📉 Wall Street ended Friday’s session mixed. Fears over US regional banks dragged the Russell 2000 lower, while the S&P 500 and Nasdaq gained just over 0.5% each.

💰 The sell-off began after reports of loan fraud at Zions Bancorporation and Western Alliance, but sentiment later improved as Donald Trump said he’s not planning vast tariffs on China and may meet the Chinese President at the APEC Summit in late October.

📈 Today, US index futures are advancing: US500 +0.34%, US100 +0.5%.

🇪🇺 In Europe, optimism around the French budget and strong results from defensive stocks lifted indices, while PM Lecornu survived two confidence votes.

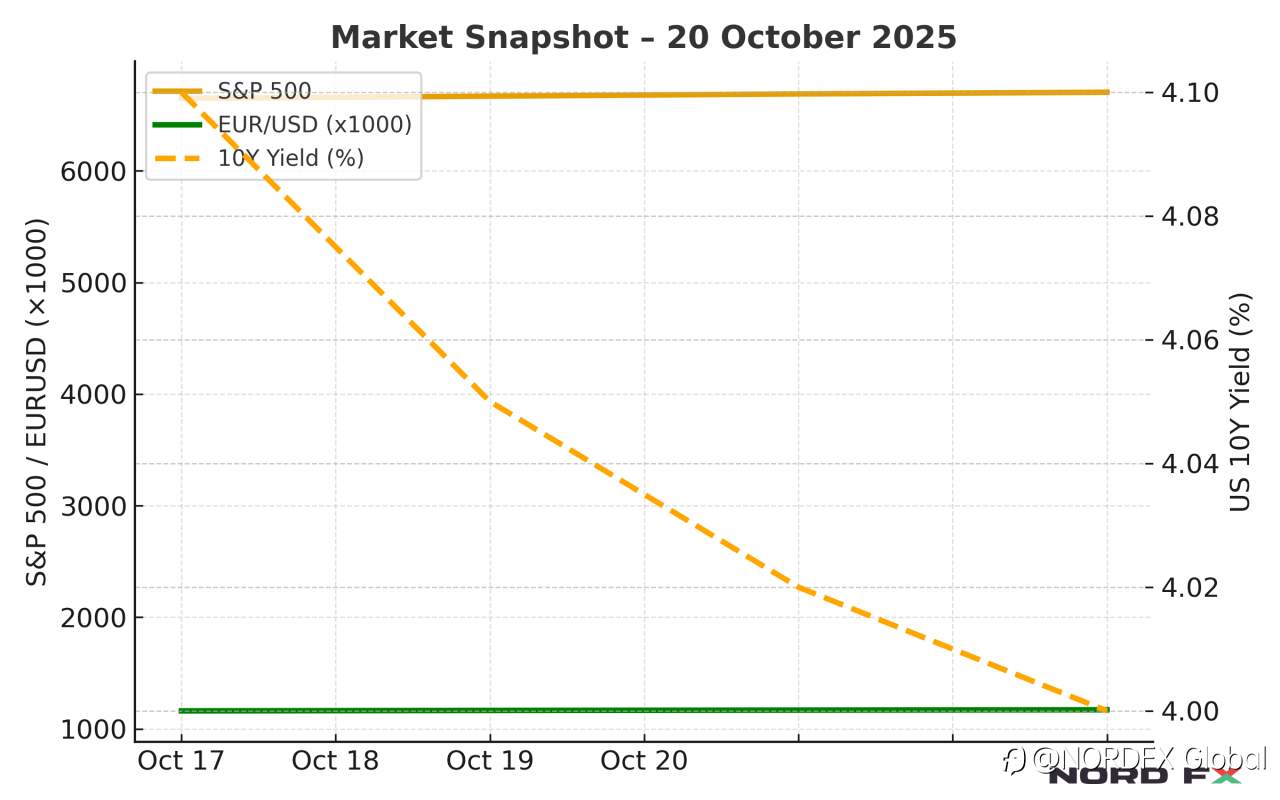

📉 US Treasury yields slipped to 4.0%, their lowest since September 2024, as traders bet on future rate cuts amid banking-sector worries.

💶 EURUSD is rebounding above 1.1670 after Friday’s dip.

☎️ Trump spoke with Vladimir Putin about possible peace terms for Ukraine, sending oil prices lower on expectations of increased supply. Later, Trump met Volodymyr Zelensky, again urging acceptance of territorial concessions for a ceasefire.

🛢️ Despite renewed tensions in the Middle East, crude oil was little changed as a new ceasefire took effect this morning.

🇯🇵 Bank of Japan hinted at possible further tightening if economic conditions improve, with its next meeting due at the end of October. The yen steadied around 150–151 per USD.

🇨🇳 China’s data were mixed:

• Retail sales +3.0% y/y (forecast 2.9%)

• Industrial production +6.5% y/y (forecast 5.0%)

• Fixed-asset investment -0.5% y/y

• Property investment -13.9% y/y

• GDP +4.8% y/y, slowing from 5.2% earlier

• Property prices -0.41% m/m – the sharpest fall in 11 months

🏗️ Goldman Sachs expects China’s rare-earth export controls to stay until 2028.

🇳🇿 New Zealand inflation rose to 3.0% y/y in Q3, matching forecasts but limiting prospects for further rate cuts.

💬 Markets enter the new week on cautious optimism — traders are watching how the banking sector, oil, and Asia-Pacific data shape global risk appetite.

📊 Stay tuned with NordFX for more daily insights and trading opportunities! 🚀

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()