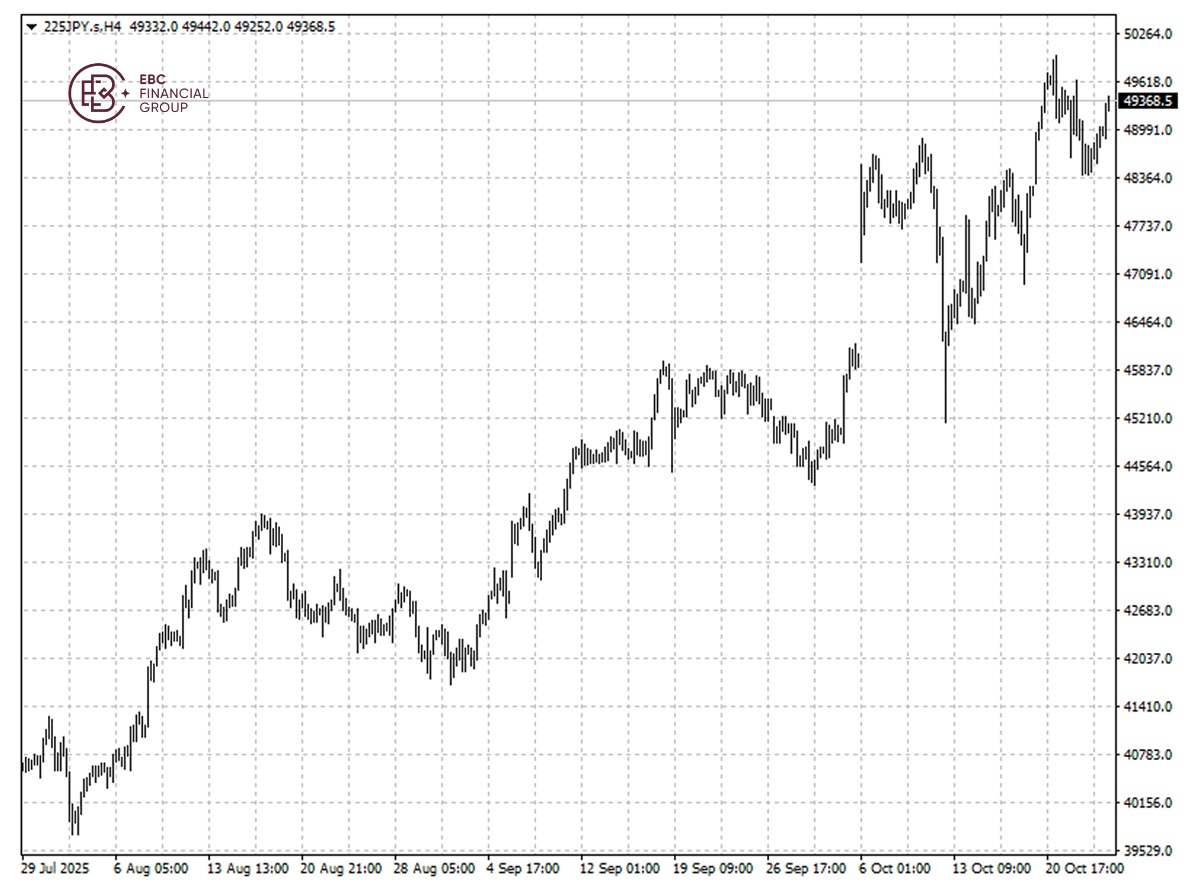

The Nikkei 225 rose more than 1% on Friday before a speech where the nation's new prime minister is expected to talk about stimulus. Wall Street earnings and signs of a thaw in US-China relations boosted investor sentiment.

Japanese exports in September snapped four months of declines, climbing 4.2% year on year, as shipments to Asia saw robust growth, partially offsetting the drop in exports to the US.

Takaichi's stance of a loose momentary policy and massive fiscal stimulus is likely to weaken the yen, making Japanese goods more competitive, benefiting exporters.

Core inflation rate accelerated to 2.9% in September, the first increase since May. Takaichi was reportedly planning an economic stimulus package of more than 13.9 trillion yen to help households cope with inflation.

Although Tokyo upgraded its views on private expenditure and capital spending, it cautioned about potential downside risks to the economic outlook from Washington's trade policies.

With consumer sentiment improving in the wake of a trade deal, private consumption, which accounts for more than half of the economy, showed "signs of picking up", government report said.

