US markets began the week under pressure 📉 as concerns grew about further tightening by the Federal Reserve and weakening macro prospects. The S&P 500, Nasdaq and Dow all finished Monday lower, with risk-off sentiment dominating.

🗣️ Fed Governor Christopher Waller signalled that the weakening labour market supports another rate cut in December. He favours a 25 bps cut on 9–10 December, though any improvement in employment could reduce the need for further easing. Despite the dovish tone, investor worries persisted, supporting the US dollar.

💵 The dollar strengthened against most major currencies, while the yen remained weak above 155 due to rising bond yields and geopolitical strains with China. AUD and NZD stayed under pressure as risk appetite faded and expectations of potential RBA easing grew.

🌏 Asia–Pacific markets opened sharply lower as global macro concerns and geopolitical tensions weighed on sentiment. Japan’s Nikkei 225 fell 2.25%, Hong Kong’s Hang Seng lost 1.11%, China’s Shanghai Composite slipped 0.5%, and Australia’s S&P/ASX 200 dropped 1.8%.

🇯🇵 Bank of Japan Governor Ueda meets PM Takaichi today (15:30 Tokyo). Discussions are centred on yen weakness and possible policy changes. Tokyo urges caution regarding rate hikes, while Ueda hints at potential action.

🇨🇳 Tensions between China and Japan continue. Beijing imposed travel bans for employees of state-owned enterprises and cancelled several joint events.

The PBoC set the USD/CNY fixing at 7.0856, far stronger than forecasts, signalling active currency support. China is also issuing EUR 4 billion in eurobonds to diversify funding.

🇦🇺 RBA minutes confirmed that policy remains only slightly restrictive, with inflation expected to stay above target until mid-2026. The bank may delay cuts but is also discussing potential easing later.

🥇 Gold trades near 4,000 USD per ounce, while Goldman Sachs expects 4,900 USD by end-2026 due to growing central bank demand.

₿ Bitcoin dropped below 90–91 thousand USD, hitting its lowest since April as risk aversion and uncertainty over Fed policy weighed on crypto markets.

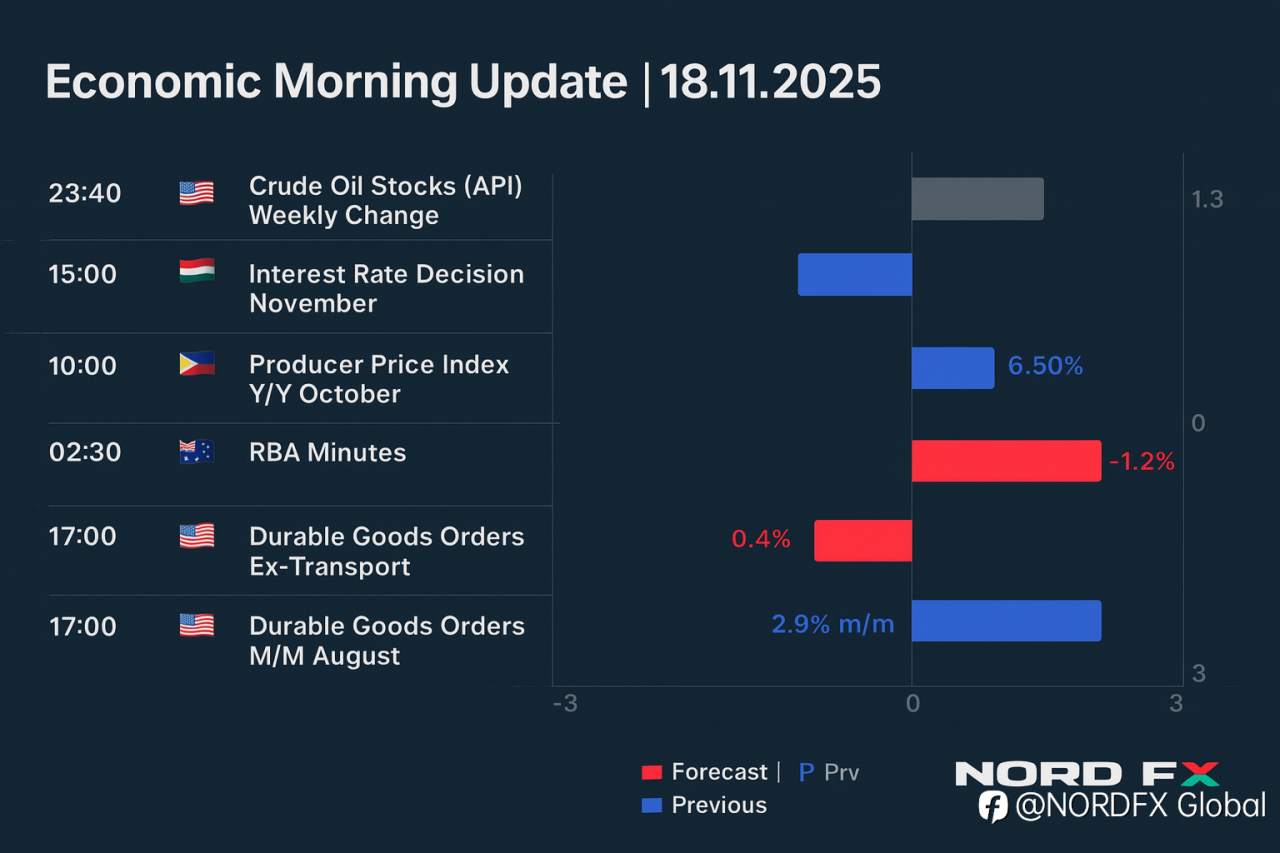

📅 Economic Calendar – 18 November 2025

⏰ 23:40 (US) – 🛢️ Crude Oil Stocks (API) – Weekly Change

• Previous: 1.3 mn

⏰ 15:00 (HU) – 💰 Interest Rate Decision (November)

• Forecast: 6.50%

• Previous: 6.50%

⏰ 10:00 (PH) – 🏭 Producer Price Index Y/Y (October)

• Forecast: –1.2% y/y

• Previous: –1% y/y

⏰ 02:30 (AU) – 📄 RBA Minutes (November)

⏰ 17:00 (US) – 🛠️ Durable Goods Orders Ex-Transport M/M (August)

• Forecast: 0.4% m/m

• Previous: 1% m/m

⏰ 17:00 (US) – 🛠️ Durable Goods Orders M/M (August)

• Forecast: 2.9% m/m

• Previous: –2.7% m/m

✨ Stay updated and trade smart with NordFX!

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发