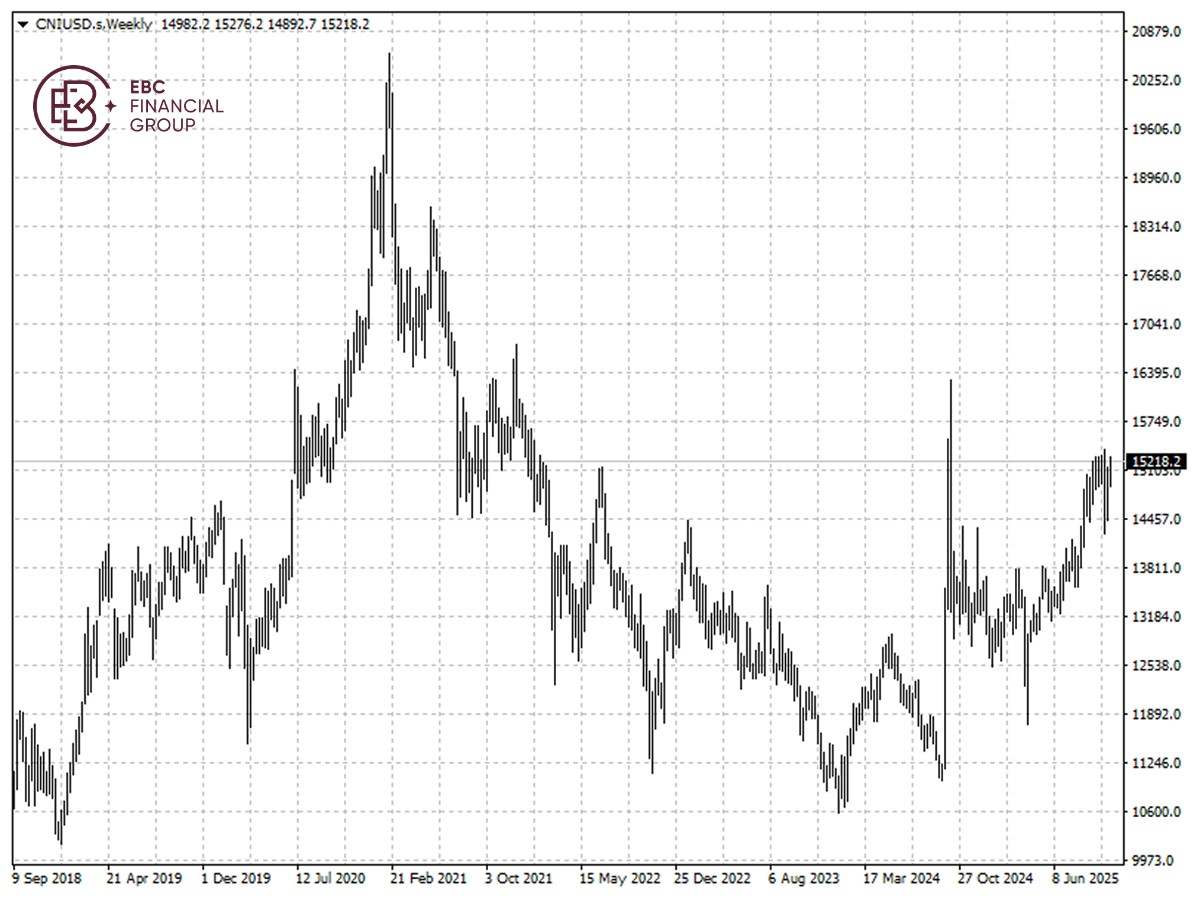

Chinese stocks have regained footing after a horrible week, but they remain remote from their all-time peak. Meanwhile, their Japanese and Korean peers reached record levels last week.

The divergence stems from trade talks with Washington and macroeconomic landscape. Sporadic flare-up in tensions between China and the US underlines the deepening mistrust dividing the world's two biggest economies.

Trump threatened to impose 100% more tariffs on Chinese goods, a move which was followed by Beijing asserting its rare earths restrictions are a "legitimate" measure. The blame game will go on.

"On the specific episode the market is focused on, the two sides may still return to the table to find a short-term fix. However, it won't be a lasting solution," said Jianwei Xu, senior economist for Greater China at Natixis.

Trump and Xi spoke over the phone last month, but have yet to meet in person since January. Trump has indicated that he might visit China early next year and seal a "fair" trade deal this month.

Elsewhere Japan's finance ministry said in September that it would set up an investment facility at a state-owned development bank to support a $550 billion investment package agreed.

South Korea has a higher chance of reaching a trade deal with the US with a couple of remaining issues by the time of the APEC summit in South Korea, the country's chief policy advisor said on Sunday.

