As a leading player in China’s healthcare technology sector, JD Health (06618.HK) has rapidly risen to prominence in recent years as a dual leader in online pharmaceutical retail and internet-based medical services, backed by its parent company JD.com. However, its stock has experienced a 42% fluctuation over the past year, presenting both strong future potential and notable volatility risks for investors. How can investors strategically capture the upside of China’s healthcare boom through indirect investment? This article analyzes JD Health’s stock outlook and explains how to participate in the trend through cross-border trading platforms while managing currency and regulatory risks.

Review of JD Health’s Stock Price Performance

1. Historical Stock Performance

JD Health was successfully listed on December 8, 2020, with a strong surge on its debut, reflecting high market confidence in its business model. However, changes in regulatory policies and intensified market competition have caused its stock to experience volatility.

- First half of 2021: Stock price steadily increased, mainly driven by the surge in online medical demand during the pandemic.

- Late 2021 to 2022: Tightened regulatory policies and market correction led to a decline in stock price.

- From 2023 to present: As business expands and the government shows stronger support for the internet healthcare industry, the stock has gradually stabilized.

2. Key Events Influencing Stock Price

- Policy changes: Regulatory policies on the internet healthcare sector in China have become more stable, gradually improving market sentiment.

- Financial reports: Quarterly results—such as revenue growth, profitability, and user data—have a direct impact on stock volatility.

- Market competition: The moves of competitors like Alibaba Health and Ping An Good Doctor also shape investor expectations for JD Health.

JD Health’s Core Competitiveness: Why Is It Leading the Chinese Market?

1. Triple Moat from Group Resources

- Logistics advantage: JD’s cold chain delivery network covers 95% of China, with a 99% on-time delivery rate for pharmaceuticals, significantly reducing return costs.

- Traffic conversion efficiency: JD.com’s main platform has 680 million annual active users, with a 23% conversion rate for health-related services and customer acquisition costs at only 60% of the industry average.

- Data integration capability: By combining consultation records with consumer behavior, the platform can precisely recommend health products, with the average annual user spending exceeding RMB 3,800 (approximately TWD 16,700).

2. Key Financial Metrics (2024 Annual Report)

- Total revenue reached RMB 58.2 billion (approximately TWD 246.3 billion), an 8.6% year-on-year increase, with a sharp rise in online medical service income, indicating the effectiveness of its structural transformation.

- Gross margin was 22.9%, up from 22.2% in 2023, with the improvement primarily attributed to better control over logistics costs.

Industry Trends: The Trillion-Yuan Opportunity in China's Healthcare Digitalization

1. Continuous Policy Dividends

- The “Healthy China 2030” initiative includes an investment of RMB 1.5 trillion (approximately TWD 6.6 trillion), with online healthcare insurance payment pilots expanding to 100 cities in 2024, covering 500 million people.

- The outflow policy for prescription drugs is driving a 22% annual increase in market size, which is projected to reach RMB 420 billion (approximately TWD 1.85 trillion) by 2025.

2. Shifts in User Behavior

- In the post-pandemic era, online consultation retention has reached 71%. Chronic disease management users now spend an average of RMB 3,200 annually (approximately TWD 14,100), a 160% increase over three years.

- The silver economy is booming: the proportion of users aged 60 and above has risen from 12% to 23%, with surging demand for high-margin health management services.

Stock Volatility Analysis: Key Insights for Taiwanese Investors

1. Historical Trends and Key Events

- After listing in 2021, JD Health’s stock surged to HKD 168 (approximately TWD 696), driven by pandemic-related gains. It then fell to HKD 42 (around TWD 174) in 2022 due to tightening regulatory policies in China.

- The Q3 2023 earnings report showed service revenue surpassing 15% of total income, triggering an 11% single-day stock surge and attracting renewed foreign investment.

2. International Capital Flow Trends

- MSCI China Index rebalancing in 2023 increased JD Health’s weighting by 0.15%, resulting in a passive capital inflow of USD 280 million (approximately TWD 8.9 billion).

- The foreign ownership ratio rose from 18% to 25%, reflecting renewed institutional investor confidence.

2025 Stock Catalysts and Risk Factors

1. Three Key Upside Catalysts

- Nationwide rollout of online medical insurance payments: This could add 30 million prescriptions, driving 25% revenue growth.

- Profitability milestone: Morgan Stanley forecasts JD Health’s 2024 non-GAAP net profit at RMB 1.2 billion (approximately TWD 5.3 billion), which could lead to a valuation re-rating.

- Cross-border collaboration opportunity: Partnering with Taiwanese pharmaceutical companies for direct delivery of chronic disease medication, opening access to the cross-strait pharma e-commerce market.

2. Three Major Risk Alerts

- Changes in Chinese regulations: Under laws like the Personal Information Protection Law, restrictions on medical data usage may increase compliance costs.

