When the "Volatility Index" soars, do you know what changes occur in the forex market?

In March 2025, Trump announced the restart of tariff policies. The Wall Street Volatility Index (VIX) surged to 22.78 points in a single day, climbing to a near six-month high.

Many investors feel anxious or confused upon hearing news of VIX spikes and financial market turbulence, yet fail to grasp what this truly signifies. In reality, this wave of market volatility, triggered by policy uncertainty, reaffirms the critical role of the Volatility Index as a "market sentiment thermometer". For forex traders, this is not just a risk alarm but a prime window to capture extreme market movements.

Today, we delve into what the Volatility Index is, how it impacts markets, and how you can leverage professional platforms like Ultima Markets to seize opportunities and execute precise operations.

What Is the Volatility Index (VIX)?

The Volatility Index (VIX), fully known as the Chicago Board Options Exchange Volatility Index (CBOE Volatility Index), is a metric that measures the market's expectation of S&P 500 index volatility over the next 30 days. Launched by the Chicago Board Options Exchange (CBOE) in 1993, VIX is widely regarded as a barometer of market sentiment. When the market anticipates increased volatility, VIX rises; conversely, when the market stabilizes, VIX declines.

VIX is calculated based on the implied volatility of S&P 500 index options, reflecting market expectations of future volatility. Thus, VIX is called the "Volatility Index" because it rises amid heightened market uncertainty, signaling investor panic.

Operational Principles of the Volatility Index

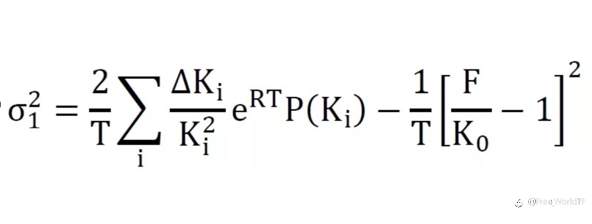

Calculation Method of VIX

VIX is calculated based on S&P 500 index options prices. Through a series of complex mathematical models, it estimates the market's expectation of 30-day volatility. These options prices reflect investors' views on future market trends, thus VIX serves as an indicator of market sentiment.

Although VIX calculation involves complex mathematics, traders need not fully understand the formulas to participate. Simply put, VIX combines weighted prices of multiple S&P 500 put and call options to measure market expectations of future volatility, providing investors with a sentiment and risk indicator.

Key Thresholds for Value Interpretation

VIX values typically fluctuate between 10 and 30:

● When VIX > 30, it indicates heightened market volatility expectations and investor anxiety;

● When VIX is in the 20-30 range, it signals intensified volatility;

● When VIX < 20, it reflects lower anticipated market volatility and stable investor sentiment.

Relationship Between the Volatility Index and Markets

VIX typically exhibits an inverse relationship with stock market trends. When stocks fall, investor panic rises, driving VIX up; when stocks rise, investor sentiment stabilizes, pushing VIX down.

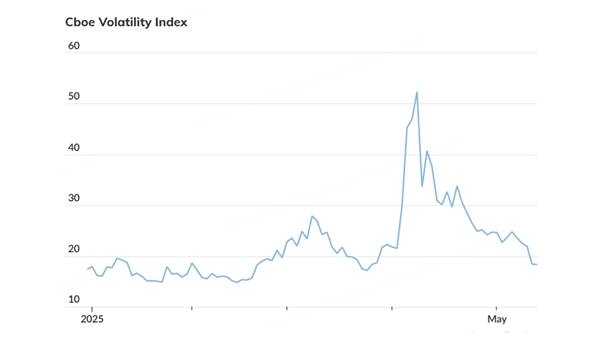

For example, on April 8, 2025, VIX hit a high of 52.33, reflecting market concerns about trade war escalation. However, following a temporary agreement reached in early May, VIX quickly fell below 20, indicating improved market sentiment.

Additionally, VIX correlates with other economic indicators. For instance, when economic data shows growth slowdown or rising inflation, VIX may increase, reflecting market worries about economic prospects.

How Can Investors Use the Volatility Index for Risk Management?

Investors can utilize VIX as a risk management tool. When VIX rises, indicating heightened market volatility expectations, investors may consider reducing exposure to risk assets and increasing allocation to hedge assets.