Choke point

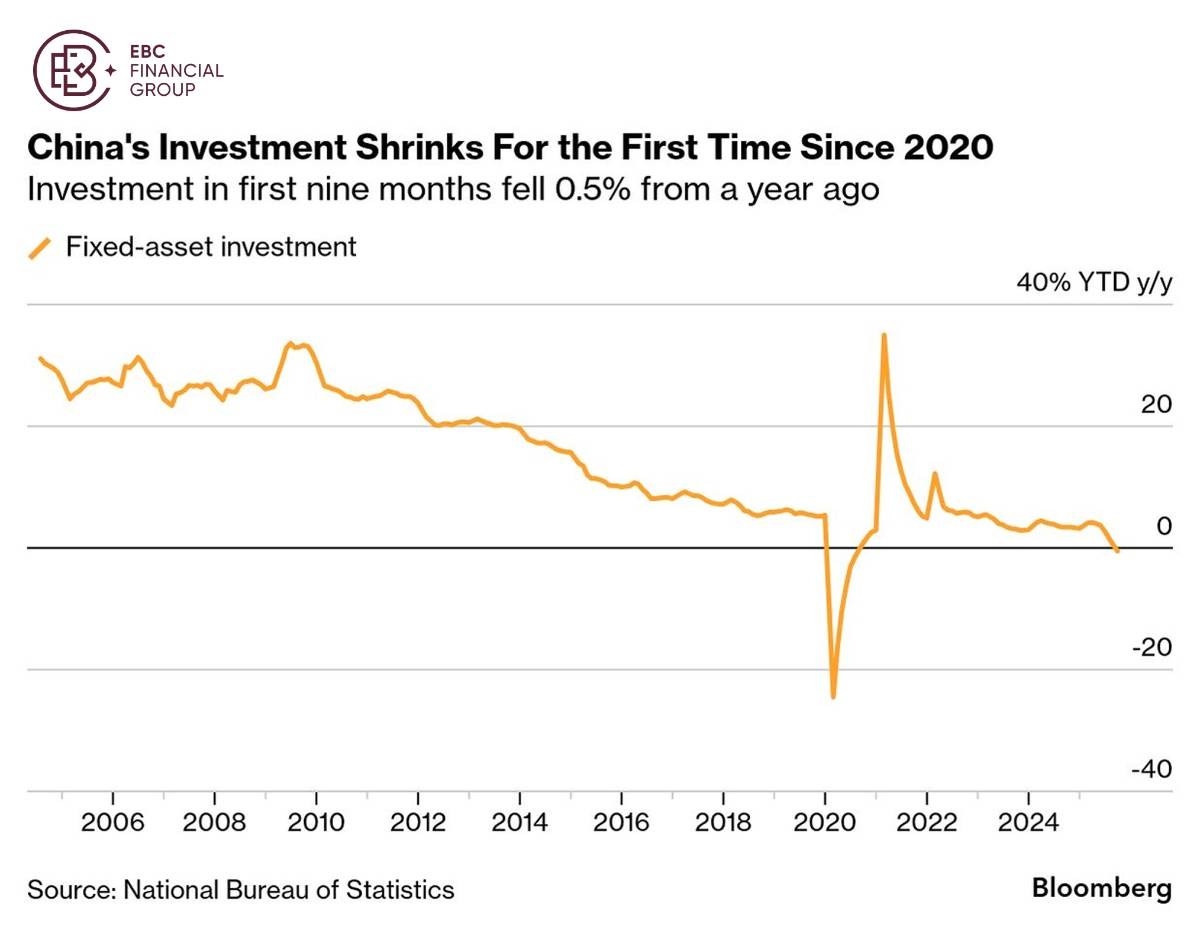

China's GDP grew at the slowest in a year in Q3 with weakness in investment, industrial output and retail sales. Booming exports provide some relief, but a lopsided recovery is not worth celebrating.

Fixed-asset investment unexpectedly contracted 0.5% in the first nine months of the year as spending on infrastructure and manufacturing slowed, which is particularly upsetting.

Beijing has sought to shift the growth engine towards domestic consumption in the face of rising trade barriers, but retail sales trend suggests the consumer good subsidy programmes are already faltering.

Big projects such as the launch of massive dam construction in Tibet fall short of a boost to business sentiment after decades of urbanization have already left China saturated with bridges and roads.

The IMF, which kept its prediction for China's 2025 growth at 4.8%, expects a slowdown next year to 4.2%. It said "real estate investment continues to shrink while the economy teeters on the verge of a debt-deflation cycle."

That dovetails with sector performance differentiation. Technology, industrial and material stocks stay on the front foot, while the ones related to consumer goods and real estate are largely in the doldrums.

Consumer prices in Japan and South Korea both rose more than 2% in September, skewing retail spending towards the upside as a buffer against a possible breakdown in China-US trade talks.

Reforms on demand

China left benchmark lending rates unchanged for the fifth consecutive month in October on Monday, meeting market expectations despite signs of slowing economic momentum.

Policymakers is likely to face a dilemma - how to shore up a weak economy without further fuelling a frothy stock market. The policy rate now stands at a record low of 1.4% and hence limited room for aggressive cuts.

The PBOC has played a key role in supporting the stock market, using targeted tools such as swap schemes and relending programs to provide institutions with liquidity for share purchases.

Officials hope that rising stocks and bonds will help repair household balance sheets hurt by the property crisis and boost consumption. However, analysts caution the effects could undershoot the goal.

Chinese households still sit on a record sum of savings, shunning consumption and investment. Some analysts say the rally is long-term and institutional, rather than buying on margin seen in 20125.

Traders are watching a political gathering in Beijing later this week that could deliver fresh policy measures. Without a big bang stimulus, economists say bigger structural reforms are needed.

The latest earnings season will help drive capital flows. Chinese onshore-listed companies' Q2 performance failed to justify optimism, so better results are necessary for the market to catch up to its competitors.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()