In the global forex trading market, MetaTrader 4 (MT4) and MetaTrader 5 (MT5) remain the preferred platforms for traders. According to recent statistics, over 85% of global retail forex transactions are executed via MT4/MT5. These platforms offer intuitive operation, Expert Advisor (EA) support, and comprehensive technical analysis tools, catering to both beginners and professional traders.

However, with numerous brokers offering MetaTrader services, how can investors select the most trustworthy MetaTrader broker? This article provides a full breakdown of selection criteria, platform comparisons, and recommended brokers to help you identify reliable MetaTrader brokers in 2025.

What Is MetaTrader?Version Differences Between MT4 and MT5

MetaTrader (MT) is a financial trading software developed by Russian fintech giant MetaQuotes, widely used in forex, futures, stocks, and CFD (Contract for Difference) markets. Its most iconic versions are MetaTrader 4 (MT4), launched in 2005, and MetaTrader 5 (MT5), released in 2010, which expanded functionality. MetaTrader consistently dominates global trading platform market share. Key differences between MT4 and MT5 include:

• MT4: Retains popularity among 65% of Asian forex beginners due to its simple interface and automated trading (EA) strengths.

• MT5: Supports diverse assets like US stocks and cryptocurrencies, driving 28% annual user growth and becoming the primary tool for advanced traders.

Evaluating the Best MetaTrader Brokers: 5 Key Criteria

1. Regulatory Compliance & Fund Security

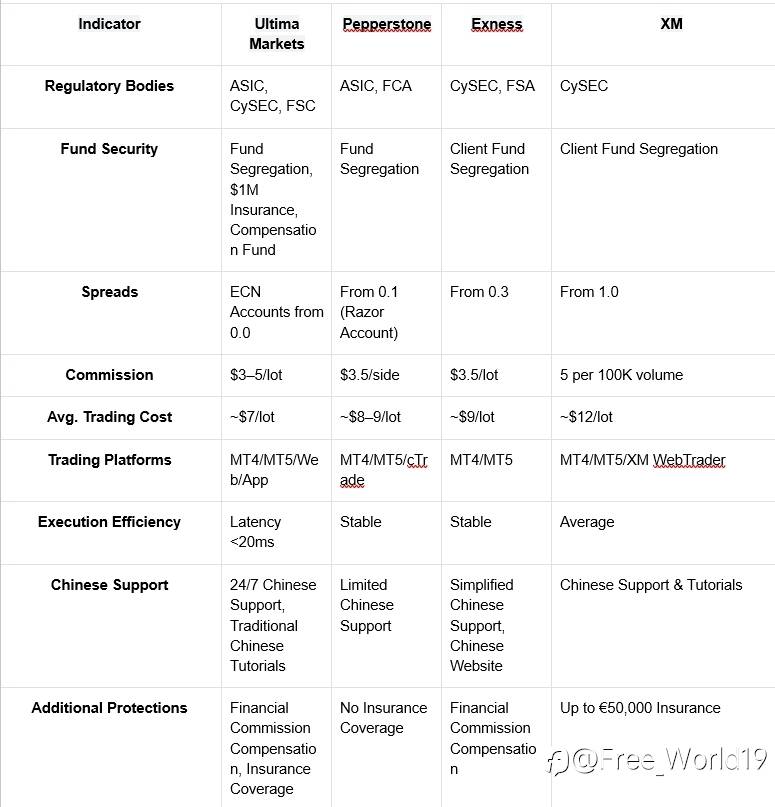

Selecting a broker with formal financial regulation is critical. Internationally recognized regulators such as ASIC (Australia), CySEC (Cyprus), and FSC (Mauritius) ensure trading fairness and fund safety. Crucially, verify whether the broker implements fund segregation mechanisms and offers additional insurance protection to mitigate unforeseen risks.

2. Transparent Trading Costs

A quality MetaTrader broker should provide transparent and competitive spreads and commissions. In 2025, most platforms offer average spreads between 1.0–1.5 pips, with commissions typically ranging from $6–7 per lot. Combining low spreads with low commissions can significantly reduce long-term trading costs.

