on market speculation about possible US pressure to prop up their currencies in their tariff talks. The yen has increased about 9% in 2025.

Yields on long-dated Japanese government bonds rose to new records this week in the wake of a poor auction result that cast doubt over debt sales looming in the weeks ahead.

JGBs have been under pressure after a dramatic sell-off in March triggered by a slide in German bunds. Recently, several political parties are calling for consumption tax cuts, further denting the asset's appeal.

The BOJ has refrained from tightening for the time being given deadlocked trade talk with the US and struggling bond markets. The yen's strength mainly stemmed from the greenback weakness.

The yen rallied after hitting the low of 144.33 per dollar, and the path of least resistance is heading towards 143 per dollar. But the upside room could be limited.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()