US stocks suffered heavy selloff on Wednesday, pressured by a sharp spike higher in Treasury yields as traders feared that a new US budget bill would put even more stress on already large deficit.

The new plan is expected to pass as lawmakers reach a compromise on SALT deductions heading into Memorial Day deadline, though the IMF urged Washington to curb debts on Wednesday.

Investors put $2.5bn into world ex-US mutual and ETFs between the start of December and the end of April, according to data from Morningstar. The inflows include the highest monthly total on record.

Wall Street have outperformed most of the past decade or more with Corporate America leading in frontier domains such as IT and biotechnology, resulting in a net outflow of $2.5bn from these funds between 2022 and 2024.

Amundi said some of the flows into ex-US funds were down to "patriotic rebalancing" by European investors, particularly given the high weighting of the so-called Magnificent Seven.

Most members of the high-flying group have underperformed benchmark stock index, with Apple and Tesla the biggest losers. Both companies rely heavily on China to produce and consume their products.

Whether Big Tech can re-establish its historical dominance in 2025 is the existential question heading into the back half of the year. Betting on a tech rally comes with its own risks amid tariff uncertainties.

Sore trial

Trump told Apple CEO Tim Cook that he was not satisfied with the plan to expand output in India, and urged him to pivot stateside, though the company is attempting to diversify production away from China.

Experts generally agree that moving production of the iPhone to the US would be highly unlikely as the final price of an iPhone is estimated to surge to between $1,500 to $3,500.

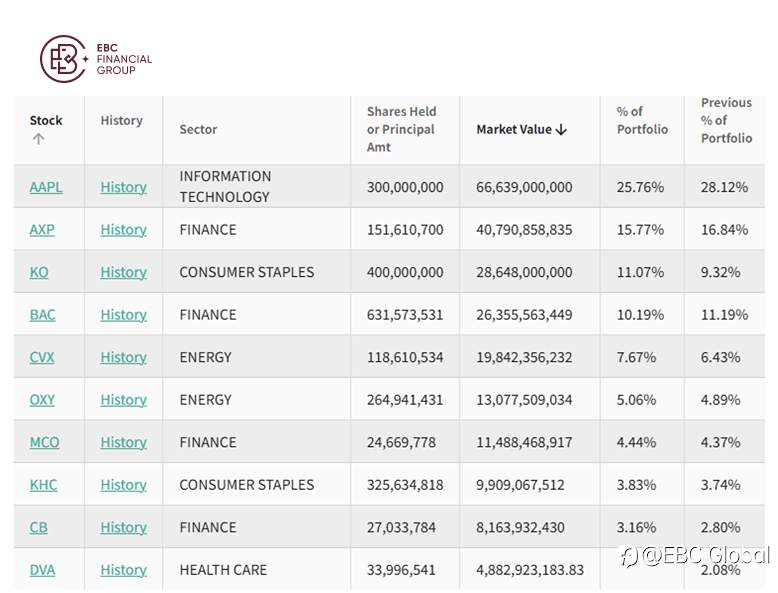

Apple stock remained the top holdings in Berkshire Hathaway's portfolio despite some exposure cuts, according to the latest 13 F filing. But Cook said it is difficult to predict tariff costs beyond June.

Trump will impose tariffs at the rate he threatened last month on trading partners that do not negotiate in "good faith" on deals, Treasury Secretary Scott Bessent said on Sunday.

Tesla appears to be in bigger trouble with its business already struggling in Q1. A 20% year-over-year drop in automotive revenue and a 71% plunge in net income can hardly please shareholders.

It counts on materials and supplies from China, Mexico, Canada and elsewhere for manufacturing some car parts. Despite those headwinds, some banks have turned more optimistic on the stock market outlook.

UBS Global Wealth Management on Thursday raised its year-end target for the S&P 500 to 6,000 from 5,800 and initiated a June 2026 target of 6,400. That indicates a less 3% growth from Thursday's close.

AI competition

Though Alphabet's Q1 results beat estimates, it faces mounting concerns about risks to its Google search business from AI chatbots like ChatGPT. Its near-90% search share now is down from around 93% in late 2022.

Apple's plan to add AI-powered search options to its browser has been fresh blow to Google, whose lucrative advertising business relies significantly on iPhone customers using its search engine.

Microsoft and Meta are the only in the Magnificent Seven stocks outperforming benchmark stock index so far in this year. They are set to nibble away at Alphabet's customer base by heavy investments in AI.

However, Nvidia that leads the AI race also disappointed with its share price barely unchanged. Concerns are growing over moderating AI demand and tightening chip trade rules from the Trump administration.

CEO Jensen Huang said that the policies are a failure that have cut its China market share from 95% to 50%r. Just as Tesla and Apple, he is stuck in the middle between Washington and Beijing in a tech cold war.

The chip maker is going to sell a technology that will tie chips together to speed up the chip-to-chip communication needed to build and deploy artificial intelligence tools, it said on Monday.

As the last of the seven to report results for this period, it will likely take centre stage for Wall Street in the coming week. In the long term, the challenge is that large technology companies could build custom AI chips.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()