Gold perched above $4,010 on Thursday, following a record-breaking rally, as concerns over the US economy and a government shutdown added fresh momentum to a scorching rally.

Bullion is on pace for its best annual performance since the 1970s, a decade when rapid inflation and the end of the gold standard sparked a 15-fold rally of the precious metal.

Goldman raised its gold forecast for December 2026 to $4,900 this week. Likewise Bridgewater Associates founder Ray Dalio said investors should allocate as much as 15% of their portfolios to gold.

Central banks have been a key driver of the rally after Russia's invasion of Ukraine. Inflation and speculation that the American government would treat foreign creditors less favourably further highlighted bullion's appeal.

Trump announced Wednesday night stateside that Israel and Hamas had agreed on the first phase of a peace plan which could put an end to the two-year war and free hostages.

However, it remained unclear whether the parties had made progress on more contentious issues such as the demilitarisation of Hamas. Meanwhile, Russia says prospects for Ukraine peace deal now faded.

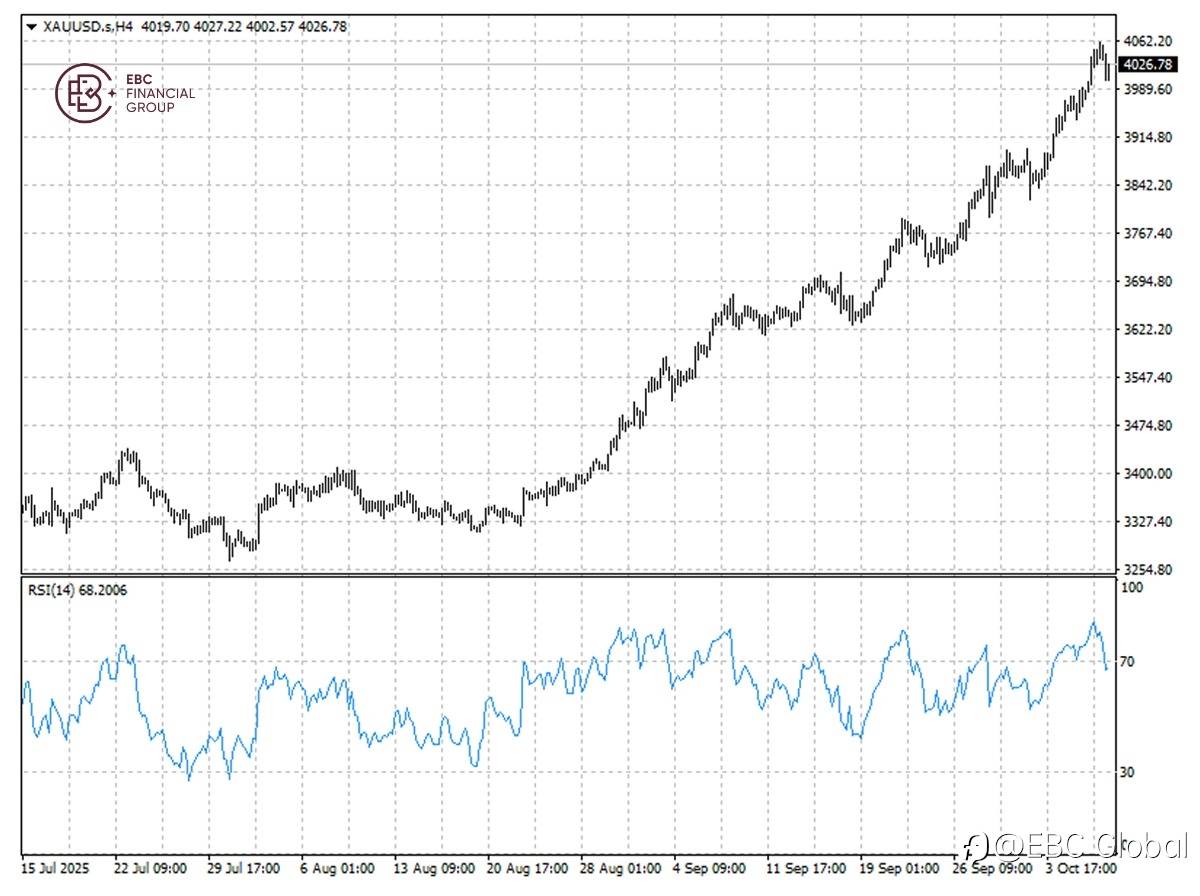

The yellow metal remains in the strongly overbought area despite a moderate pullback. A push below the psychological support of $4,000 is unlikely though until the major US jobs report is released.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()