Additionally, investors can hedge risks by trading VIX-linked financial instruments, such as VIX futures, options, or ETFs. For example, when anticipating increased market volatility, investors can buy VIX futures or ETFs to hedge equity investment risks.

On the Ultima Markets platform, investors can use the MT4/MT5 trading platforms, integrated with Trading Central analysis tools, to track VIX changes in real-time and formulate corresponding investment strategies.

▲Track the weekly chart of the VIX Index at Ultima Markets

Volatility Index Investment Products and Operational Methods

Investors can participate in VIX-linked investment products through multiple avenues:

● VIX Futures and Options: Directly trade VIX futures or options contracts, suitable for advanced investors.

● VIX ETFs: Such as ProShares VIX Short-Term Futures ETF (VIXY) or iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX), suitable for general investors.

● Leveraged VIX ETFs: Like UVXY, offering 1.5x the index’s daily returns, ideal for short-term traders.

On the UM platform, investors can create accounts to trade VIX-linked CFD products, flexibly utilizing leverage to seize opportunities from market volatility.

Historical Cases and Analysis

Historically, VIX typically surges sharply during market crises. For example:

● 2008 Financial Crisis: VIX hit a record high of 89.53, reflecting extreme market panic.

● 2020 COVID-19 Pandemic Outbreak: VIX reached 82.69 on March 16, signaling market concerns about the pandemic's impact.

● 2025 Trade War Escalation: VIX peaked at 52.33 on April 8, then fell below 20 by early May, demonstrating rapid shifts in market sentiment.

These cases show VIX serves as a market sentiment indicator, helping investors gauge risks and formulate corresponding investment strategies.

Why Choose Ultima Markets to Navigate Market Volatility?

Ultima Markets provides professional trading platforms and tools to help investors capitalize on market fluctuations:

Low Spreads, High Leverage

When the Volatility Index (VIX) surges, market volatility typically expands, presenting both risks and opportunities for traders. Ultima Markets offers highly competitive low spreads (ECN accounts from 0 pips) and leverage up to 1:2000, enabling investors to flexibly amplify trading positions even with small capital, capitalizing on profit potential from short-term fluctuations.

Additionally, the UM platform’s low-latency execution (average below 20 milliseconds) ensures your orders react instantly to market movements, reducing slippage and costs.

Diverse Trading Tools and Smart Analysis for Comprehensive Market Sentiment Mastery

Amid market panic and sentiment fluctuations triggered by a rising Volatility Index, mere visual data observation is often insufficient. The Ultima Markets platform integrates MT4, MT5, and the proprietary Ultima Markets App, featuring built-in Trading Central professional analysis tools. These deliver real-time technical indicators, volatility forecasts, support/resistance level analysis, and more, empowering investors to clearly grasp market trends.

Additionally, whether tracking major EUR/USD currency pairs, gold, crude oil, or global indices, UM provides one-stop access to meet diverse strategic needs.

Professional Risk Management and Fund Security

In high-volatility markets, risk management is crucial. Ultima Markets offers diverse order tools like trailing stops and auto take-profit, enabling traders to automatically control risks during major market movements and avoid emotional decisions.

Simultaneously, UM segregates client funds with Westpac Banking Corporation in Australia, provides additional insurance coverage up to US$1,000,000, and offers compensation funds up to €20,000 from the Financial Commission. This ensures confident trading amid market volatility without concerns.

In summary, choosing Ultima Markets isn’t just about its user-friendly platform, but also because it provides a professional, secure, and flexible environment. This enables you to trade steadily even amid soaring Volatility Index and global market turbulence, turning risks into opportunities.

Register with Ultima Markets now to open a $100,000 demo account, practice your market volatility strategies, and experience a professional investment platform!

Conclusion

The Volatility Index (VIX) serves as a market sentiment indicator, helping investors assess market risks and formulate corresponding investment strategies. By understanding how the VIX operates, its relationship with the market, and how to utilize it for risk management, investors can respond more effectively to market fluctuations.

Choose Ultima Markets, combining professional trading platforms and tools to seize opportunities arising from market volatility, helping you enhance investment judgment.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()