The index has swung sharply recently, but lower volatility is likely after the election. We see a retreat below 49,000 as market seems to have fully priced in political tailwinds.

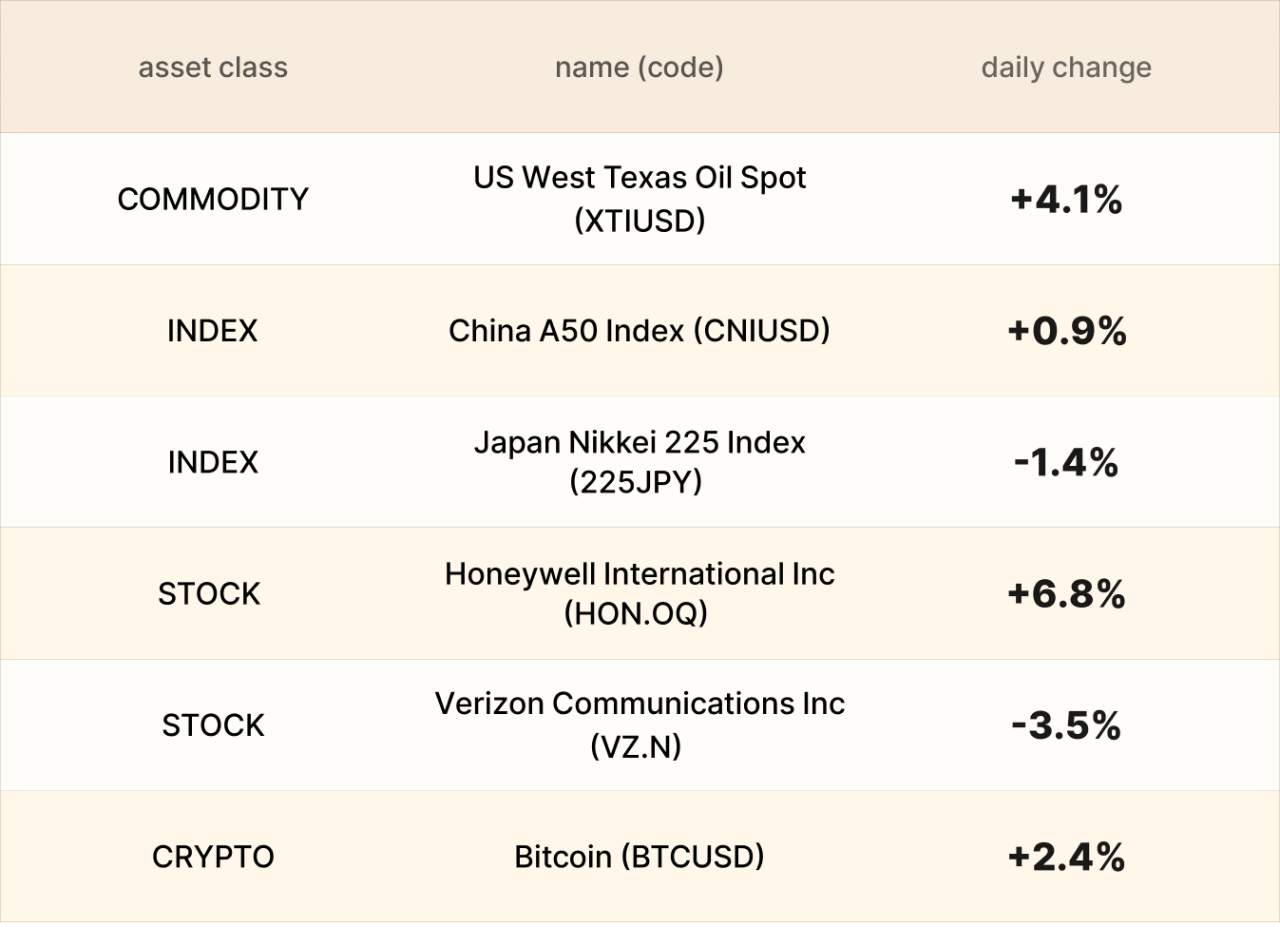

Asset recap

As of market close on 23 October, among EBC products, Honeywell and WTI crude led gains. Trump will meet Chinese President Xi Jinping next week as part of his trip through Asia.

A clutch of positive earnings reports also helped to support stocks. Shares of Honeywell surged after the company reported Q3 earnings beat and lifted its 2025 profit forecast.

Telecom stocks were still struggling with the dim business outlook amid market saturation. The industry is yet to draw investment interests despite high dividend yields.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发