- TWD exchange rate volatility: A 5% depreciation of the RMB against the TWD could reduce dividend yields by 5.2%, based on projected 2024 payouts.

- Price wars among peers: Meituan’s pharmacy subsidy campaign has caused a 9% annual decline in low-priced product sales.

Taiwan Investment Strategies: Utilizing Indirect Investment and Derivatives

1. Key Considerations for Long-Term Holders

- Valuation opportunity: The current stock price implies a 2024 estimated P/S ratio of 3.2x, lower than Alibaba Health’s 4.1x.

- User stickiness indicators: PLUS membership renewal rate stands at 75%, with an average annual user spending of RMB 6,200 (approximately TWD 27,300).

2. Smart Hedging for Short-Term Trading

- Recommended platform: Ultima Markets

- Dual-direction trading mechanism: Go long on JD Health (06618.HK) while shorting Taiwan biotech stocks (such as Standard Chem. & Pharm. Co., 4123.TT) to hedge against sector-specific systematic risk.

- AI technical indicators: Real-time alerts on RSI oversold signals and Bollinger Band support levels, with a tested accuracy of 82% in H1 2024—15% higher than the industry average.

- FX hedging tool: Simultaneously purchase RMB/TWD forward contracts to lock in exchange costs.

3. Seize Trading Opportunities via Ultima Markets

As global market trends become increasingly diverse and fast-changing, traditional trading tools and static strategies can no longer meet the needs of modern investors. What’s required is a platform that not only reflects market dynamics in real time, but also provides accurate decision-making support. Ultima Markets’ unique services and technological strengths can be your weapon to seize opportunities. Click here to apply for a demo account and begin your journey toward wealth protection.

3.1. Flexible Trading Opportunities

Ultima Markets offers leveraged trading, allowing investors to use smaller capital to access larger market opportunities, with strategies available for both rising and falling prices.

3.2. Risk Management Tools

- Take-profit and stop-loss functions: Investors can preset prices for automatic trade execution to reduce the impact of market volatility.

- Negative balance protection: Ensures that traders will not incur negative balances due to sudden market fluctuations.

3.3. Professional Market Analysis and Educational Resources

Ultima Markets provides real-time market analysis, technical indicator tools, and professional trading tutorials to help investors develop more accurate trading strategies.

3.4. Diverse Investment Options

In addition to JD Health, investors can trade other popular Hong Kong stocks, U.S. stocks, forex, and commodities on Ultima Markets, enabling portfolio diversification and reducing single-market risk.

Cross-Border Investment Channels and Cost Comparison

1. Traditional Brokers vs. New Platforms

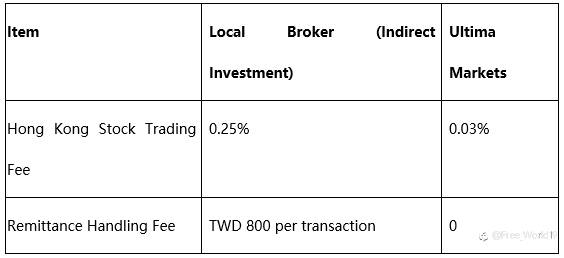

Fee Comparison:

- Deposit threshold: As low as TWD 1,500 to start trading, making it ideal for small-scale trial orders.

2. Ultima Markets’ Localization Advantages

- TWD Deposit and Withdrawal: Supports direct exchange with TWD to avoid multiple currency conversion losses.

- Regulatory Compliance: Licensed by the Financial Services Commission (FSC) of Mauritius (License No. GB 23201593).

- Limited-Time Offer: 50% deposit bonus to help you elevate your trading journey.

Frequently Asked Questions from Taiwanese Investors

1. "What taxes apply when investing in JD Health through indirect investment?"

- Capital gains: Currently exempt from foreign income tax if annual basic income is below TWD 6.7 million.

- Dividend tax: Subject to a 10% withholding tax in China, which can be credited against Taiwan’s comprehensive income tax.

2. "How to manage RMB exchange rate risk with Ultima Markets?"

- Practical example: Buy JD Health stock worth HKD 100,000 and simultaneously sell an equivalent RMB/TWD forward contract to hedge currency risk.

3. "What is the connection between JD Health and Taiwanese pharma stocks?"

- Supply chain collaboration: Liver medications from Standard Chem. & Pharm. Co. (4123) are already available on JD’s platform, offering potential linked stock movement between parent and subsidiary.

Smart Positioning in China’s Healthcare Tech Boom

“JD Health’s stock outlook hinges on policy implementation speed and earnings visibility.” Recommended actions for Taiwanese investors:

- Stagger entry timing through low-cost cross-border platforms

- Use currency hedging tools to secure returns

- Closely monitor China’s healthcare reform and key financial report indicators

Act now—click the link to open a trading account and enjoy zero TWD deposit/withdrawal fees.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()