3. Execution Speed & Stability

A trading platform’s execution speed and stability directly impact trading outcomes. Top MetaTrader brokers typically feature low latency (under 30ms), high order fill rates, and slippage control mechanisms, ensuring rapid order execution even during critical moments.

4. Trading Tools & Technical Support

Beyond basic MT4/MT5 functionality, the availability of EA trading, technical indicators, and multi-account management (MAM/PAMM) tools is key to evaluating a platform’s professionalism.

5. Customer Service & Localized Support

For Taiwanese traders, Chinese-speaking support and localized guides are essential. Premium platforms typically offer 24/7 Chinese live chat, deposit tutorials, online webinars, and demo accounts, enabling users to start forex trading with confidence.

Why Is Ultima Markets the Best Choice for MetaTrader?

- Supports MT4/MT5 & Multi-Device Trading

Ultima Markets fully supports MT4, MT5, WebTrader, and a proprietary app, ensuring seamless operation across desktops and mobile devices to accommodate diverse trading preferences.

- Multi-Regulation, Fund Segregation & High-Coverage Insurance

UM is regulated by three major authorities: the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Mauritius Financial Services Commission (FSC). Client funds are segregated in Westpac Bank, Australia, with additional safeguards: a $1 million insurance policy underwritten by Willis Towers Watson and a €20,000 compensation fund provided by the Financial Commission. This multi-layered framework ensures the security of traders' funds.

- Low Spreads & Low Commissions, Highly Competitive Trading Costs

Ultima Markets’ ECN accounts offer average spreads as low as 0.0 pips and commissions of $3–5 per lot, significantly below industry averages, positioning it as one of the most price-competitive and best MetaTrader brokers in the forex market.

- Comprehensive Chinese Support & Educational Resources

Provides 24/7 Chinese-speaking customer support, demo accounts, and exclusive educational materials, including online webinars, market analysis reports, and technical indicator tutorials, benefiting both novices and professional traders.

- Limited-Time Offers & Reward Incentives

UM continuously launches diverse reward campaigns to engage users, including 1% additional profit on closed positions, profit-weighted trading competitions, new client deposit bonus schemes, Easter Egg Cash Prize Event (applicable to all live accounts), granting users enhanced flexibility and profit opportunities.

How to Open a MetaTrader Account and Start Trading?

After selecting the best MetaTrader broker, the account-opening process is straightforward:

5 Steps to Open an Account:

1. Visit the Ultima Markets official website and click “Open Trading Account”

2. Fill in personal information and submit identity and address proofs

3. Wait for verification (typically completed within 24 hours)

4. Deposit funds via bank transfer, credit card, or crypto wallet

5. Log into MT4/MT5 and start trading!

Tip for Beginners: Apply for UM’s demo account to practice with $100,000 virtual funds.

Conclusion: Choose the Right MetaTrader Broker for a High-Efficiency Trading Experience

In today’s trading landscape, selecting the right platform is pivotal to enhancing efficiency and achieving consistent profitability. Whether you are a beginner or a professional trader pursuing optimal trading conditions, Ultima Markets demonstrates comprehensive strength as a top-tier MetaTrader broker through competitive trading costs, robust security safeguards, cutting-edge platform technology, and localized services.

Launch your trading journey now with Ultima Markets and experience global-tier MT4/MT5 trading!

Frequently Asked Questions FAQ

Q1: Which is better for beginners, MT4 or MT5?

A: MT4 is simpler and ideal for beginners, while MT5 offers advanced features for experienced traders. Ultima Markets supports both, allowing you to choose freely.

Q2: How does Ultima Markets ensure fund safety?

A: UM provides three-layer fund protection——bank segregation of funds, $1 million insurance, €20,000 compensation fund, all safeguards are verifiable and transparent.

Q3: Is lower spread always better?

A: While spreads matter, commissions and execution efficiency must also be considered. UM offers spreads from 0.0 pips + $3 commissions, delivering overall costs below market averages.

Q4: Can I test the platform first?

A: Absolutely! Ultima Markets provides a free demo account with $100,000 virtual funds—no deposit required—to practice trading strategies.

Q5: Can I use the platform in Chinese?

A: Yes! UM offers a full Chinese website and 24/7 Chinese-speaking customer support, ensuring seamless trading without language barriers.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()