The Canadian dollar weakened to a one-week low on Tuesday, with the currency giving back much of the previous week's gains ahead of a speech by BOC Governor Macklem.

The BOC cut its policy rate by 25 bps as expected last week citing a weaker economy and less upside risk to inflation as reasons for its first rate reduction since March. Economists believe further rate relief is on the way.

There was a worse-than-expected contraction in Q2 GDP as tariffs squeezed exports, but higher household and government spending softened the blow somewhat, according to Statistics Canada.

Labour market lost a cumulative 100,000 jobs in July and August, pushing the unemployment rate up to 7.1%. Canada and Mexico have vowed closer co-operation on trade as both grapple with Trump's policies.

Annual inflation rate rose to 1.9% in August, picking up from 1.7% in July, as gasoline prices fell less sharply and food costs continued to climb. That could set the bar higher for further rate cuts.

For all the talk of whether the country needs a new oil pipeline, there's one thing missing: a company wanting to build it. In June, Alberta Premier Danielle Smith said there was "no proponent" on the table.

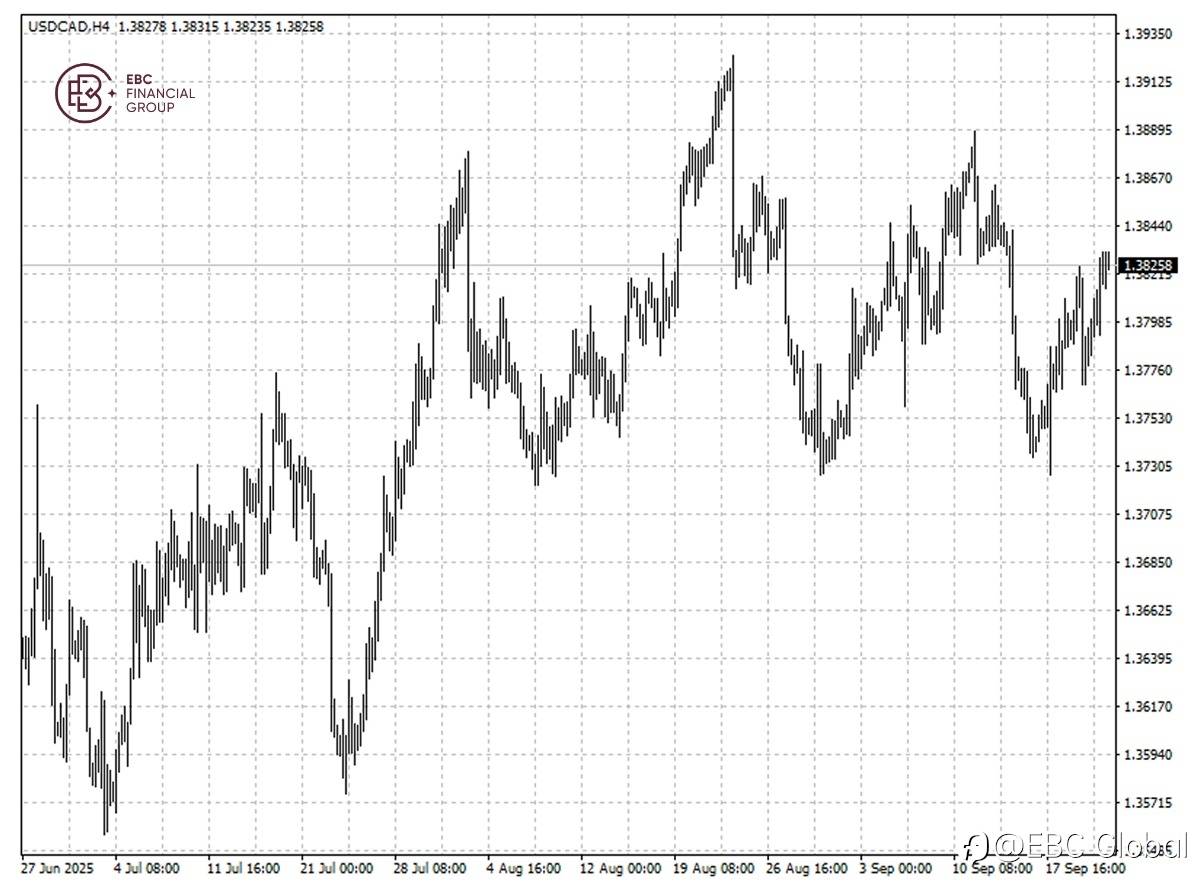

Loonie has been under selling pressures since the double-top pattern was formed. The path of least resistance is further weaknesses towards the low around 1.3840 per dollar.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发