Wall Street surged on Tuesday as investor risk appetite was buoyed by Trump's latest tariff respite and an unexpected jump in consumer confidence. The Nasdaq 100 led the gains with Nvidia up 3.2%.

An upbeat earnings report by Nvidia that is taking centre stage would bode well for a rally in US equities as investors have about $7 trillion parked in cash funds, according to BBVA strategists.

For VanEck Semiconductor ETF, the largest, about 2.4 put options changed hands daily over the last 10 days against every call option traded, the most defensive the trading has been in about 10 months.

Year-on-year, the AI darling is expected to post a 43.5% jump in EPS, on a 66.2% revenue surge. By comparison, the figures are 461% and 262% receptively for the same period last year.

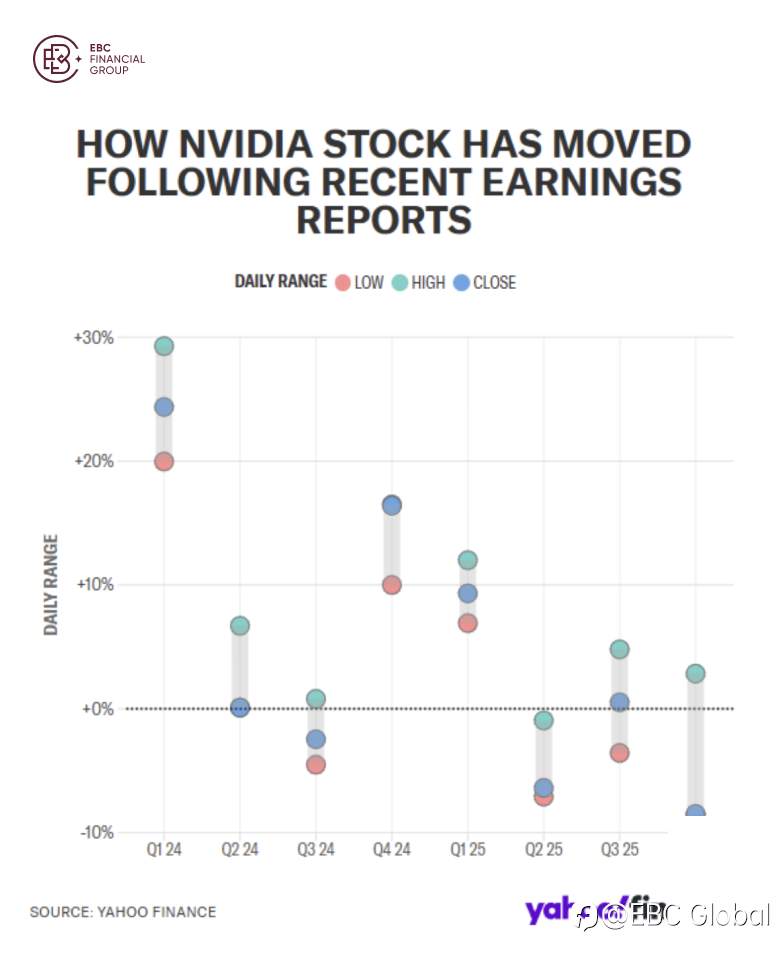

The stock is likely to gain or lose as much as 7.4% the day after the release, options traders tracked by Bloomberg predict. Its volatility was even higher following the company's last eight quarterly earnings report.

That represents a golden opportunity for traders. The shares fell 8.5% in February after Q4 earnings topped Wall Street's expectations, but its outlook for the current quarter gross margin came in lower than estimates.

According to data compiled by Yahoo Finance over the past 10 years, the median return is as high as nearly 120% if buying shares before Nvidia's earnings results and holding on to them for 12 months.

Top buy

Morgan Stanley named Nvidia its "top pick" among semiconductor stocks Tuesday. The analysts said potential troubles are "well telegraphed" and the "path to re-acceleration is clear."

The bank affirmed its overweight rating and $160 price target. CEO Jensen Huang is making efforts on a high note to find new sources of revenue while the growth is expected to slow further ahead.

Nvidia is strategically pivoting to reduce its dependency on Big Tech such as Microsoft, Amazon, and Google, establishing partnerships with various state-owned firms and emerging cloud service providers.

The announcement that Nivida will more than 18,000 of its latest AI chips to a startup, which is backed by Saudi Arabia's sovereign wealth fund, helped fuel a rally in market value this month.

The large order can be viewed as part of the remarkable shift in its business model that has the potential to reshape not only its company strategy but also the wider industry's dynamics.

The US also has a preliminary agreement with the UAE to allow it to import 500,000 of Nvidia's most advanced AI chips per year, starting in 2025, sources familiar said earlier this month.

NVIDIA suppliers have overcome technical challenges that previously delayed shipments of flagship AI data centre racks, the FT reported, when Huang aims to meet its ambitious annual sales targets.

China ban

The deals Trump secured in his Gulf tour can hardly have decisive impacts though. China is a huge market for Nvidia, accounting for 13% of its sales in the past financial year.

DeepSeek sent shockwaves through Wall Street when it proved it could produce powerful AI models using below top-of-the-line Nvidia chips. The Hang Seng index has notched strong yearly gains amid optimism.

Analysts anticipate its China revenue to come in at $6.2 billion, up 150% from the $2.4 billion it sold in the region in Q1 last year. The US is expected to account for $21.6 billion of the company's sales.

The stock has fluctuated wildly this year as the company has dealt with setbacks ranging from the Trump's ban on shipments of its H20 chips bound for China to concerns related to expected semiconductor tariffs.

The company said it could write down $5.5 billion in charges related to sales ban. According to Reuters, a modified version of the H20 is under development for China to offset some losses.

Furthermore, Huawei has made a bold move that could potentially change who leads the global AI chip race. The company has unveiled a powerful new computing system called the CloudMatrix 384 Supernode.

The product purportedly performs better than similar technology from Nvidia. Competition in this space could increase available computing capacity and provide more options for training and deploying AI models.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()